Trade & Invest

Tools

Learn

Company

Metal Sector Stocks

Metal Sector Stocks

Metal sector stocks include companies involved in the extraction, production, and distribution of metals such as steel, aluminum, copper, and precious metals like gold and silver. This sector is fundamental to various industries, including construction, manufacturing, technology, and automotive. Investing in metal sector stocks allows investors to capitalize on the demand for raw materials essential for industrial growth and technological advancements.

Filters

COMPANY

PRICE

Introduction to Metal Sector Stocks

Metal stocks play a crucial role in India’s economic development by producing and distributing various metals essential for multiple industries. With substantial market capitalization, these companies contribute significantly to sectors such as construction, automotive, and manufacturing. Among these sectors, the steel industry stands out as a cornerstone of the metal sector, being extensively utilized in diverse infrastructure projects that drive the nation’s growth.

The metal industry’s performance often serves as an indicator of economic health due to its widespread applications across different sectors. Investing in metal stocks can be a strategic move for investors looking to capitalize on India’s industrial expansion and infrastructure development. Additionally, keeping abreast of market trends and global demand for metals can provide valuable insights for decision-making in this sector.

Furthermore, advancements in technology and sustainable practices within the metal industry are shaping its future trajectory. Embracing innovation and eco-friendly initiatives can enhance competitiveness and bolster long-term sustainability for metal stocks in India. As the economy continues to evolve, metal stocks remain integral players supporting growth across various key industries.

Why Do Investors Care About Metal Sector Stocks?

1

Profit Potential

Metal companies can be highly profitable due to the essential nature of metals in numerous industries and their global demand.

2

Growth Potential

The sector has significant growth potential, driven by infrastructure projects, industrial development, and technological advancements that require metals.

3

Diversification

Investing in metal stocks provides diversification, as metals are crucial to various sectors, including construction, automotive, technology, and renewable energy.

Details of Metal Sector Stocks

How to analyse Metal Sector Stocks?

1

Key Metrics

Evaluate financial indicators like revenue growth, profitability, and debt levels to gauge a company’s financial health.

2

Investment Strategies

Explore strategies such as systematic investment plans (SIPs) or dollar-cost averaging for consistent, long-term returns.

3

Valuation

Check if the stock’s PE ratio is within industry standards for that particular sector to justify your investment.

Who Should Invest in Metal Sector Stocks?

Investing in the metal sector can be a lucrative endeavor, provided that it aligns with your financial objectives and risk tolerance. Conducting a comprehensive assessment of your financial status before diving into metal stocks is essential. It’s crucial to understand that the metal industry is subject to cyclical fluctuations, making it imperative to familiarize yourself with the growth prospects of specific metal companies.

For those interested in contributing to India’s infrastructure development, investing in metal stocks can be a strategic move. However, it’s vital to brace yourself for market volatility stemming from shifts in commodity prices and global economic conditions. Thorough research on potential investments such as Tata Steel, JSW Steel, or Jindal Steel is paramount. Evaluating their debt ratios and profitability can equip you with the insights needed to make informed investment choices.

Furthermore, staying abreast of industry trends and market dynamics will aid in navigating the uncertainties inherent in the metal sector. Diversifying your investment portfolio and seeking expert advice can further mitigate risks associated with investing in this dynamic industry. Remember that informed decision-making based on diligent research is key to maximizing returns while managing potential risks in the metal sector.

FAQs

What are Metal Sector Stocks?

These stocks represent companies involved in the mining, production, and distribution of metals like steel, aluminum, copper, and precious metals.

Are Metal Sector Stocks Risky?

While metal stocks can offer high returns, they also come with risks such as commodity price volatility, regulatory changes, and global economic conditions.

How Can I Find Metal Sector Stocks?

Use stock screeners on financial websites or brokerage platforms, filtering for companies in the metal sector.

What Factors Affect the Value of Metal Sector Stocks?

Factors include commodity prices, global economic conditions, supply and demand dynamics, and regulatory policies.

