Gross Pay vs. Net Pay: Understanding the Difference

Introduction to Salary Components

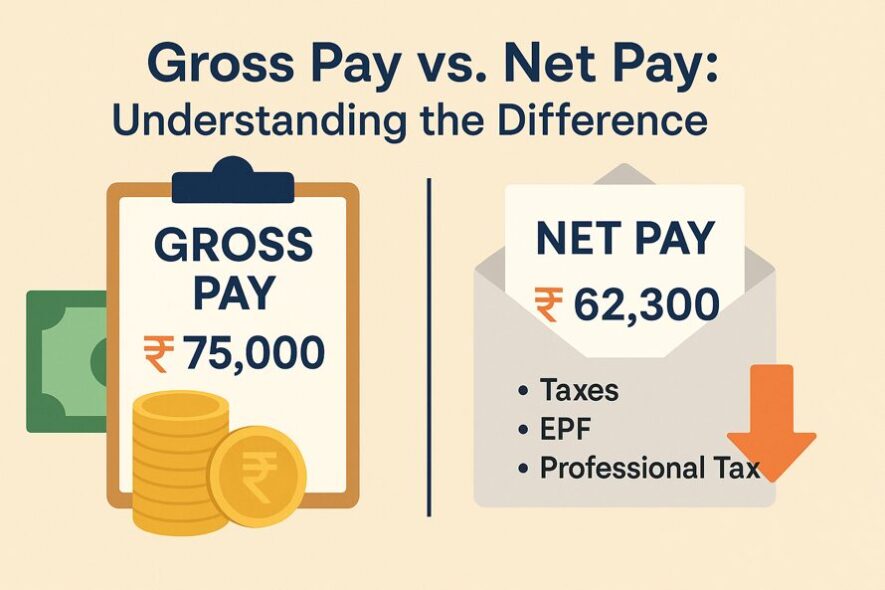

Picture this. Your first paycheck arrives, and the number on the salary slip looks very different from the figure mentioned in the offer letter. It creates a mix of excitement and confusion. Why does one number look so generous while the other feels more grounded? The answer lies in understanding the difference between gross pay and net pay.

Your salary is never a single block of money. It is structured like a dish, comprising various ingredients: basic pay, allowances, bonuses, and deductions. Gross pay refers to the full amount stated in your offer letter before any deductions. Net pay is the amount that finally shows up in your bank account. Both are important, but for very different reasons. Once you grasp this difference, every salary slip becomes more understandable, and every job offer becomes easier to evaluate.

What is Gross Pay?

Gross pay is the number that sets the tone in every salary discussion. Employers highlight it in offer letters as it represents the complete salary package before deductions. Think of it as the grand total, everything you earn in a month/year, stacked together, without accounting for deductions like income tax or provident fund contributions.

Inclusions in Gross Pay (Basic, HRA, Bonuses)

Gross pay is not one component but a basket of several. At the heart sits basic pay, the fixed portion that forms the largest share of your earnings. Added to that is the house rent allowance (HRA), which is especially relevant for employees living in rented homes.

Then come the bonuses, sometimes linked to performance, sometimes related to festivals, and most of the time purely discretionary. Many companies also add special allowances such as shift pay, project incentives, or city compensations. In some cases, overtime payments also make their way into the gross pay figure.

Together, these create the “headline” salary that gets presented as your gross pay.

Gross Pay on Salary Slips and Offer Letters

On a salary slip, gross pay usually appears in the “Earnings” section right at the top. It’s the total of all the listed components, before any cuts are applied. Offer letters often highlight the gross pay to present an appealing package, which is why candidates sometimes feel the actual payout later looks smaller.

Gross pay sets the outer frame of your salary, but it doesn’t specify what you get in hand. For that, you should look at the net pay.

Example Calculation of Gross Pay

Let’s imagine a monthly package.

- Basic Pay: ₹40,000

- HRA: ₹20,000

- Special Allowance: ₹10,000

- Performance Bonus: ₹5,000

Add it all up, and the gross pay stands at ₹75,000. This is the complete figure before tax and other deductions come into play.

What is Net Pay?

Net pay is the practical side of the salary. It’s the money that lands in your bank account, the amount you actually use for paying bills, buying groceries, EMIs, savings, and for that occasional indulgence. While gross pay looks impressive on paper, net pay reflects what is in your hand to spend every month.

Deductions from Gross Pay (Taxes, EPF, Professional Tax)

The transition from gross pay to net pay happens through deductions. The largest slice is usually income tax, which your employer deducts every month in the form of TDS (Tax Deducted at Source).

Then comes the Employee Provident Fund (EPF) contribution, a mandatory saving mechanism where a portion of your salary gets set aside in a government-mandated retirement fund. Some firms also charge a professional tax, a small but consistent deduction. On top of these, there may be deductions for health insurance premiums or contributions to company-specific welfare funds, depending purely on the employer.

Each of these brings the gross pay down to the figure you actually take home.

