How to calculate in hand salary from CTC

Calculating your in hand salary from your CTC (Cost to Company) might sound difficult. Once referred to as gross salary, CTC salary means the total amount a firm spends on an employee in a year. Your base salary, allowances, joining bonus, and other perks are included. Understanding the difference between CTC and in hand salary is important to calculate your take-home pay. Your in hand salary is the amount that gets credited to your bank account every month after all deductions. This blog post is a step-by-step guide to calculating your in hand salary from your CTC.

Difference between CTC and in hand salary

It is important to distinguish between CTC and in hand salary to plan your finances effectively. Put simply, CTC salary means the Cost to the Company or the total amount a company spends to keep an employee on its payroll. Your CTC salary might look big on paper, but the take-home salary would be a much lesser amount.

As mentioned above, the amount you receive after all deductions is your in hand salary. Deductions include taxes and provident fund contributions. These deductions will result in a decreased in hand salary. Consider this analogy to help you grasp CTC against in hand: While in hand salary is the last amount you pay or receive after all adjustments, CTC is like the total cost of an item before any discounts or taxes. Your current CTC may include perks like health insurance and a company car, which might not immediately increase your take home salary. Your entire compensation does, however, gain value from these benefits.

The difference between CTC vs. in hand pay is unavoidable, thanks to mandatory deductions. With a deeper grasp of what you actually earn each month versus what is represented in your CTC, you may plan your finances well and budget more effectively.

General terminologies related to salary

Although it can be confusing, understanding salary terms will help you better manage your finances. A brief guide to some of the frequently used salary-related terms is provided below.

CTC

CTC salary means cost to the company, or the total amount that a company spends on an employee in a year. Included in the CTC are the base salary, allowances, bonuses, and other perks. Your total package is referred to as your CTC salary. The total salary and various deductions are included in this figure. As it includes all the benefits the organization offers, the CTC for freshers would sound big. Although it’s not the same as your in hand salary, knowing your current CTC will help you calculate total compensation.

Gross Salary

Your gross salary is the total amount you earn before deductions. Your base salary plus any additional bonuses and allowances are included. This is the figure that is mentioned in your offer letter before taxes and different deductions are applied. Gross salary is a fundamental term to understand as it offers a rough idea about what you can expect to earn.

Gratuity

Gratuity is a payment made to employees who have served an organization for at least five years. Here, a lumpsum payment is made when an employee retires from a company or takes up another job elsewhere. Based on your latest salary and the number of years you’ve worked, you can calculate the gratuity amount. Gratuity is a company’s way of appreciating employees for long-term service. Gratuity calculators are available for free across many websites.

In hand salary or take home

The amount you actually receive after all deductions is referred to as in hand salary or take-home pay. Taxes, provident fund contributions, and other deductions are included. That is the money that gets credited in your bank account every month. The in hand salary is what you can actually spend when comparing CTC with the in hand salary. Knowing this amount is essential for budgeting and keeping tabs on your daily expenses.

Components of cost to company

When you get a job offer, your base salary is just one component of the CTC (Cost to Company). There are a few distinct elements that make up your total compensation package. You can understand the true value of your employment offer by knowing these components. The key elements of CTC are explained in this brief guide.

Direct Benefits

Your CTC salary includes direct benefits, which are immediate and tangible perks. The amount you earn before any deductions or additions is known as your basic salary. Direct benefits also cover allowances, including medical, travel, and house rent allowance (HRA). These are simple and shown on your pay slip. These benefits might make up a sizable portion of the CTC for new employees or freshers. Understanding them helps you comprehend what you truly receive on a monthly basis.

Indirect Benefits

The perks that aren’t immediately apparent yet increase the value of your total compensation are called indirect benefits. These include health insurance, business insurance, and subsidized meals. These advantages, which can be highly valuable, enhance your overall work experience. For example, health insurance will pay your medical bills, helping you save on costs. For instance, if your salary is Rs. 50,000 and the company pays Rs. 5,000 as health insurance premium, your CTC is Rs. 55,000. Although they are a part of your CTC, these perks have no direct impact on your monthly pay. You can get a better picture of the whole value of your CTC compared to your in hand salary by understanding these benefits.

Saving Contributions

Savings for future financial security are known as contributions. Contributions to pensions, savings plans, and provident fund are examples. They are important components of your general compensation package despite the fact that you do not get them in hand immediately. They add to your long-term financial planning and are deducted from your gross salary. Understanding these contributions is significant for freshers since they affect their future pay and savings. You can readily grasp your total compensation by breaking down the different elements of CTC.

Here is how to calculate in hand salary from CTC

Calculating your in hand salary from your CTC (Cost to Company) might appear confusing, but it is not that difficult if you follow a methodical approach. The total amount that a firm spends on you, including all benefits and deductions, is your CTC salary. Subtract deductions from your CTC to determine how much you really take home. To walk you through this calculation, we have provided a step-by-step guide.

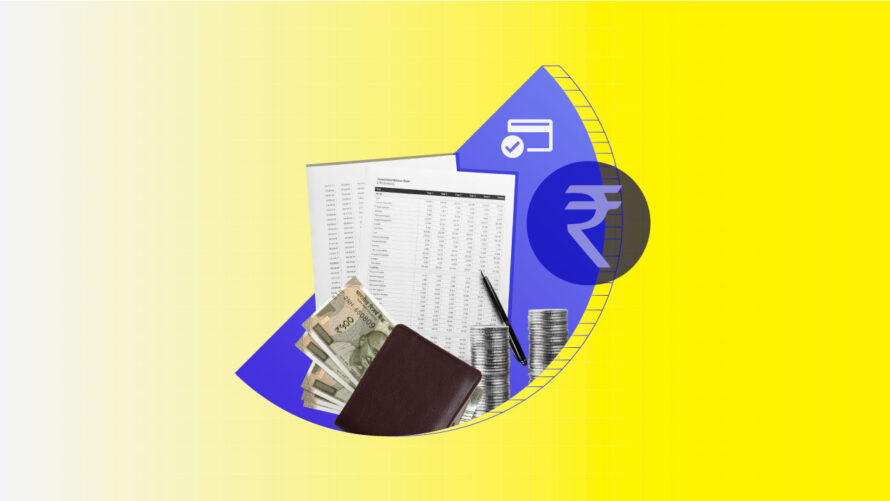

Here is an example to demonstrate how

Say your current CTC is Rs. 6,00,000 per annum. You should break down this amount and account for deductions in order to determine your in hand salary.

To calculate the in hand salary:

Total Deductions

Monthly Professional Tax: Rs. 1,000

Employer Provident Fund: Rs. 1,800

Employee PF: 1,800

Insurance: 250

Total monthly deductions: Rs. 4,850

Total annual deductions: Rs. 58,200

Monthly take home salary: Rs. 37,650

Annual take home salary: Rs. 4,51,800

Summary of the calculation procedure

To calculate your in hand salary from your basic salary, first determine your CTC salary, allowances, bonuses, and whatever other benefits are included. Take into account all deductions like professional tax, provident fund, and other costs. Subtract these deductions from your gross salary to calculate your in hand pay. Once you complete this, you will have a fair idea of how much you will really take home each month. Realizing the difference between CTC and in hand salary is important to make your personal finance plans.

Conclusion

Making the distinction between CTC vs. in hand salary is the first step to plan your finances successfully. Your total annual compensation is referred to as your CTC salary and this is not the same as your monthly take home. After deducting for taxes and provident fund contributions, the amount that you get is your monthly salary. While evaluating job offers, making this distinction is important for both freshers and experienced professionals.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.