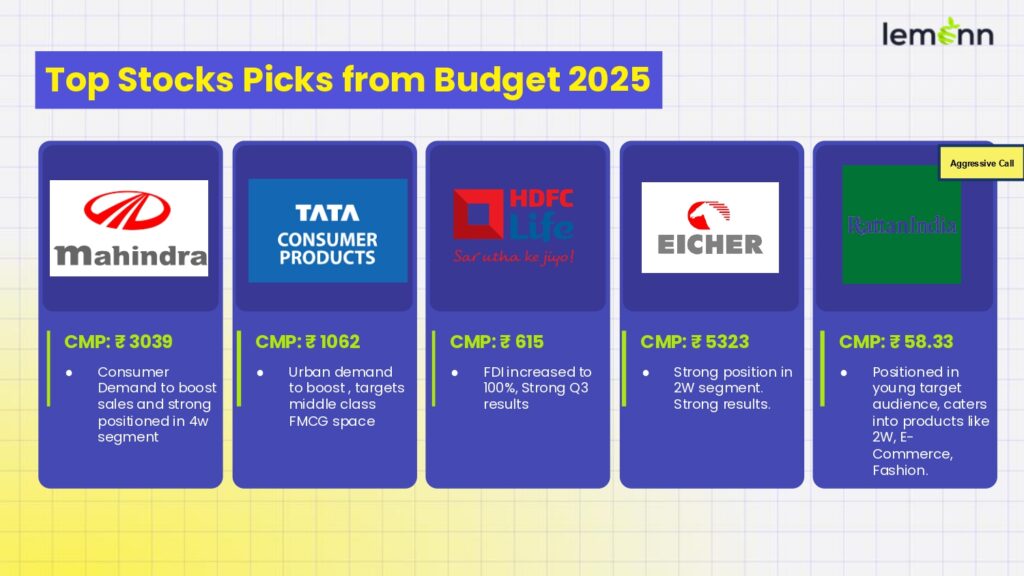

Post Budget Analysis by Lemonn RA

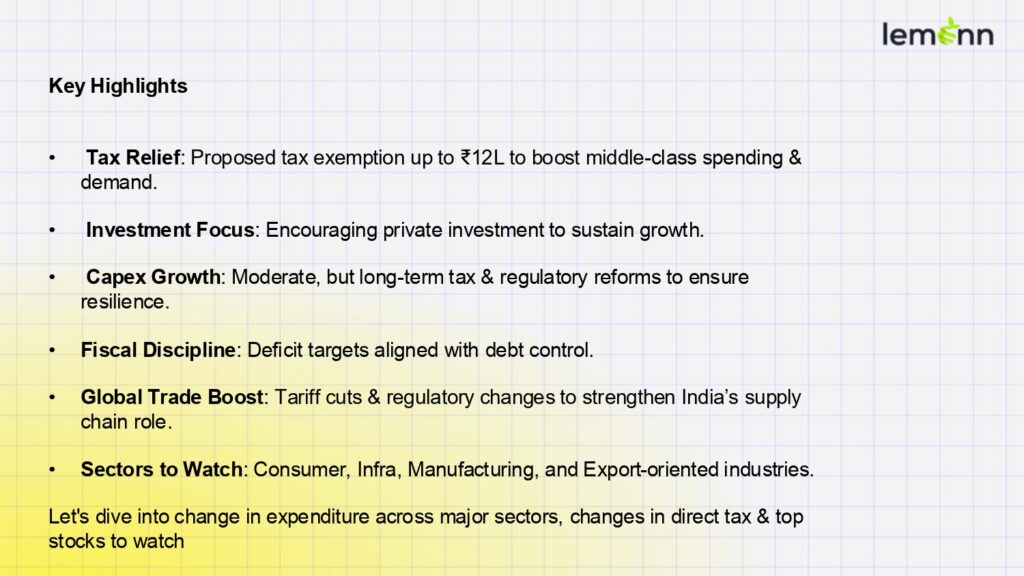

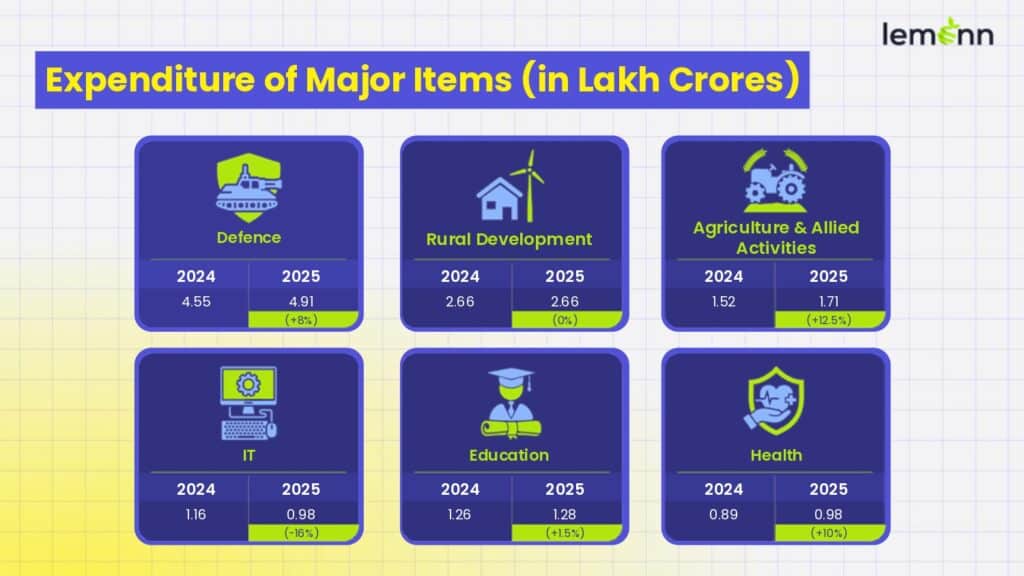

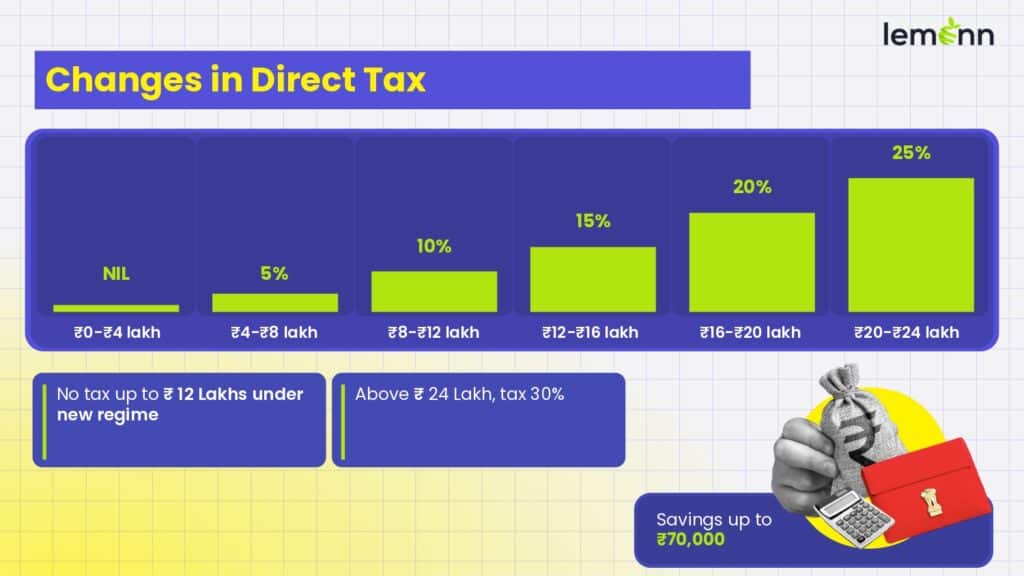

India’s 2025-26 budget focuses on boosting middle-class spending through personal income tax cuts and increasing private investment to sustain growth amid slowing economic expansion. A proposed tax exemption of up to ₹1.2 million aims to enhance disposable income and consumer demand. While capital expenditure growth remains moderate, long-term tax and regulatory reforms are expected to support economic resilience. The budget also emphasizes fiscal discipline, aligning deficit targets with debt levels, and strengthening India’s role in global supply chains through regulatory reforms and tariff rationalization to improve business competitiveness.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.