Net Pay or Take-Home Salary Defined

In straightforward terms, net pay is gross pay minus all deductions. It’s often labeled on the payslip as “Net Salary” or “Net Amount Payable.” This is the figure that matters for everyday life. When you’re setting a budget, applying for a loan, or planning investments, net pay is the only number you can realistically count on.

Example Calculation of Net Pay

Let’s revisit the earlier gross pay of ₹75,000. Assume the following deductions apply:

- Income Tax and TDS: ₹8,000

- EPF Contribution: ₹4,500

- Professional Tax: ₹200

That totals ₹12,700 in deductions. Subtracting this from the gross leaves a net pay of ₹62,300. That’s the actual money available in the employee’s bank account.

Key Differences Between Gross and Net Pay

Both gross and net pay are meaningful in their own way, but they serve different purposes. Knowing the distinction helps employees manage expectations and plan finances with confidence.

Earnings vs. Actual Take-Home

Gross pay is the entire salary package. Net pay is the real take-home. Gross is the promise, net is the delivery. While gross pay is useful for comparing job offers on paper, net pay decides how much you actually live on each month.

Taxation Impact

Taxation is the main factor that separates gross from net. As income rises, so do tax obligations, which cut into take-home salary. Employees who understand tax slabs, exemptions, and deductions can calculate their real net pay more accurately and avoid surprises.

Financial Planning Relevance

Financial planning always starts with net pay. Your monthly expenses, loan EMIs, insurance premiums, and investment commitments are all based on the amount that actually arrives in your account. Gross pay may look appealing, but it’s the net pay that decides your financial flexibility.

Components That Affect the Gap Between Gross and Net Pay

The distance between gross and net pay depends on how deductions are structured. Some employees see a narrow gap; others see a wider one. The following components play the biggest roles.

Income Tax Slabs and TDS

India’s tax system works on slabs. The more you earn, the higher the rate that applies. Every month, employers deduct tax in the form of TDS to meet these obligations. For employees, this means the higher the gross pay, the more significant the tax deduction, unless exemptions and deductions are used wisely.

Employee Provident Fund (EPF)

EPF is both a deduction and a benefit. A portion of your salary goes into this fund, and your employer adds an equal share. Over time, this builds into a sizable retirement corpus with interest. While it reduces monthly take-home salary, it secures long-term savings.

Other Voluntary/Statutory Deductions

Apart from tax and EPF, other deductions also shape the final net pay. Contributions to pension schemes, group health insurance premiums, or welfare funds may all appear on a salary slip. These deductions may be small individually, but they add up collectively to reduce the difference between gross and net pay.

How to Read Your Salary Slip

At first glance, a salary slip may look like a grid of numbers, but once you know what to look for, it becomes easy to interpret.

Identifying Gross and Net Pay

Gross pay is usually displayed in the top section under “Earnings.” It adds up all components before deductions. Net pay is mentioned at the bottom as “Net Salary” or “Net Amount Payable.” Comparing the two gives you immediate clarity on how much of your salary is actually spendable.

Common Salary Slip Terms Explained

A salary slip can look like a puzzle at first. But once you know the terms, it becomes clear. Basic pay is the steady part of your income. HRA supports rent payments. Special allowance changes from company to company and balances the structure.

On the deduction side, you’ll see TDS, which covers income tax, EPF for retirement savings, and sometimes a small professional tax. Once you understand these, the slip stops feeling technical and starts acting like a guide to your money.

Why It Matters for Budgeting and Financial Planning

The gap between gross and net pay shapes everyday finances. It decides how much you can spend, save, or invest without stretching yourself.

Knowing What You Actually Earn

Gross pay may look impressive, but it’s the net pay that matters. This is the amount that pays your bills and funds savings. Knowing this figure keeps your budget steady and realistic.

Planning Investments and EMIs

Every financial plan depends on steady take-home pay. EMIs, SIPs, and insurance premiums all run on net pay, not the gross. Basing your plans on this figure helps you avoid overcommitting and keeps your goals sustainable.

Gross Pay vs Net Pay in Job Offers: What to Look For

When comparing offers, don’t stop at gross pay. Two jobs may show the same number, but deductions change the real picture. Always ask for a salary breakup and salary components to check the approximate net pay.

Conclusion

Gross pay shows the package, and net pay shows the absolute number. One reflects what is promised, the other pays for your expenses. When you understand the difference, salary slips make sense, job offers look clearer, and financial planning becomes easier. Gross is the headline, but net is the story you live each month.

FAQs:

Q. Is net pay the same as take-home salary?

Yes. Net pay is the take-home salary, the amount credited to your bank after deductions.

Q. Why is my net pay so much lower than my gross salary?

Gross pay includes everything, while net pay comes after tax, EPF, and other deductions. That’s why the difference feels large.

Q. How can I increase my net salary?

Use tax-saving options like 80C or 80D, declare investments, and negotiate for allowances that reduce taxable income.

Q. Do bonuses and incentives count in gross pay?

Yes. They’re part of gross pay since they’re earnings, but they’re taxable, so they also impact the net pay.

Q. Are all deductions mandatory from gross pay?

No. Some, like tax and EPF, are compulsory. Others, like extra insurance or pension contributions, depend on company policy or choice.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.