Tax Evasion vs Tax Avoidance: Understanding the Legal and Ethical Divide

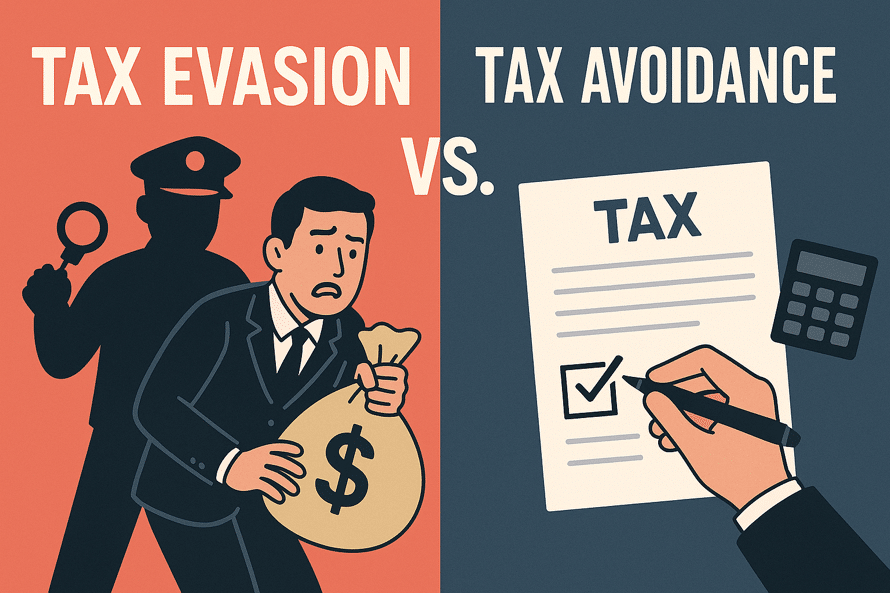

Many get confused by the terms Tax Evasion and Tax Avoidance in the world of finance. Although they both reduce taxes, their purpose and method are entirely different. Individuals and corporations try to minimize the taxes they pay. Some individuals follow legal procedures, while others break the law. Thus, all taxpayers should pay attention to this topic.

It is necessary to be aware and informed. Understanding the difference between permitted actions and forbidden actions prevents problems. Tax evasion vs. tax avoidance is not only a financial matter; it also requires us to think about what is right and wrong.

What Is the Difference Between Tax Evasion and Tax Avoidance?

People should be able to spot the difference between Tax Evasion and Tax Avoidance. Despite efforts to lower tax payments, their legality and ethical standards remain distinct.

Tax Evasion: Definition and Legal Framework

Tax evasion means people or companies do not declare all their earnings or disclose wrong information to avoid paying taxes. Underreporting your earnings, exaggerating your deductions, or not paying your taxes to the government are all part of it. Chapter XXII of the Income Tax Act of 1961 explains that evading taxes is strictly against the law, and the offender may be penalized, fined, or sent to prison.

Tax Avoidance: Definition and Strategic Use

People who practice tax avoidance use legal methods to pay less tax. It means taking advantage of valid deductions, making wise investments that lower taxes, or planning your earnings to remain at a lower tax bracket. Tax savings initiatives are perfectly legal, provided the law supports it.

Legality, Intent, and Ethical Implications

Evading taxes is not allowed and is unethical. Tax avoidance is generally deemed legal. Understanding the difference between tax evasion and tax avoidance can help people avoid mistakes.

Common Methods of Tax Evasion (Illegal Practices)

Many different strategies are used to evade taxes. Learning about tax evasion vs tax avoidance helps you follow tax laws.

Underreporting Income and Falsifying Records

Many use underreporting income as a common way to cheat. Here, individuals and businesses try to reduce their tax burden by hiding some of their income. They could make fake invoices or receipts to avoid paying taxes.

Offshore Accounts and Asset Concealment

Many individuals use offshore banks to hide their financial assets. These accounts are usually found in countries with strict rules for protecting privacy, making it difficult for tax authorities to trace these assets.

