Trade & Invest

Tools

Learn

Company

Stocks Under 500

Stocks Under 500

Stocks under 500 rupees refer to shares of companies that are priced below 500 units of the Indian currency, the rupee. These stocks are typically considered low-priced or penny stocks and can be appealing to investors looking for affordable investment opportunities in the Indian stock market.

Filters

COMPANY

PRICE

Introduction to Stocks Under 500

Stocks under 500 rupees offer affordable investment opportunities for investors seeking growth or value opportunities in the Indian stock market. While they provide accessibility and potential for higher returns, they also come with risks such as volatility, quality concerns, and liquidity issues. By conducting thorough fundamental and technical analysis, understanding market dynamics, and practicing prudent risk management, investors can make informed decisions and potentially benefit from investing in stocks under 500 rupees.

Why Do Investors Care About Stocks Under 500?

1

Affordability

Affordability refers to the ability of an individual or entity to purchase goods or services without causing financial strain, considering factors like income, expenses, and available resources.

2

Growth Potential

Growth potential refers to the capacity of a company or investment to increase in value over time, often influenced by factors like expanding markets, innovative products or services, and effective management strategies.

3

Diversification

Diversification involves spreading investments across different asset classes, industries, or geographical regions to reduce risk and optimize returns by minimizing the impact of any single investment’s performance on the overall portfolio.

Details of Stocks Under 500

How to analyse Stocks under 500

1

Key Metrics

Evaluate financial indicators like revenue growth, profitability, and debt levels to gauge a company’s financial health.

2

Investment Strategies

Explore strategies such as systematic investment plans (SIPs) or dollar-cost averaging for consistent, long-term returns.

3

Valuation

Check if the stock’s PE ratio is within industry standards for that particular sector to justify your investment.

Who should invest in Stocks Under 500

Investing in these stocks requires careful analysis, risk management, and a thorough understanding of market dynamics.

FAQs

What are stocks under 500 rupees?

Stocks under 500 rupees are those trading at a price below 500 Indian rupees per share on the stock market.

Are stocks under 500 rupees considered cheap or undervalued?

The price of a stock alone does not determine its value or whether it’s undervalued. Stocks trading under 500 rupees may or may not be undervalued, depending on various factors such as the company’s fundamentals, growth prospects, industry conditions, and market sentiment.

How can I find stocks trading under 500 rupees?

You can find stocks trading under 500 rupees by using stock screeners available on financial websites or brokerage platforms. These tools allow you to filter stocks based on price per share, market capitalization, sector, and other criteria.

Should I invest in stocks under 500 rupees for short-term gains or long-term growth?

The decision to invest in stocks under 500 rupees for short-term gains or long-term growth depends on your investment goals, risk tolerance, and the specific characteristics of the stocks in question. Some investors may consider lower-priced stocks for short-term trading opportunities, while others may seek long-term investment potential in fundamentally sound companies.

How do I know if a stock under 500 rupees is undervalued or overvalued?

Determining whether a stock under 500 rupees is undervalued or overvalued requires analysis of various factors, including the company’s earnings growth potential, industry comparables, market conditions, and qualitative aspects such as management quality and competitive positioning. Fundamental analysis and valuation techniques can help assess whether a stock is trading at a discount or premium relative to its intrinsic value.

