Balanced Fund vs Balanced Advantage Fund

Having multiple sources of income is necessary to maintain a respectable standard of living in the face of rising living costs. A time-tested way to create a second source of income is via investing. One can invest in a variety of financial instruments, such as mutual funds and stocks.

Investments in mutual funds are quite popular with retail investors in India. Selecting the best one might be challenging since they are available in all shapes and sizes. This article will focus on explaining the differences between balanced fund vs balanced advantage fund. Let’s dig in.

Introduction

Mutual funds use a balanced strategy that combines growth potential and stability. Some of these funds blend equity and debt to reduce volatility. Investors love them as they provide for diversification without the need to manage many assets.

What are Hybrid Mutual Funds?

Hybrid mutual funds invest in a combination of debt and equity instruments. They aim to deliver income stability from debt and growth from stocks. They serve a range of investor profiles by striking a balance between risk and return.

Importance of Asset Allocation in Mutual Funds

The distribution of your investment among debt, equity, and other instruments is known as asset allocation. Through exposure diversification, it aids in risk and return management. A good blend matches an investing approach to individual objectives and risk tolerance.

What is a Balanced Fund?

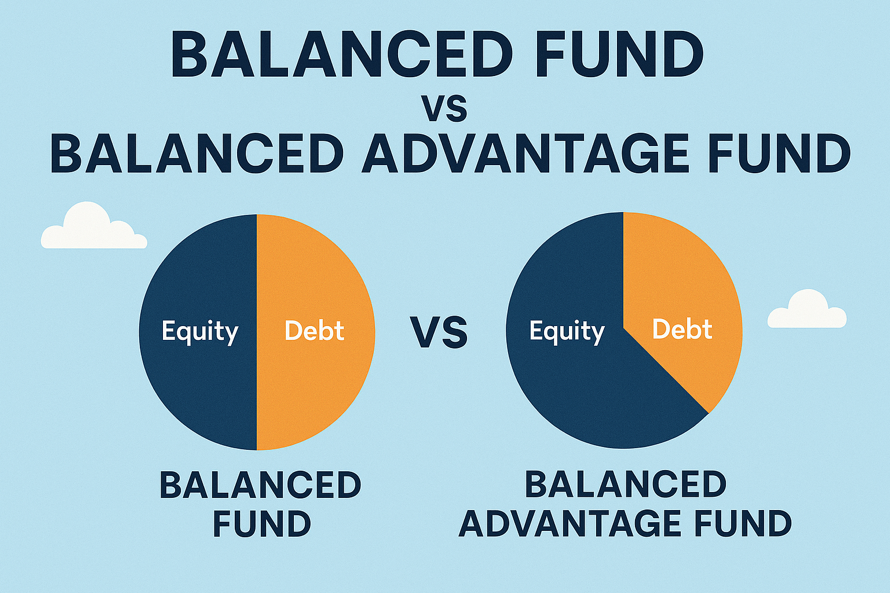

A balanced fund provides investors with the twin advantages of growth and stability. A balanced fund, often called a hybrid fund, is a mutual fund that invests in a combination of stocks and bonds to offer a balance between growth and income. In the context of balanced fund vs balanced advantage fund, combining equity and debt in a single portfolio creates a middle path between high-risk equity funds and conservative debt funds.

Definition and Key Features

Balanced funds allocate a fixed proportion of equity and debt instruments to build a diversified portfolio. Typical asset allocation can be 70% equities and 30% bonds, or sometimes a 60:40 equity-to-debt ratio. The equity portion drives capital appreciation, while the debt portion adds stability and income. The management team focuses on controlling risk while driving long-term growth through diversified exposure.

Fixed Asset Allocation Strategy

Balanced funds adhere to a predetermined asset allocation model, typically maintaining a 60:40 equity-to-debt ratio, in contrast to dynamic funds. This structure stays mostly the same unless you need to rebalance it. The fund rarely reacts to market conditions, providing predictability and clarity for investors who favor a stable approach.