Claiming False Deductions and Personal Expenses

Fraudsters sometimes pretend to have deductions on their tax returns. When filing taxes, some individuals show money spent on themselves as business expenses. It reduces their taxable earnings in a way that is not fair.

Dual Bookkeeping and Use of False IDs

Some companies maintain a set of accounts for the authorities that are different from their actual accounts. Cybercriminals use fake names and IDs to open accounts and engage in illegal business activities without using their real identities.

Legal Tax Avoidance Strategies

You should be aware of tax evasion vs tax avoidance, which is very important in the financial field. There are secure and wise strategies you can use to reduce your taxes.

Claiming Deductions and Credits (Mortgage, Education, Charities)

Make use of deductions and credits when filing your income tax return. Interest paid on a housing loan, education fees for children, and contributions to recognized charities qualify for tax deductions and help lower taxes. You should retain all proofs and records to avoid missing out on these benefits.

Contributing to Provident Fund and Health Insurance

In India, employee contributions made to the provident fund qualify for tax deduction under Section 80C of the Income Tax Act. Furthermore, health insurance premiums paid also can be deducted from your taxable income provided you furnish proof of payment.

Income Deferral and Capital Gains Timing

If you can, receive any pending income in the following tax year. Also, make sure to sell your assets when capital gains taxes are lower. Holding on to your investments for a longer period can lead to lesser taxes.

Tax Arbitrage and Entity Structuring

For tax arbitrage, businesses should create the right kind of entity. The types of business entities determine the way taxes are assessed. If done properly, it can make tax planning legal and save you money.

Key Differences Between Tax Evasion and Tax Avoidance

Tax evasion vs. tax avoidance is often discussed in terms of compliance with the law. Planning your taxes legally is always a better option than breaking the law.

Legal Status and Enforcement

People engage in tax evasion when they illegally avoid reporting their income or alter their accounts. It is against the law. Alternatively, tax avoidance tries to reduce how much tax a company or individual pays by claiming deductions, using tax-saving strategies, and taking advantage of other legal loopholes. However, tax evasion is illegal and is punishable under Indian laws.

Intent and Transparency

People who evade taxes intend to cheat the government. Avoidance clearly shows that the individual is trying to reduce their tax obligation ethically. Proper planning and being open about it are necessary.

Methods and Documentation

Someone who evades can use fake records, neglect to report some earnings or disguise their assets. One can use approved ways such as deductions, exemptions or smart investing to avoid taxes. Having good documentation enables you to avoid taxes.

Consequences and Penalties

People who evade taxes may face fines, prison time, and a damaged reputation. The act is considered illegal. Legal means of tax avoidance are not subject to any punishment. It commonly results in paying less tax and making better financial plans.

Real-World Examples to Clarify the Distinction

Tax evasion and tax avoidance can sound confusing to many. The Reserve Bank of India (RBI) reported bank frauds totalling over 139.3 billion Indian rupees in the financial year 2024. We can understand the difference by analyzing real examples and a comparison table.

Case Examples of Tax Evasion

In the Jain case, the Central Board of Indirect Taxes and Customs (2016) reported that the applicant sought information about a tax evasion case involving Bhushan Steels. It was revealed that large corporations can intentionally withhold information and avoid paying taxes.

Another concern was the alleged inaction regarding an incorrect order from CBIC, which went unchecked, raising further questions about accountability. It shows that the authorities took the matter to court following a suspected tax evasion claim.

Case Examples of Tax Avoidance

When Vodafone won the case, Vodafone International Holdings B.V. vs Union of India (2012), it used arrangements in other countries to skip paying capital gains tax on its investment in Hutchison Essar. The decision by the government to charge Vodafone was deemed illegal by the Supreme Court. The company’s actions in this case presented an incident of lawfully avoiding paying taxes.

Comparison of Scenarios At a Glance

| Aspect | Tax Evasion | Tax Avoidance |

| Legality | Illegal | Legal |

| Method | Hiding income or false reporting | Using loopholes or planning |

| Example | Bhushan Steels case | Vodafone case |

| Consequence | Penalties, prosecution | May be reviewed, but not penalized |

The Ethical Grey Area: Aggressive Tax Avoidance

Trying to avoid paying taxes is considered legal, but may not be morally right. It involves some legal strategies to reduce the amount of tax, though it can raise ethical concerns. While the difference between tax evasion vs tax avoidance is not big, evasion is illegal and avoidance is not.

