Why Does a Weak Rupee Upset Us?

Introduction: The Emotional Economics of a Falling Rupee

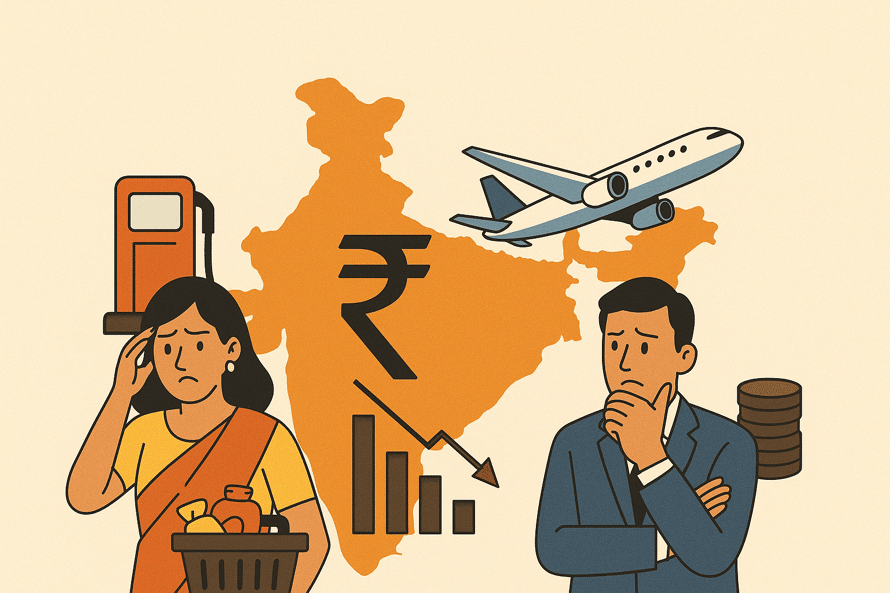

Each time the Indian Rupee dips against the US Dollar, a wave of concern sweeps across the nation. The headlines scream, the petrol pump meter ticks faster, and social media erupts with anxiety. But what does a “weak rupee” really mean? And why does it upset us so deeply?

Let’s break it down in simple terms—like a friend explaining it over chai. The rupee’s fall isn’t just about forex charts; it’s about how much we pay for everyday essentials, our dreams of sending kids abroad, or our country’s economic confidence.

What is Rupee Depreciation?

Rupee depreciation means you need more rupees today to buy one US dollar than you did yesterday. If a dollar cost ₹70 earlier but costs ₹87 now, the rupee has lost value. India follows a managed floating exchange rate system, where market forces determine the rupee’s value, but the RBI occasionally steps in to limit wild swings.

Why is the Rupee Weakening?

Several global and domestic factors drive this:

1. Strong US Dollar

High US bond yields attract global investors, pulling capital out of emerging markets like India. It’s like everyone rushing to a party in the US, leaving India’s investment gathering sparse.

2. Trade Deficits

India imports more than it exports, especially expensive items like crude oil and gold. This creates a constant demand for dollars.

3. Capital Outflows

When foreign investors pull out of Indian markets due to geopolitical tensions or better returns elsewhere, the rupee takes a hit.

4. High Inflation and Policy Gaps

If inflation is higher in India compared to other countries, or if RBI’s interest rates are lower than the Fed’s, money tends to flow out.

How It Hurts Us: Everyday Impacts of a Weak Rupee

1. Rising Cost of Living

A weak rupee means costlier imports. Since India imports 88% of its crude oil, fuel prices rise—affecting everything from cab fares to food prices. This leads to cost-push inflation, where basic items become pricier just because getting them into the country costs more.

2. Foreign Education and Travel Dreams Take a Hit

Planning to send your child to the US or travel to Europe? That just got 10–15% more expensive. You’ll need more rupees to pay tuition or book flights.

This acts like an “aspiration tax” on India’s middle class, limiting global opportunities due to currency shifts.

Impact on Businesses and the Economy

1. Corporate Debt Burdens

Many Indian firms borrow in dollars. A weaker rupee makes repaying these loans costlier in rupee terms, squeezing profits.

2. Wider Trade and Current Account Deficits

Costlier imports increase the trade gap, leading to further rupee weakness. It becomes a vicious cycle—more depreciation, bigger deficits, and so on.

3. Capital Flight

Investor confidence shakes, leading to pull-outs. This especially hurts startups and sectors like IT that rely on FDI and FPI.

4. Policy Tightrope for RBI

The RBI must juggle inflation control with growth. Raise interest rates too much, and growth slows. Keep them low, and inflation soars. A weak rupee makes this balance harder.

Limited Benefits of a Weak Rupee: The Export Paradox

In theory, a weaker rupee should help exporters—making Indian goods cheaper abroad. But here’s the catch:

- Many Indian exports rely on imported inputs (like pharma and electronics), so their costs also go up.

- Foreign buyers often demand discounts, canceling out the pricing advantage.

- Global demand and protectionism limit how much more we can export.

Some Silver Linings

Not everything is gloomy.

- Remittances from NRIs become more valuable in rupees, helping families back home.

- Inbound Tourism becomes more attractive—foreigners find India cheaper to visit.

But these perks are limited and don’t offset the broader financial strain.

What’s Being Done: RBI & Government Response

RBI’s Role

- Regularly intervenes in the forex market to manage volatility.

- Uses forex swaps and interest rate tweaks to stabilize the rupee.

- Holds over $600 billion in reserves to defend the rupee when needed.

Government’s Measures

- Promoting domestic manufacturing through Make in India.

- Pushing exports by signing FTAs and improving ease of business.

- Exploring trade in rupees and managing non-essential imports.

However, the real fix lies in reducing import dependence, improving manufacturing, and strengthening fundamentals.

Conclusion: The Bigger Picture

A weak rupee isn’t just a currency chart—it’s a mirror reflecting deeper issues in our economy. It affects our wallets, our dreams, and our nation’s global standing. The solution? A mix of strategic reforms, careful policy management, and building long-term resilience.

FAQs

What does it mean when the rupee is weak?

A weak rupee means it takes more Indian currency to buy one US dollar, reducing purchasing power and increasing import costs.

Who benefits from a weak rupee?

NRIs sending money home and foreign tourists benefit, as their money goes further in India.

Does a weak rupee mean the economy is failing?

Not necessarily. It reflects multiple factors, including global trends. But persistent weakness can signal economic vulnerabilities.

Can a weak rupee help Indian exports?

In theory, yes. But in practice, high import content and global demand issues often limit these gains.

What can the government do to fix this?

Promote local manufacturing, reduce import dependence, attract stable foreign investment, and manage inflation.

What is the impact of rupee depreciation on common people?

Higher costs for fuel, imported goods, foreign education, and travel.

Why is the Indian rupee falling against the US dollar?

Strong US economy, capital outflows, trade deficits, and inflation differences.

How does RBI control rupee depreciation?

By selling dollars from its reserves, using forex swaps, and managing interest rates.