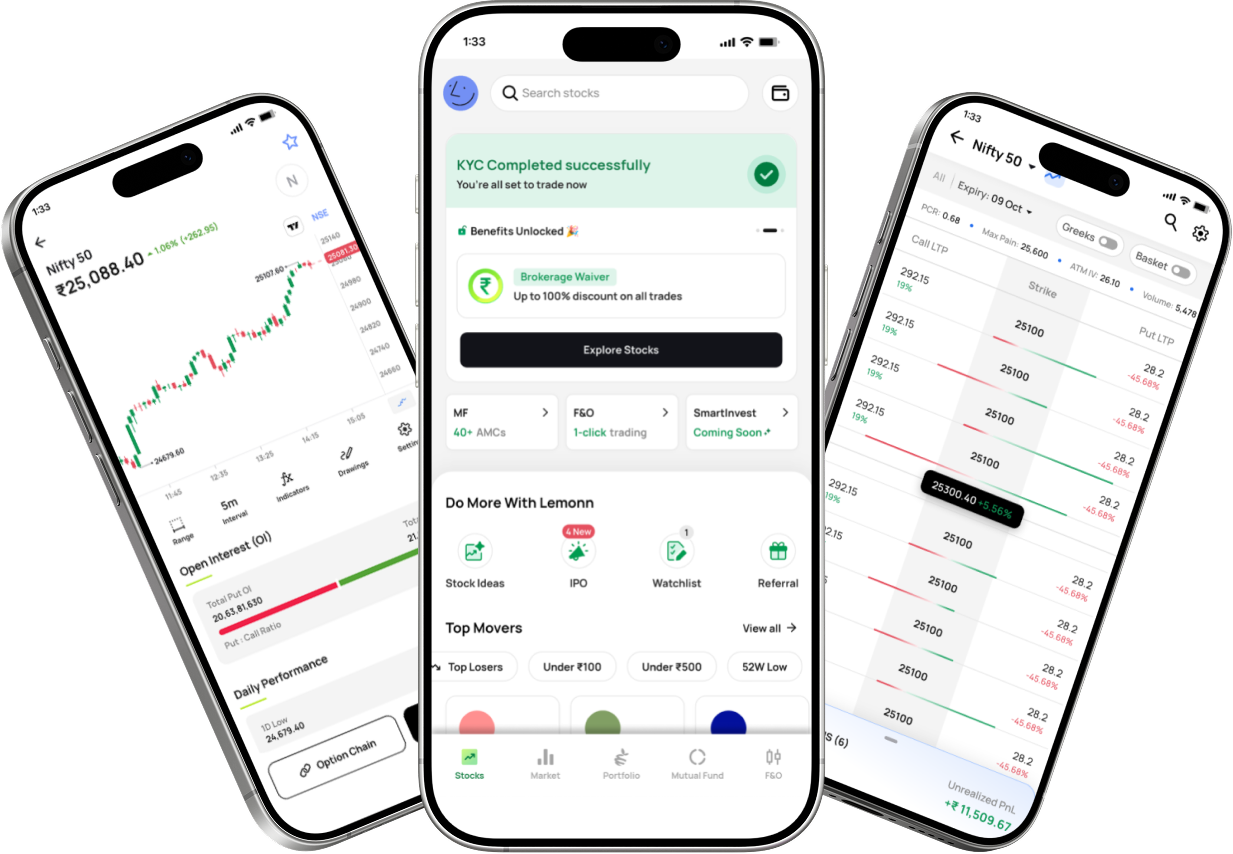

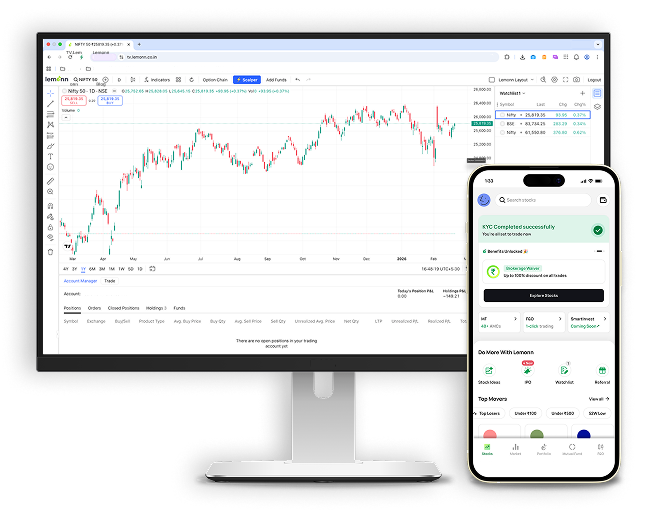

Loved by 1.5M+ users with a 4.3+ ⭐ app rating - Join now!