Exploiting Loopholes vs. Following the Spirit of the Law

Companies can take advantage of certain legal provisions to send their profits elsewhere, avoid paying taxes on time, or lower their tax rates. This act is legal, even though it may not follow the law as it was meant. Some argue that it goes against the essence of being fair and responsible.

Corporate Responsibility and Public Perception

People believe businesses should pay the right amount of taxes. Trying to lower tax bills could harm a company’s reputation and its relationships with customers and partners. Thanks to campaigns and media reports, firms are now considering strategy changes.

Governmental Crackdown and Global Policy Trends

Governments take steps to close gaps by revising rules and increasing transparency. The OECD’s BEPS framework is designed to ensure that profits are connected with real economic activities. Tax agencies in different countries are now sharing information to crack down on offenders.

Why Understanding the Difference Matters

Understanding Tax Evasion vs Tax Avoidance plays an important role in financial planning. People often mix these up, but learning the differences might protect you and help manage your taxes better.

Legal Risk vs. Strategic Planning

Tax evasion is illegal. This translates to hiding how much is earned, adding more deductions, or failing to file tax returns. It is legal to avoid paying taxes by making use of deductions available, unlike tax evasion. It applies legal measures such as exemptions, deductions, and investments to reduce the amount of tax to be paid.

Importance of Documentation and Compliance

Proper records are necessary to prevent allegations of tax evasion. Keep copies of your bills, investment papers, and returns. If you follow tax laws, your savings plans will not be questioned later on.

Role of Tax Advisors and Financial Planners

Experts will help you prepare your yearly tax returns correctly. Tax advisors often suggest legal ways to reduce your tax burden. PPF, ELSS, and insurance are among the tax-saving instruments that financial planners recommend selecting.

Conclusion

The difference between considered tax evasion and tax avoidance is an important issue to understand to remain both legally and morally compliant. Although tax evasion is a criminal offense, tax avoidance is legal if done properly as per the income tax law. It means that being informed, maintaining transparency, and consulting professionals are the key to smart tax planning. It will not put you at risk of penalties and spoil your financial reputation.

FAQs

1. What is tax evasion, and why is it illegal?

People who indulge in tax evasion do not pay tax by hiding their earnings or giving wrong information. The law prohibits it since tax laws are broken.

2. Is tax avoidance legal and ethical?

Tax avoidance happens legally since it is based on legal provisions that allow deductions. Sometimes, it is not fair when companies try to avoid paying what they owe in taxes.

3. Can aggressive tax avoidance turn into tax evasion?

If someone uses aggressive tax avoidance along with lies or concealment of true information, it is considered tax evasion. Overusing loopholes may result in being charged with illegal activities.

4. What are common tax avoidance strategies for individuals?

Some people lower their tax expenses by making use of tax-deductible expenditures, saving through appropriate plans or using their retirement accounts.

5. How do businesses avoid taxes legally?

Dedications, credits, and transferring earnings to regions with lower tax rates help businesses avoid taxes. If these approaches adhere to the rules, they are regarded as legal ways to reduce taxes.

6. What are the penalties for tax evasion in the US?

There are steep fines of $100,000 for unpaid taxes and the chance of going to jail as penalties. If someone or a business is found guilty, the IRS has the right to take action through the courts to collect the taxes owed.

7. Why is tax avoidance sometimes controversial?

People view tax avoidance as controversial when those with high incomes or major companies reduce their tax liability significantly. Although it isn’t illegal, many believe it causes injustice and negatively affects public services.

8. How can I reduce my tax liability legally?

Lowering your taxes is possible by using deductions, joining retirement plans and using tax credits. Taking care of your tax filing and looking ahead through planning helps you decrease your total payment for taxes.

9. When should I consult a tax professional?

A tax expert should be consulted if your taxes are detailed, you begin a business, or you have to deal with an audit. You can rely on them to direct you on proper filing.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.