Ex-Date vs Record Date: Understanding the Key Differences

Every investor has a distinct and well-defined goal when making investment plans. While some individuals attempt to save money for retirement, others prefer to invest for a steady income. One of the tactics individuals use for long-term gain while investing in the stock market is dividend investing.

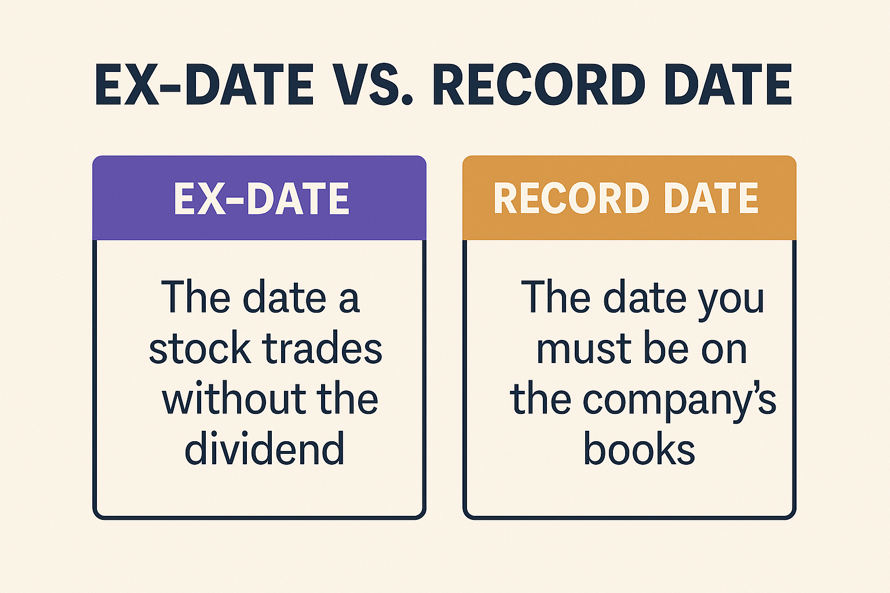

It entails making investments in businesses that consistently pay dividends and provide lucrative returns. There are two dates in the dividend concept that people often misunderstand. This blog post will discuss ex-date vs record date to allay doubts and ensure your investment is successful.

What is Ex-Date?

The stock market in India is estimated to grow to US$5.32 trillion in 2025. With this increased growth and the number of investors involved, it is necessary to know some of the important concepts, such as the ex-dividend date.

Ex-dividend date or ex-date is the date on or after which the buyer of a company’s stock becomes ineligible for the dividend payout. By purchasing the stock on/after this date, you will not have an entitlement to the dividend payment. However, purchasing before the ex-date helps you qualify to receive the dividend payout.

Definition and Meaning of Ex‑Date

The ex-date signals the point when shares begin trading without the upcoming dividend. The stock exchange sets it, and the settlement rules primarily influence it. The shift to a shorter T+1 settlement cycle now typically aligns the ex-date with the record date. This alignment makes it easier for most retail investors to understand the ex-date and record date.

How Ex‑Date Affects Shareholders

The ex-date sets the eligibility for the dividend. When you purchase before the cum-dividend date, you secure your position. But, purchase on or after the ex-dividend date, and the seller retains the benefit. The stock price typically drops by approximately the dividend amount on the ex-dividend date. This price adjustment reflects the cash leaving the company.

Example of Ex‑Date in Action

For instance, company XYZ declares a dividend with the ex-date and record date set for July 15. Buy on or before July 14 and hold through the ex-date to receive the dividend. If your purchase settles on or after July 15, you will miss out—the seller will be entitled to the dividend. This timeline clearly illustrates how the ex-date and record date impact decisions regarding dividend eligibility.

What is Record Date?

The record date marks the date when the company reviews its shareholder records to identify who qualifies for the dividend. The Ex-Date vs Record Date serves as the corporate-determined cut-off for officially identifying entitled shareholders.

Definition and Meaning of Record Date

The board of directors sets the record date to determine which shareholders are eligible for dividends or other corporate benefits. Only individuals listed in the company’s records by the end of this date will receive the announced distributions or entitlements. This distinction clarifies the confusion between ex-date and record date for both new and seasoned investors.

Role of Record Date in Corporate Actions

The record date has a significant impact on corporate actions, including dividend payments, stock splits, rights issues, and bonus shares. The company identifies eligible shareholders for these benefits. Only individuals listed in the company’s records on the record date can participate in the announced action.

It guarantees transparency and accuracy when distributing corporate benefits to entitled shareholders. Investors should monitor this date to ensure they don’t miss critical payments and related opportunities. This process enhances awareness of the ex-date and record date in financial planning and portfolio strategy.

Example of Record Date in Practice

A company announces a record date of October 10. Shareholders listed at market close on October 10 will receive the declared dividend, regardless of whether they sell their shares afterwards. If your trade settles by that date, you will receive payment. This shows how the ex-date and record date affect investor entitlement and payout certainty.

Ex-Date vs Record Date: Key Differences

Understanding dividend mechanics requires differentiating between the ex-date vs record date. Both mark necessary cut-offs for dividend entitlement, but they operate in distinct ways.

