Trade & Invest

Tools

Learn

Company

Infra Sector Stocks

Infra Sector Stocks

Infra sector stocks include companies engaged in the development, construction, and maintenance of infrastructure projects such as roads, bridges, airports, railways, and utilities.

Filters

COMPANY

PRICE

Introduction to Infra Sector Stocks

These stocks offer investors opportunities to capitalize on the growth of essential public services and large-scale construction projects driven by urbanization and government investments.

Why Do Investors Care About Infra Sector Stocks?

1

Profit Potential

Infrastructure companies can be highly profitable due to large-scale, long-term projects and government contracts.

2

Growth Potential

The infra sector has significant growth potential, especially with increasing urbanization, population growth, and the need for modern infrastructure.

3

Stability

Infrastructure projects are often essential and funded by governments, providing a level of stability and steady income through contracts and tolls.

Details of Infra Sector Stocks

How to analyse Infra Sector Stocks?

1

Key Metrics

Evaluate financial indicators like revenue growth, profitability, and debt levels to gauge a company’s financial health.

2

Investment Strategies

Explore strategies such as systematic investment plans (SIPs) or dollar-cost averaging for consistent, long-term returns.

3

Valuation

Check if the stock’s PE ratio is within industry standards for that particular sector to justify your investment.

Who Should Invest in Infra Sector Stocks?

Those looking for stable, long-term growth driven by ongoing infrastructure needs and government spending.

FAQs

What are Infra Sector Stocks?

These stocks represent companies involved in the construction, development, and maintenance of infrastructure projects like roads, bridges, airports, and utilities.

Are Infra Sector Stocks Stable Investments?

Infra sector stocks tend to be more stable due to the essential nature of infrastructure projects and government backing, though they can be affected by economic cycles and political factors.

How Can I Find Infra Sector Stocks?

Use stock screeners on financial websites or brokerage platforms, filtering for companies in the infrastructure sector.

Should I Invest in Infra Sector Stocks for Short-term Gains or Long-term Growth?

Infra sector stocks are generally better suited for long-term growth and stability due to the nature of infrastructure projects and government contracts.

What Factors Affect the Value of Infra Sector Stocks?

Factors include government spending, economic conditions, political stability, and the demand for new infrastructure projects.

MORE CATEGORIES

Banking And Finance Sector Stocks

Realty Sector Stocks

Chemical Sector Stocks

Transportation Sector Stocks

Fmcg Sector Stocks

Metal Sector Stocks

Logistics Sector Stocks

Consumer Discretionary Sector Stocks

It Sector Stocks

Engineering Sector Stocks

Building Material Sector Stocks

Infra Sector Stocks

Auto Sector Stocks

Pharma Sector Stocks

Agriculture Sector Stocks

Oil And Gas Sector Stocks

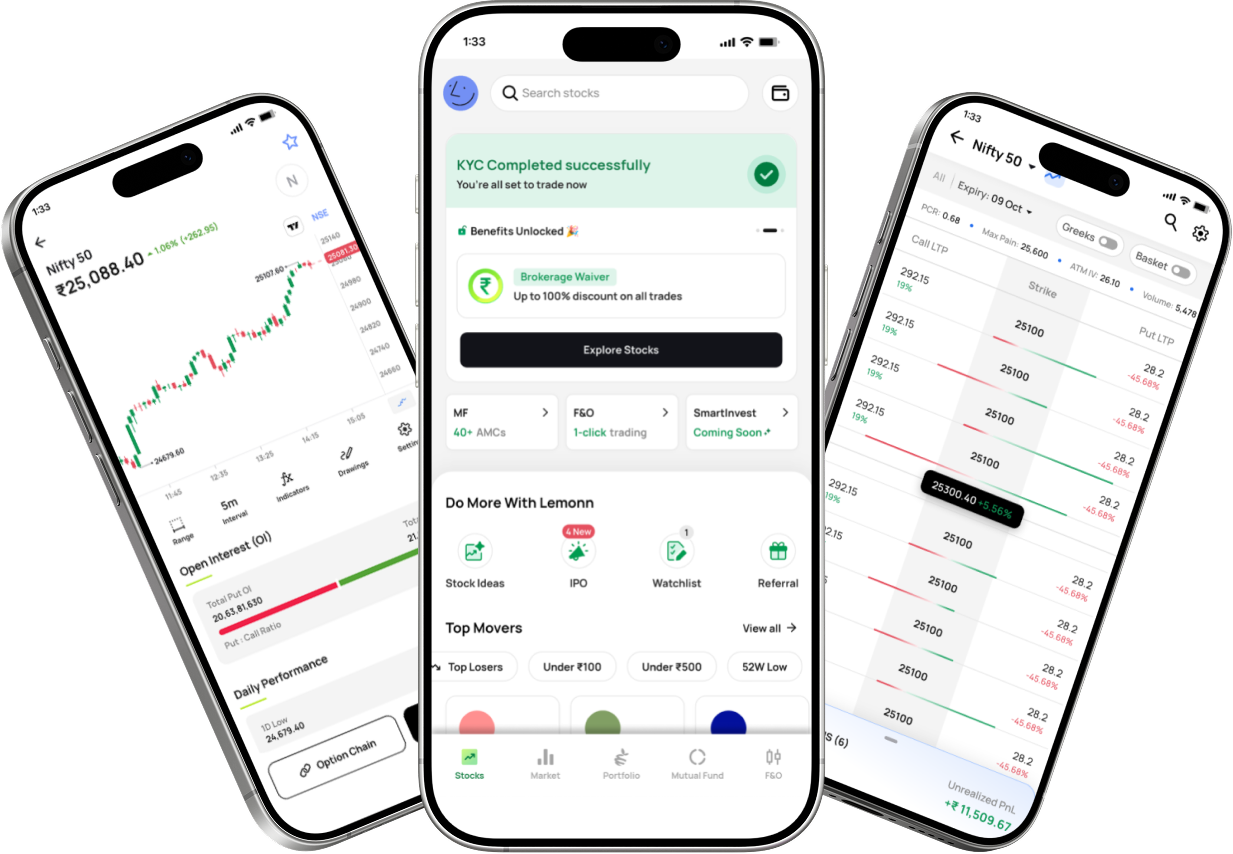

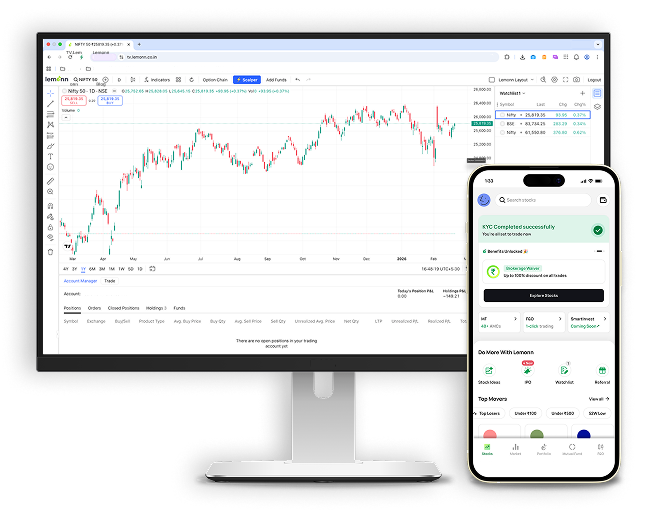

Loved by 1.5M+ users with a 4.3+ ⭐ app rating - Join now!