GST 2.0 Explained: What India’s New Tax Reform Means for You

India is about to roll out one of its biggest tax reforms since GST was first introduced. Called GST 2.0, this new system promises simpler tax rates, lower prices on essentials, and a boost to both consumption and business growth. Here’s what you need to know — in plain English.

What Is GST 2.0?

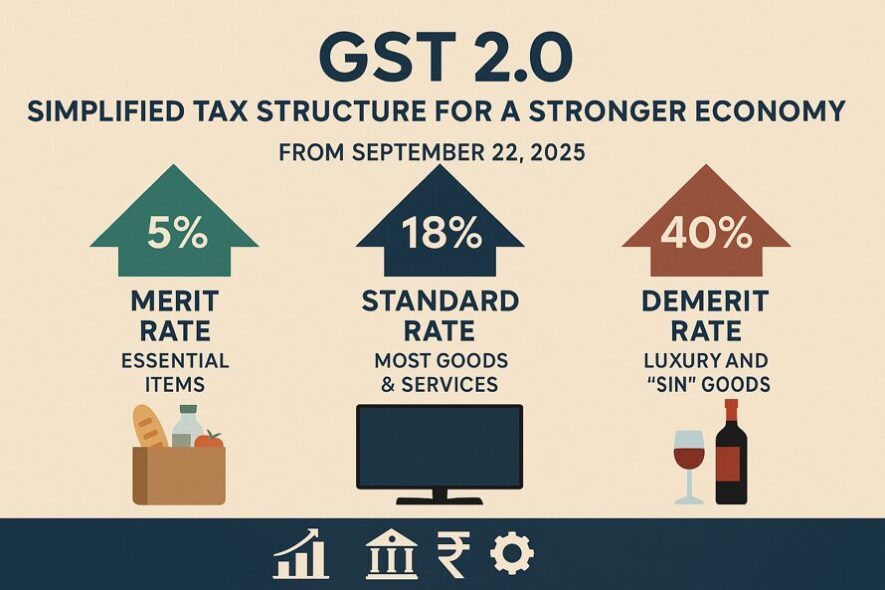

Starting September 22, 2025, the GST system in India will shift from four tax slabs (5%, 12%, 18%, 28%) to just three:

- 5% – Essential items (Merit Rate)

- 18% – Most goods and services (Standard Rate)

- 40% – Luxury and sin goods (Demerit Rate)

This major simplification aims to cut red tape, reduce costs for consumers, and drive a consumption-led growth model.

🗓️ Why September 22? It’s the start of the Navratri festival — a period of high spending — to maximize the economic boost.

What Gets Cheaper Under GST 2.0?

The government has slashed GST rates across a wide range of products and services. Here’s a snapshot:

GST Rate Changes: Goods at a Glance

| Category | Item | Old Rate | New Rate | Why It Matters |

|---|---|---|---|---|

| Household Essentials | Shampoos, soaps, toothpaste | 18% | 5% | Makes daily essentials more affordable for families. |

| Packaged foods, namkeens, sauces | 12–18% | 5% | Boosts spending on common groceries. | |

| Healthcare | Life-saving drugs, diagnostic kits | 5–12% | 0% | Ensures critical medical items are tax-free. |

| Ayurveda, Unani, homoeopathy medicines | 12% | 5% | Supports traditional medicine affordability. | |

| Electronics & Durables | Air conditioners, TVs (>32”), dishwashers | 28% | 18% | Encourages consumer electronics purchases. |

| Vehicles | Small cars, bikes (≤350cc), buses | 28% | 18% | Lowers transportation costs for individuals and businesses. |

| Luxury cars, high-end bikes (>350cc), yachts | 28% + cess | 40% | Keeps overall tax incidence the same after cess removal. | |

| Education | Notebooks, pencils, erasers, maps | 5–12% | 0% | Reduces school supply costs for parents and students. |

| Construction | Cement, bricks, marble | 12–28% | 5–18% | Makes building homes and infrastructure cheaper. |

GST Rate Changes: Services You’ll Use

| Service | Old Rate | New Rate | Impact |

|---|---|---|---|

| Hotel stays (tariff ≤ ₹7,500) | 12% | 5% | More affordable mid-range travel and stay options. |

| Salons, gyms, yoga centers | 18% | 5% | Promotes personal wellness and local service industries. |

| Air travel (economy) | 5% | 5% | No change — continues to be accessible for travelers. |

| Air travel (business class) | 12% | 18% | Higher cost for premium flyers. |

| Health & life insurance premiums | 18% | 0% | Major relief for individuals investing in protection. |

Why These Changes Matter for You

For Consumers

Lower taxes on essentials = More money in your pocket. Analysts expect this could reduce retail inflation by over 1 percentage point.

For Small Businesses (MSMEs)

Reduced GST on raw materials like cement and machinery helps cut costs, improve cash flow, and boost competitiveness, especially in semi-urban and rural areas.

For the Economy

The reforms are expected to stimulate demand, encourage credit growth, and drive employment. It’s a shift from infrastructure-led growth to people-first consumption growth.

What About Compliance & Filing?

GST 2.0 isn’t just about rate cuts. It’s also making compliance easier:

- GST Amnesty Scheme 2024: Businesses can settle old disputes and start fresh.

- Return filing stricter: GSTR-3B returns can’t be filed after 3 years from July 2025 onwards — encouraging timely compliance.

- GSTR-2B focus: A new static tool to make claiming Input Tax Credit (ITC) simpler and error-free.

📢 Bonus: GST Tribunal (GSTAT) is being set up to resolve tax disputes faster and more efficiently.

Banks & Credit: What’s the Link?

With items like electronics and vehicles becoming cheaper, banks expect a jump in retail loan demand — home loans, car loans, and personal credit. MSMEs will also likely seek more business credit, especially in rural and Tier 2 cities.

Key Takeaways

- GST 2.0 rolls out on September 22, 2025

- Simplifies tax to 3 slabs: 5%, 18%, and 40%

- Big tax cuts on essentials, medicines, electronics, education

- Boosts affordability, consumption, and MSME growth

- Includes major compliance reforms and dispute resolution tools

FAQs on GST 2.0

Q1: When do the new GST rates apply?

From September 22, 2025, across India.

Q2: What will become tax-free?

Life-saving drugs, insurance premiums, notebooks, UHT milk, and more.

Q3: Will this increase inflation?

No. In fact, it’s expected to reduce retail inflation slightly due to lower costs.

Q4: How will it help small businesses?

By cutting input costs and simplifying filing, GST 2.0 improves margins and cash flow.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.