MORE CATEGORIES

Banking And Finance Sector Stocks

Realty Sector Stocks

Chemical Sector Stocks

Transportation Sector Stocks

Fmcg Sector Stocks

Metal Sector Stocks

Logistics Sector Stocks

Consumer Discretionary Sector Stocks

It Sector Stocks

Engineering Sector Stocks

Building Material Sector Stocks

Infra Sector Stocks

Auto Sector Stocks

Pharma Sector Stocks

Agriculture Sector Stocks

Oil And Gas Sector Stocks

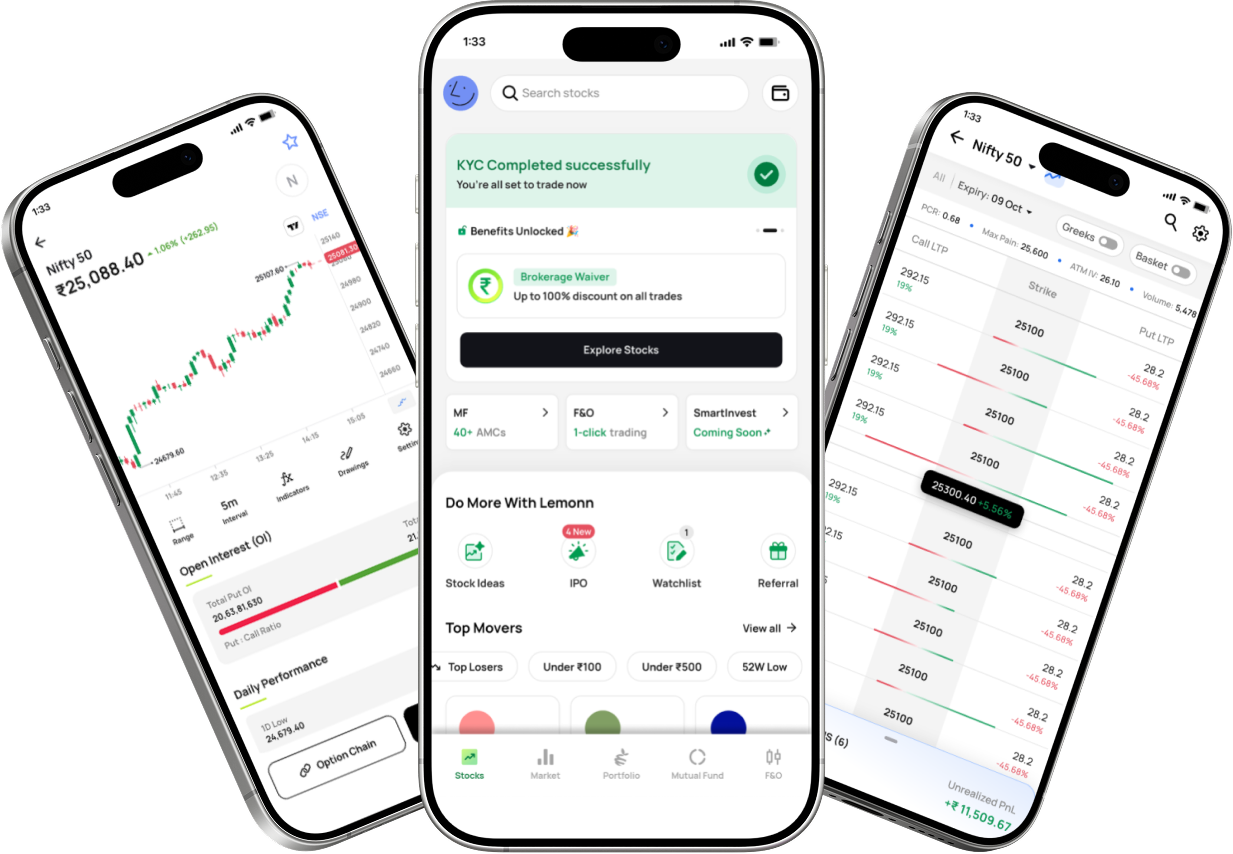

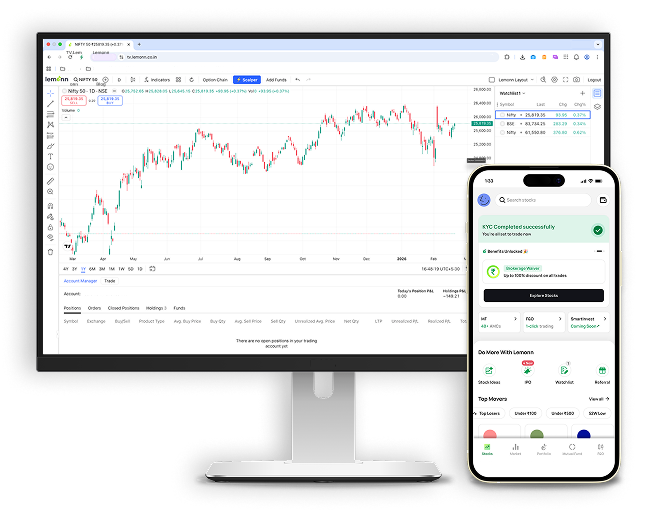

Loved by 1.5M+ users with a 4.3+ ⭐ app rating - Join now!