Net Present Value vs Internal Rate of Return: Which is better for Investment Decisions?

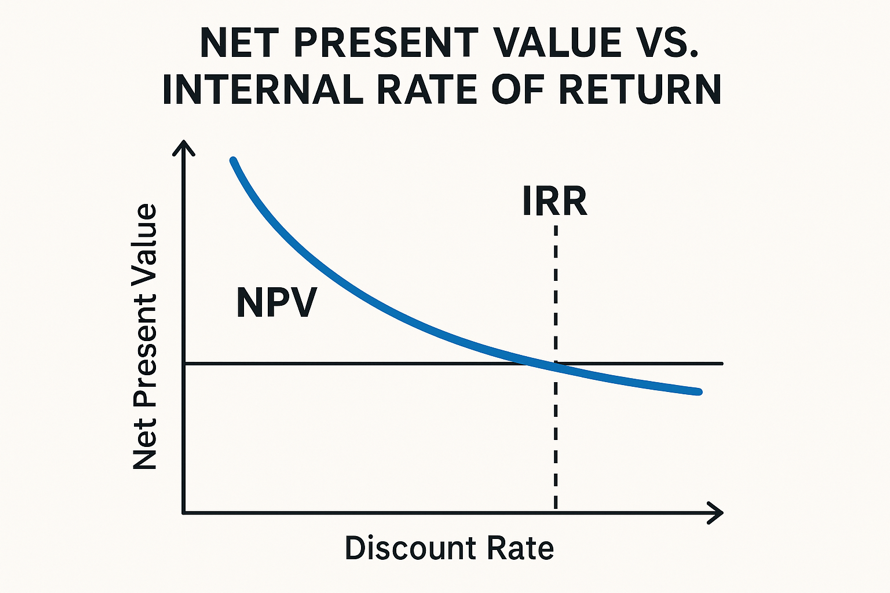

Two of the most common methods for evaluating business prospects using financial metrics are the Net Present Value (NPV) and the Internal Rate of Return (IRR). NPV finds the present value of all of a project’s future cash flows, including both positive and negative ones, based on their present value today.

IRR, on the other hand, estimates the rate at which these cash flows break even, which makes it a key sign of how profitable the business might be, or the rate of return the investment is expected to yield. Let’s compare which is better for investment decisions: NPV vs. IRR.

Understanding the Basics

NPV is a method for determining the present value of future cash flows, taking into account the time value of money and the associated risks of an investment. The IRR shows the expected return. Both help determine whether a project will generate a profit; NPV indicates the value added, and IRR shows the potential for growth. Now, let’s understand the difference between NPV vs IRR.

What is Net Present Value (NPV)?

Net Present Value (NPV) is the difference between the current value of all cash inflows in the future and the current value of all cash outflows. It helps you figure out if a business is profitable. NPV shows whether you might win or lose money by comparing future cash flows to their value right now.

What is the Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR) indicates the point at which a project’s Net Present Value (NPV) equals zero, also known as the break-even point. It is more profitable to have a bigger IRR. It helps you compare funding options and determine if a project is feasible.

Why Use NPV and IRR in Capital Budgeting?

There are times when IRR is better than NPV. IRR is a great way to compare different projects or when you don’t know the discount rate. NPV is more effective when cash flows fluctuate over time or when different discount rates are applied.

Key Differences between NPV and IRR

NPV vs. IRR refers to two key financial tools used to assess whether a project will be successful. Both use cash flow forecasts, but they do so in different ways, with different assumptions and meanings. Investors can make informed decisions by understanding these differences.

Conceptual Differences

NPV determines the actual value of a project by using a discount rate to calculate the present value of future cash flows. IRR represents the discount rate. IRR looks at the investment’s percentage return, which helps you compare different project choices. NPV examines the value created.

Calculation Methods

To find the NPV, you reduce each future cash flow at a specific rate and take away the original expenditure. IRR is the process of figuring out the rate at which the NPV equals zero. This is typically accomplished by utilizing financial tools. It’s easier to understand NPV than IRR, which requires you to use tools or solve complicated math.

Interpretation of Results

If the NPV is positive, the purchase is worth more, and if it is negative, it is worth less. The estimated rate of return on a project is shown by its IRR. If it is higher than the cost of capital, the project can go ahead. IRR gives you a quick way to compare success rates, while NPV gives you a better picture of the financial value.

Impact of Discount Rates and Reinvestment Assumptions

NPV assumes that short-term cash flows will be reinvested at the discount rate, which is equivalent to the cost of capital. IRR believes that the money will be reinvested at the internal rate of return, which isn’t always the case.

When to Use NPV Over IRR?

When it comes to a project, NPV vs IRR have different strengths. NPV is a more reliable method for making decisions in some instances, such as when cash flows are irregular, purchases can’t be made simultaneously, or discount rates fluctuate over time. Knowing when to use NPV as a priority helps you avoid drawing wrong conclusions.

