Starting SIP at 25 vs. 35: How 10 Years Can Build Crores More

Thinking about starting a SIP but not sure when? Here’s the truth:

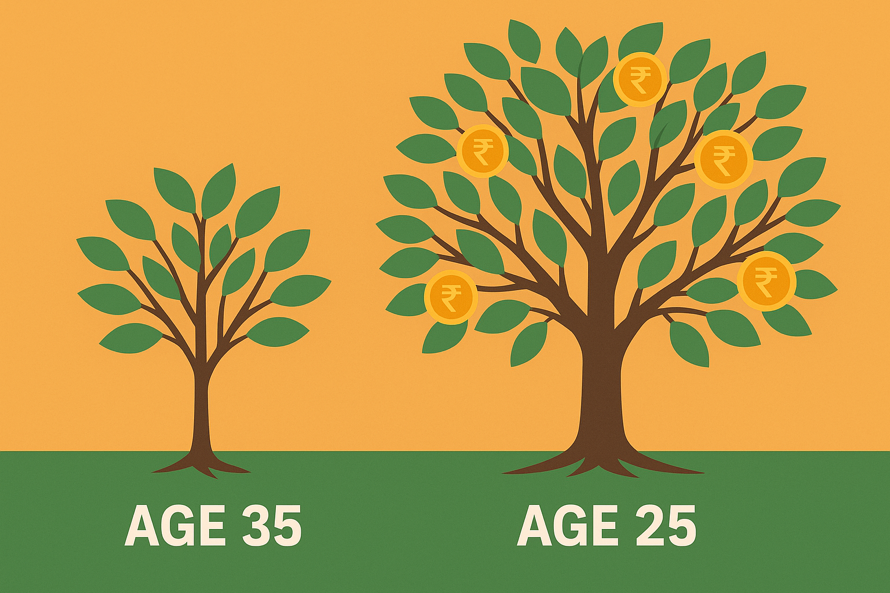

Starting a ₹15,000 monthly SIP at age 25 can make you crores richer by age 50 than starting the same SIP at 35. The difference isn’t just about investing more money—it’s about giving your investments more time to grow.

Why SIPs Work So Well

A Systematic Investment Plan (SIP) is a way to invest a fixed amount into mutual funds regularly—usually monthly. You don’t need to time the market or worry about when to buy. You just invest, stay consistent, and let time and compounding do the work.

Here’s why SIPs are so powerful:

- Discipline on autopilot: You invest every month, no matter what.

- Rupee Cost Averaging: You buy more units when the market is down and fewer when it’s up.

- Compounding: Your returns earn returns. The longer your money stays invested, the faster it grows.

- Low entry barrier: Start with as little as ₹500/month.

- Diversification: Mutual funds spread your money across stocks, reducing risk.

The Real Difference: 25 vs. 35 — Same SIP, Drastically Different Outcomes

Let’s compare two people:

- Aarav, who starts a ₹15,000 SIP at age 25

- Rohit, who starts the same ₹15,000 SIP at age 35

Both stop investing at age 50.

We’ll look at two common long-term return estimates: 12% and 15% CAGR (Compounded Annual Growth Rate).

₹15,000 Monthly SIP – Starting at Age 25 vs. 35

| Starting Age | Investment Tenure | Total Invested (₹) | Corpus @ 12% CAGR (₹) | Corpus @ 15% CAGR (₹) | Wealth Difference @ 12% (₹) | Wealth Difference @ 15% (₹) |

|---|---|---|---|---|---|---|

| 25 | 25 years | 45,00,000 | 2,84,96,220 | 5,39,23,350 | – | – |

| 35 | 15 years | 27,00,000 | 75,67,425 | 1,02,77,100 | 2,09,28,795 | 4,36,46,250 |

Conclusion: Starting 10 years earlier means:

- ₹18 lakh more invested

- ₹2–4.3 crore more accumulated

- More than 6x returns in the 25-year plan vs. 2.8x in the 15-year plan.

Why Time Beats Money in Investing

You might think Rohit could just invest more to catch up. But even if he invests double the amount, he still loses out because time is the real multiplier—not just money.

That’s because of compounding. In your first few years, your money grows slowly. But over time, the growth accelerates. The last 5–10 years often contribute the most to your total wealth. Skipping those years means missing the biggest gains.

What If You Can’t Start Big? Start Small, But Start Now

Even if you can’t commit ₹15,000/month today, starting with ₹1,000 or ₹2,000 still puts the compounding engine in motion. You can increase your SIP amount later as your income grows.

Pro tip: Look into Top-Up SIPs that let you increase your investment annually.

Practical Tips to Maximize SIP Returns

- Start early: Even a small SIP at 25 beats a larger one at 35.

- Choose direct mutual fund plans: Lower fees = higher returns over time.

- Check expense ratios: Prefer funds with low expense ratios—these eat into your gains.

- Stay invested: Don’t stop SIPs during market dips—that’s when you buy the most units.

- Review your funds annually: Make sure they still align with your goals.

Key Takeaways

- Starting early makes a huge difference thanks to compounding.

- The difference in returns is not just linear—it’s exponential.

- SIPs offer a disciplined, flexible, and stress-free way to build long-term wealth.

FAQs

Q: What is the ideal age to start a SIP?

A: As early as possible. The sooner you start, the more time your money has to grow.

Q: What if I can’t invest ₹15,000 a month?

A: Start with what you can afford. Even ₹1,000/month helps. You can always increase later.

Q: Are mutual funds safe?

A: All investments carry some risk, but mutual funds are professionally managed and diversified. Over long periods, they tend to outperform most other investment options.

Q: Can I pause or stop my SIP?

A: Yes. SIPs are flexible. But stopping too often reduces compounding benefits.

Final Thoughts: The Best Time to Start is Now

The numbers speak for themselves. A 25-year-old who starts investing early can build over ₹5 crore with just ₹15,000/month. Wait 10 years, and you could lose more than ₹4 crore in potential wealth.

Investing isn’t about how much you start with—it’s about when you start. And the best time? Today.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.