Risk Profile and Suitable Investor Types

Balanced funds mix equities and debt, carrying moderate risk—lower than pure equity funds but higher than debt-oriented schemes. Conservative to moderately aggressive investors will find these funds suitable. During uncertain markets, those seeking a blend of income, stability, and modest capital growth may find them ideal.

What is a Balanced Advantage Fund?

Balanced Advantage Fund is also referred to as Dynamic Asset Allocation Fund. It is a mutual fund that combines equity (stocks) and debt (bonds). However, Balanced Advantage Funds follow a dynamic approach to managing investments, actively adjusting the mix of equity and debt based on market conditions. Discussing balanced fund vs balanced advantage fund, these funds shift allocations as market conditions evolve to optimize returns and reduce overall volatility.

Definition and Key Features

A Balanced Advantage Fund, or dynamic asset allocation fund, adjusts its equity and debt exposure according to market valuations, sentiment, or predefined models. It actively seeks to balance risk and return, unlike fixed allocation funds. It aims to capture market upside and protect capital during downturns.

Dynamic Asset Allocation Strategy

These funds maintain flexibility in their equity and debt ratios. They use valuation metrics—like price-to-earnings ratios or moving averages—to decide when to increase or reduce exposure. They respond proactively to changing market dynamics, offering flexibility and achieving better risk-adjusted performance over time.

Risk Profile and Suitable Investor Types

Balanced Advantage Funds involve moderate to moderately high risk because they frequently change their portfolio composition. These options suit investors who favor professional fund management and can handle short-term fluctuations. Individuals seeking long-term growth with active downside protection often find these funds suitable.

Balanced Fund vs Balanced Advantage Fund – Key Differences

Both funds belong to the hybrid mutual fund category, yet they differ significantly in strategy and performance potential. Comparing balanced fund vs balanced advantage fund helps investors understand these differences and make informed choices that align with their financial goals and market outlook.

Asset Allocation Approach

Balanced funds keep a fixed asset allocation, usually between equity and debt, no matter how the market moves. Balanced advantage funds use a flexible strategy, dynamically adjusting their mix based on valuation models and market signals. They provide a more adaptive investment approach during volatile or uncertain phases.

Risk Management Strategies

Balanced funds manage risk by diversifying, maintaining a consistent division between debt and equity. Balanced advantage funds actively manage risk by increasing or reducing equity exposure based on market conditions. They can potentially mitigate downside risk during adverse market environments.

Return Expectations and Historical Performance

Balanced funds historically deliver stable yet moderate returns because of their fixed exposure. Balanced advantage funds generate better risk-adjusted returns during fluctuating markets by shifting allocations. The performance of the latter relies heavily on the fund manager’s skill in effectively timing market cycles.

Taxation Rules

If their average equity allocation stays above the prescribed threshold, both fund types typically face taxation as equity-oriented funds. Tax authorities impose concessional rates on long-term capital gains after a holding period, whereas they apply higher taxes to short-term profits.

Expense Ratios and Fund Management Styles

Balanced funds typically have lower expense ratios because of their static structure and minimal trading. Balanced advantage funds require frequent adjustments, which leads to higher costs. The latter requires more active management, which makes fund manager expertise a crucial element for long-term success.

Pros and Cons of Balanced Funds

Investors who value consistency and predictability in their portfolios find balanced funds appealing. In the balanced fund vs balanced advantage fund comparison, the rigid structure of balanced funds limits flexibility during significant market movements or sharp economic changes.

Advantages

Balanced funds offer a stable investment experience, combining moderate exposure to both equity and debt. These investments provide easy understanding and deliver consistent returns with lower volatility. Their fixed allocation works well for investors who want a straightforward strategy, avoiding the complexities of timing or frequent rebalancing.

Limitations

Balanced funds provide stability, but they cannot quickly adapt to rapidly changing markets. Extreme bull or bear markets can cause their performance to suffer. Additionally, they might miss opportunities for higher returns because of their static allocation model and limited tactical adjustments.