Projects with Non-Conventional Cash Flows

When cash amounts change direction more than once, the IRR may provide you with more than one number, which can be confusing. However, NPV always yields the same value because it employs a constant discount rate.

Mutually Exclusive Projects

When choosing between projects that can’t work together, use IRR to pick the smaller ones with higher returns. NPV shows the total value created. In these situations, NPV is better. It tracks extra wealth directly and is not influenced by different project sizes.

Sensitivity to Discount Rates

It doesn’t matter if the discount rate changes because IRR assumes that investments will be made at the same rate. If you change the discount rate for each cash flow, NPV shows you how much it costs to borrow money. This approach is more flexible and stable.

Advantages and Limitations of Each Method

It is essential to know the benefits and limitations of both NPV and IRR. With them, investors and managers can select the most suitable tool for a project or strategic goal by understanding how NPV vs IRR differ in terms of risk assumptions, reinvestment basis, and scalability.

Pros and Cons of NPV

NPV provides a precise dollar estimate of the value added, works with different discount rates and cash flow timings, and accumulates across projects. It shows a reasonable spending based on the cost of capital. However, it depends on the assumptions made about the discount rate and may incorrectly favor larger projects.

Pros and Cons of IRR

IRR gives you a simple percentage return that you can use to compare investments and set easy-to-understand goals. Using financial tools makes it easier to perform math calculations. However, IRR assumes a reinvestment rate, which may not be realistic, can produce multiple values with non-standard cash flows, and doesn’t take project size into account.

Practical Applications and Examples

Corporate leaders understand the difference between NPV vs IRR, so they can decide whether an investment is a good idea. Real-life examples show how each measure can help you learn more. Here are two real-world examples.

Real-World Case Study: Using NPV

A hospital considered purchasing an X-ray device for $3,170, with annual payments of $1,000, increasing at a 10% discount rate. The NPV estimate showed that the project would return the investment and meet the return threshold. This meant that the project could go ahead, as the NPV was positive.

Real-World Case Study: Using IRR

The starting funding for a solar plant project was $500,000. Over the next five years, the project would receive $150,000 each year. The estimated IRR was about 14.8%, which was higher than the company’s cost of capital standard of 10%. Along with a good NPV, this high IRR helped to support the investment.

Expert Opinions and Best Practices

Many experienced financial experts recommend using NPV and IRR. Each method has its benefits, but the best way to evaluate an investment is to use more than one and understand what each one is based on.

What Financial Analysts Prefer

Analysts typically prefer NPV because it facilitates the prediction of total wealth added, a key objective in maximizing stockholder value, and it is particularly suitable for projects that can’t be completed simultaneously. IRR remains popular because it provides a simple numerical return; however, experts advise against relying on it alone, as it doesn’t account for scale or renewal rate assumptions.

Combining NPV and IRR in Decision Making

Considering both metrics can help you make more informed financial decisions. Use the IRR to quickly determine if a project has a favorable rate of return. Then, use NPV to verify that the project generates total value, taking into account factors such as size or changing cash flows.

Conclusion

When making financial choices, NPV vs IRR are both essential. When considering the time value of money, NPV represents the dollar value of an investment. On the other hand, the IRR provides a percentage return, which helps you compare different financial choices. IRR shows the rate of return, while NPV shows the exact value. Besides, you can use both metrics together. This will help you better understand business projects.

FAQs

1. What are the main assumptions behind NPV and IRR?

The NPV method is more realistic because it assumes spending at the company’s cost of capital or a rate that takes into account the project’s risk. IRR, on the other hand, assumes that money will be reinvested at its rate, which may not align with financial circumstances.

2. Can NPV and IRR give conflicting results?

Yes, NPV and IRR can give you different answers, especially when the projects are mutually exclusive. Differences in the size of the project or the length of the investment can also cause the results of the two approaches to differ.

3. Which is more reliable in the long term, NPV or IRR?

NPV is arguably a more effective method for determining which investments to make, as it provides a clear indication of the potential return on investment. It calculates the difference between the present values of cash coming in and going out.

4. How does the reinvestment assumption differ in NPV vs IRR?

One big difference between NPV vs IRR is the rule for the investing rate. NPV assumes that cash flows get reinvested at the project’s discount rate. This rate is also referred to as the required rate of return or cost of capital. Besides, IRR assumes that cash flows get reinvested at the project’s internal rate of return.

5. Why might IRR be misleading in specific projects?

The timing of cash flows is crucial to the IRR. There will be a higher IRR if the cash flows occur more frequently. This means that investments that pay off quickly can have high IRRs even if they don’t give excellent total returns. Besides, a high IRR could mislead investors seeking to build wealth over the long term.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.