How to invest in SIP: A guide

A Systematic Investment Plan, or SIP, is a popular investment option in India. It involves regularly investing money into a plan at predetermined intervals, usually monthly. SIPs help individuals create wealth through regular investments in products like mutual funds.

The best part is that when you invest through SIP, you can grow your investment over time. It does not matter if you start with a small amount. In fact, you can start with as low as Rs. 500. So, if you are wondering how to invest in SIP, the process is pretty straightforward. This blog post will help you understand the detailed process. Let’s dig in.

Understanding SIP

Retail investors often ask how to invest in SIP and what SIP is. Well, SIP is a mutual fund investment method that involves investing modest sums of money in various mutual fund types at regular intervals. Through consistent investments, this tried-and-tested method reduces the possibility of money loss and enables investors to accumulate mutual fund units at a reduced rate over a period of time.

Putting money into mutual funds through systematic investment plans, or SIPs, is one of the best ways to save money. If you put a set amount of money into a mutual fund daily, you can benefit from market instability without worrying about when to buy or sell. With SIPs, you can invest your money without worrying about stock market fluctuations.

How to invest in SIP in India?

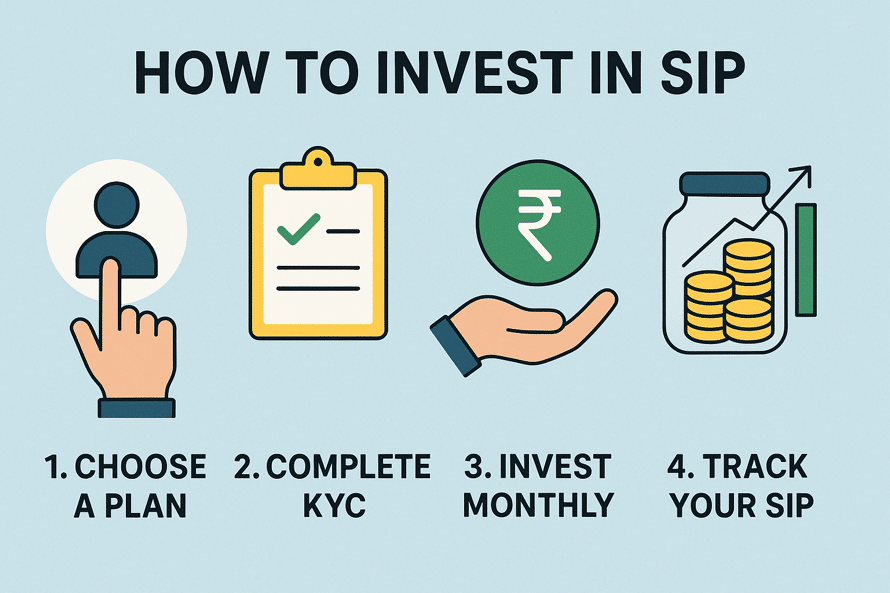

Establishing an SIP investment encourages the saving habit and builds money over time. To answer the question of how to invest in SIP in India, consider these simple steps:

Step 1 – Keep all necessary documents ready

Before investing, you must ensure all necessary documentation is in place. Start by ensuring you can access and store all your data, as this process is extensive. This includes the following personal information:

- ID Proof

- Address Proof

- PAN card

Additionally, check that the name of your bank account and any other information you have are correct. You must provide a copy of your driver’s license or your passport. You should ensure that it adheres to the Know Your Customer (KYC) guidelines established by the government.

Step 2 – Get your KYC done

Investors must meet Know Your Customer (KYC) standards before investing in any financial product.

Applying online is an option if you don’t want to go to the bank/mutual fund house in person or if there isn’t one near your home. The application form must include your name, address, picture ID, proof of identity, and a copy of your passport or driver’s license, along with a statement of your investment.

Step 3 – Register for SIP

To start the process of how to invest in SIP, you need to register with an Indian broker or financial advisor that you are interested in working with.