Pros and Cons of Balanced Advantage Funds

Balanced advantage funds excel at adapting to changing market conditions. In the balanced fund vs balanced advantage fund comparison, flexibility offers an edge but also presents challenges, particularly in terms of higher cost and inconsistent performance.

Advantages

These funds actively shift between equity and debt, enabling investors to capture gains during rallies and minimize losses during downturns. Fund management actively protects against downside risks. They align well with changing market conditions, making them suitable for long-term, market-aware investors.

Limitations

Frequent trading drives higher expense ratios for these funds. Their performance relies heavily on the fund manager’s decisions. When market timing is off, it leads to inconsistent returns that may disappoint some investors, even with the fund’s intended flexibility.

Which Fund is Better for You?

Your financial situation is the main determining factor in deciding between a balanced fund and a balanced advantage fund. Your comfort level with volatility and your understanding of the market should influence your decision-making process. Also, your investment horizon is a significant consideration while analyzing balanced fund vs balanced advantage fund.

Choosing Based on Risk Appetite

A balanced fund best addresses your needs if you are seeking moderate, regular gains and are not risk-takers. If you are optimistic about movements in the market and believe fund managers can time the allocations, balanced advantage funds offer greater returns while effectively managing risk.

Investment Goals and Time Horizon

Investors seeking medium- to long-term goals should consider balanced funds for their consistency. Meanwhile, balanced advantage funds align well with long-term goals that benefit from market cycles. Consider your investment duration and desired outcome before you select between the two.

Market Outlook and Economic Conditions

Balanced funds perform reasonably well in stable or rising markets. During volatile or declining markets, balanced advantage funds provide better downside protection. Keeping an eye on macroeconomic indicators and market trends guides your fund selection.

Conclusion

Balanced funds and balanced advantage funds are different from each other, with their advantages and disadvantages. Comparing balanced fund vs balanced advantage fund, one is stable through fixed distribution, the other is flexible through dynamic rebalancing. Therefore, selecting the right fund depends on your personal goals, investment mode, and risk appetite under various market conditions.

FAQs

What is the main difference between a balanced fund and a balanced advantage fund?

The primary distinction is how they manage assets. A Balanced Fund offers a mix of equity and debt. Balanced Advantage Fund is a mutual fund that combines equity (stocks) and debt (bonds). However, Balanced Advantage Funds follow a dynamic approach to managing investments, actively adjusting the mix of equity and debt based on market conditions.

Are balanced advantage funds less risky than balanced funds?

Not necessarily. They tend to reduce downside risk through dynamic allocation, though not necessarily every time. Their success is highly dependent on market timing and fund manager decisions, which creates a new risk.

How do balanced advantage funds manage asset allocation?

These funds adjust allocations from valuation models, market data, or algorithms. They switch between debt and stock based on opportunities or threats, offering greater flexibility than fixed-allocation funds.

Are returns guaranteed in balanced funds or balanced advantage funds?

No fund type can offer guaranteed returns since they are subject to market risks. When you compare a balanced fund vs a balanced advantage fund, both strive to reduce risk, but the results depend on how well the assets perform and market conditions.

Can I switch from a balanced fund to a balanced advantage fund?

Through redemption and reinvestment, or within the same AMC, investors may alternate between the two options. Before switching, it’s critical to assess the exit load.

What are the tax implications for both types of funds?

Both face similar taxation, as they qualify as equity-oriented schemes. Long-term and short-term capital gains face taxation under the same rules that apply to equity mutual funds.

Which fund is better for long-term investment?

Your investment approach and risk tolerance determine the outcome. Balanced funds offer more stability than balanced advantage funds. However, when asset allocation is well managed and market circumstances favor it, balanced advantage funds can outperform.

Do balanced advantage funds perform better in volatile markets?

Yes, they tend to outperform in volatile markets by reducing equity exposure during downturns. However, actual results depend on the fund manager’s ability to navigate unpredictable market shifts accurately.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.