Timeline Comparison of Ex‑Date and Record Date

The exchange sets the ex-date under settlement rules, and it typically occurs one business day before the record date. Today, shares start trading without the upcoming dividend value; buying on or after means missing out. The company’s board designates the record date, officially determining which shareholders are entitled to the dividend. Investors must purchase shares before the ex-date to ensure their transactions settle in time for the record date.

Impact on Dividend Eligibility

The ex-date determines eligibility: buy before it, and you receive the dividend; buy on or after, and you miss out. The record date serves as an administrative checkpoint that confirms who qualifies, but it does not qualify new purchases.

Knowing the difference between ex-date and record date enables investors to avoid timing errors in dividend-related trades. This clarity is crucial for long-term investors and those seeking to capture short-term dividends. Timing accurately around these dates ensures you receive your rightful entitlement to dividends or other corporate benefits.

Why Do Ex-Date and Record Date Matter to Investors?

Investors must understand the significance of the ex-date vs record date to comprehend dividend mechanics. These dates impact eligibility, taxation, and strategic timing in making portfolio decisions.

Dividend Payment Eligibility

The ex-date serves as the practical cut-off: own shares before this date, and you’re entitled to the dividend; buy on or after, and you aren’t. Purchasing ahead of this threshold ensures inclusion. The record date serves an administrative purpose—it confirms eligibility for those already established, rather than qualifying new investors.

Tax Implications

Additionally, taxes serve a crucial purpose. Dividends are subject to favorable taxation based on the holding period surrounding the ex-date. For instance, to qualify for reduced dividend tax rates, you must hold a stock for a minimum number of days around the ex-date window. Understanding these temporal rules helps investors maximize after-tax returns.

Strategic Investment Decisions

These dates guide investment strategy. Dividend traders buy shares just before the ex-dividend date to collect the dividend and sell afterwards. However, this tactic carries risks of price drops, commissions, and unfavorable tax treatment. Long-term investors hold through these dates for income consistency, minimizing concern over timing nuances while benefiting from informed awareness of payout schedules.

Common Misconceptions about Ex-Date and Record Date

Many misconceptions concerning the ex-date vs record date confuse new investors. If you understand their purpose and when to use them, you can quickly dispel these misconceptions and avoid them when making future investment plans.

Misconception: Purchasing after the record date ensures you receive the dividend

If you purchase after the record date, you won’t be able to. Everyone may participate, but only stockholders who are registered by the record date can receive dividends. So, any purchases made after that forfeit their right to the item.

Misconception: The record date determines who receives dividends

The record date formalizes eligibility based on existing share ownership. It creates no entitlement. While it confirms recipients, it does not affect who qualified before that day. This highlights the need to distinguish between ex-date and record date in dividend timing strategies.

Misconception: The ex-date and record date can happen at the same time without affecting settlement

Settlement rules still apply, even if they align with each other. Purchasing on the ex-date may settle too late for the record date. Understanding settlement remains crucial, even in cases of date coincidences. This shows that the alignment of ex-date and record date does not change the settlement timelines for dividend eligibility.

Misconception: These dates affect dividends only

These cut-off dates also apply to other corporate actions such as stock splits or rights issues. Investors must consider ex-benefit and record dates beyond dividends to ensure they understand their entitlements during corporate events.

Conclusion

The distinction between the ex-date vs record date plays a crucial role in the dividend process. The ex-date acts as the operational cut-off, and the record date identifies the official roster of eligible shareholders. Modern T+1 settlement systems often align these dates, but understanding both is essential for effective investing, tax planning, and portfolio strategy.

The knowledge helps investors avoid missing out on entitlements and make more informed, income-focused investments. Recognizing how these dates interact can simplify dividend planning and enhance portfolio performance. Understanding the distinction between ex-date and record date enhances trust in a company’s activities and investment schedules.

FAQs

Q. What happens if I buy shares on the ex-date?

Buying shares on the ex‑date means you will not receive the upcoming dividend. The seller gets the dividend instead of you, as the settlement happens too late to qualify.

Q. Can I sell my shares after the record date and still get the dividend?

You can do it. After you become a shareholder on the record date, selling your shares later does not change your entitlement. You will still receive the dividend even after the sale.

Q. Why are ex‑date and record date not the same?

In the context of ex-date vs record date, the company sets the record date to determine which shareholders are eligible. Ex-date is the day on which the stock begins trading ex-dividend, or without the dividend.

Q. Does the ex‑date apply to stock splits and bonuses as well?

It certainly does. Like dividends, corporate actions such as stock splits and bonus shares establish an ex‑benefit date and record date, which determine entitlement based on the timing of ownership registration.

Q. How many days before the record date is the ex‑date?

The ex-date typically occurs one business day before the record date. However, on non-business record days, settlement rules may adjust the ex-date accordingly.

Q. What is the cum‑dividend date?

The cum-dividend date marks when shares still carry the right to the next dividend. Purchases made before this date are eligible for the payout, but those made afterwards are not.

Q. Are ex‑date and record date applicable for mutual funds?

Indeed, they are. Mutual funds have a similar record and established ex-distribution dates. In the context of ex-date vs record date, if you own fund units by the record date, you will receive distributions. Ex-date is the business day after the record date. On this day, a fund’s share price drops by the amount of the distribution that will be paid for each share, not including adjustments for market fluctuations.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.