After completing the registration procedure, you can choose from different investment plans. These programs are tailored to match your unique requirements and the degree to which you are comfortable with risk.

Step 4 – Choose the right plan for yourself

Do not skip this essential step. Choosing the appropriate plan is necessary if you want a satisfactory return on your investment. One plan will include certain features and benefits that the other will not.

Before settling on a strategy, ask yourself a few questions. To what extent are you prepared to expose yourself to risk? What is the total number of shares or units that you are willing to invest in? When it comes to investing, what category do you fall into?

Step 5 – Choose the amount that you want to invest

Determine how much money you want to put into the plan. If you wish to save money every week or month, choose the amount you want to put away. You can evaluate this based on your financial requirements and the current value of those desires.

Step 6 – Choose the date of your SIP

When applying the steps on how to invest in SIP, make sure that the day you choose is convenient for you. Additionally, you can select several dates for various SIPs within the same month.

Step 7 – Submit your form

Once you have chosen a mutual fund, you may begin a systematic investment plan (SIP) by submitting the necessary online or offline papers, depending on your chosen fund house. Your SIPs may be sent online if you already have a Demat account registered with the company. The option is also to send it via mail or to a bank.

Getting an SIP is free and straightforward. Many banks and brokerages let customers set up regular deposits into index funds or stocks, which is a smart move. Moreover, you may invest in SIPs online using an Internet investing service.

Things to consider before investing in SIP

A monthly report from the Association of Mutual Funds shows that SIP contributions hit a record high of Rs 26,459 crore in December 2024. It demonstrates the rising demand for investing through SIP.

But you may not be successful like others if you do not keep a few things in mind. So, before you start looking into how to invest in SIP, here are some things you should think about:

• Consider your financial goals

Once you understand how to use SIP, you should be clear about your financial goals. Your investing objectives are the long-term financial targets you want to reach with your capital. Things like investing for retirement, having an emergency fund, or saving for a large purchase like a home or vehicle all fall under this category.

• Consider your investment horizon

Knowing your investment horizon, which refers to how long you plan to keep your money in an investment, is also an important part of learning how to invest in SIP. If you are unsure when you will need your money for retirement, exercise more caution regarding your investments. Keep this in mind if you have a long-term strategy in mind.

• Know your risk appetite

Knowing your level of comfort with risk is necessary before investing in a systematic investment strategy. Based on your investing objectives and risk appetite, you should decide the amount of money that you are prepared to invest each month.

To determine your ability to take risks, tally up your monthly expenditures and divide the total by 12. The outcome will give you an estimate of the amount you can afford to lose.

• Calculate your SIP returns

After assessing your comfort level with risk, you can utilize a systematic investment plan (SIP) calculator. This tool will help you estimate the monthly investment required based on your desired portfolio size. Moreover, it gives you a proper understanding of how to invest in SIP.

This calculator determines the amount of money that needs to be invested each month. It considers the initial deposit amount and the years remaining until retirement. This will show you exactly how long it will take for your investments to pay off. Also, the calculator will display monthly payments and returns over time. This is the most pleasant aspect of using this calculator as it truly enhances the experience.

• Seek financial advice

Consult with a financial advisor before investing in a systematic investment plan. This is an essential step, and you need to be very careful when taking it. Financial advisors can help you identify the best investment funds.

Consider visiting your neighborhood accountant or financial advisor. This will facilitate the discussion of your goals and determine whether a systematic investing plan is appropriate for you.

Conclusion

One easy and convenient way to invest in mutual funds is through a Systematic Investment Plan (SIP). This plan lets a user put away a set amount of money every month or every three months. Learning how to invest in SIPs gives people the power to get rich easily because it motivates them to be disciplined and make regular investments in well-performing mutual funds.

It’s a better way to accumulate wealth than investing all at once, as it lowers the risk of a stock market crash. With SIPs, you can rest assured your money will grow steadily and regularly.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.