Dow Jones vs NASDAQ vs S&P 500: What’s the Difference?

When people talk about “the market,” they’re usually referring to one of three major indexes: the Dow Jones, NASDAQ, or S&P 500. These benchmarks track how different groups of U.S. stocks are performing – but they’re not the same.

Let’s break down how each index works, what it measures, and how they compare, so you can better understand market news and make smarter investing decisions.

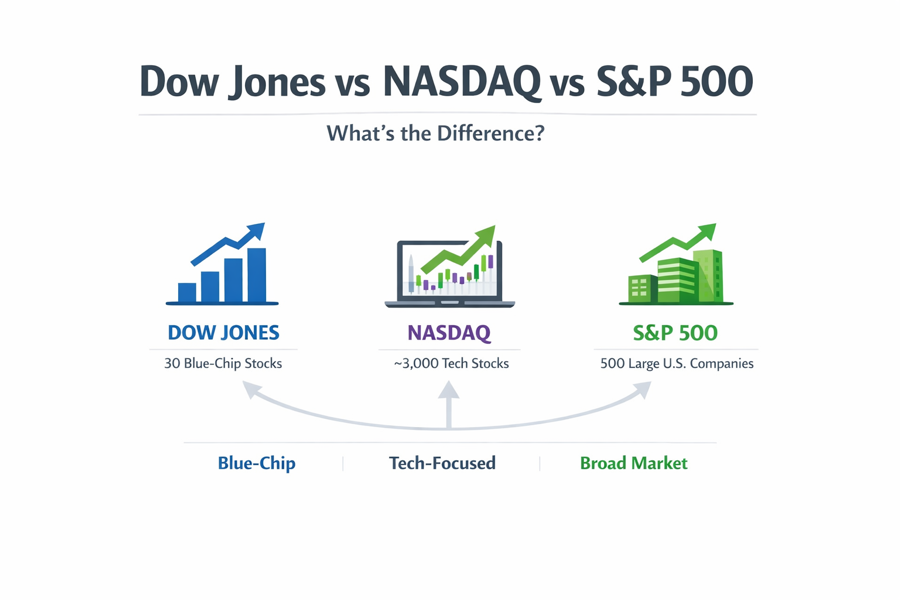

Quick Summary: The Big Three Stock Indexes

| Index | Tracks | Weighting Type | Key Focus |

|---|---|---|---|

| Dow Jones | 30 large U.S. companies | Price-weighted | Blue-chip, established stocks |

| S&P 500 | 500 large U.S. companies | Market cap-weighted | Broad U.S. market |

| NASDAQ | Over 3,000 companies (NASDAQ exchange) | Market cap-weighted | Tech-heavy, growth stocks |

What Is the Dow Jones Industrial Average (DJIA)?

The Dow Jones, officially called the Dow Jones Industrial Average (DJIA), is the oldest and most well-known stock index in the U.S.

- Tracks 30 large, publicly traded companies like Apple, Coca-Cola, and Boeing.

- Created in 1896 by Charles Dow and Edward Jones.

- Price-weighted: Stocks with higher prices have more influence, regardless of company size.

What it reflects:

The Dow gives a snapshot of how major blue-chip companies — typically leaders in their industries — are performing.

Pros:

- Focuses on stability and legacy companies.

- Simple to follow.

Cons:

- Only 30 companies.

- Ignores market cap, so it can misrepresent larger market trends.

What Is the S&P 500?

The S&P 500 (Standard & Poor’s 500) is the most widely followed index by investors and financial professionals.

- Includes 500 of the largest U.S. companies, across all sectors.

- Market capitalization-weighted, so bigger companies like Apple, Microsoft, and Amazon have more influence.

- Created in 1957.

What it reflects:

A broad look at the U.S. economy and overall stock market health. If you want a big-picture view, this is the index to watch.

Pros:

- Broad and diversified.

- Better representation of the U.S. market.

Cons:

- Still only tracks large-cap companies (misses small caps).

- Heavily weighted toward tech and mega-caps.

What Is the NASDAQ Composite?

The NASDAQ Composite tracks all stocks listed on the NASDAQ exchange – over 3,000 companies.

- Includes giants like Apple, Microsoft, Amazon, and Tesla.

- Market cap-weighted and tech-heavy.

- Launched in 1971.

What it reflects:

NASDAQ is often seen as a barometer for tech and growth stocks. It’s more volatile but offers insight into innovation-driven sectors.

Pros:

- Tech-focused and innovation-driven.

- Includes small- and mid-cap companies, not just giants.

Cons:

- More volatile than other indexes.

- Not as diversified across industries.

Key Differences: Dow vs S&P 500 vs NASDAQ

Here’s how they stack up:

- Size: Dow (30 companies) < S&P 500 (500 companies) < NASDAQ (~3,000 companies)

- Diversity: S&P 500 is most diversified across sectors. Dow is the most concentrated.

- Weighting Method:

- Dow: Price-weighted

- S&P 500 and NASDAQ: Market cap-weighted

- Sector Focus:

- Dow: Blue-chip, legacy firms

- S&P 500: Broad U.S. economy

- NASDAQ: Tech-heavy, growth-oriented

Which Index Should You Watch?

It depends on what you want to track:

- For a general sense of the U.S. market, the S&P 500 is the most balanced and widely used benchmark.

- If you’re interested in tech stocks and innovation, the NASDAQ is a better fit.

- To track the performance of industry leaders and blue-chip companies, watch the Dow Jones.

Most financial analysts and investors use the S&P 500 as the primary market gauge, but all three indexes offer valuable insights.

FAQs

Q: Is the NASDAQ only tech companies?

No, but it’s heavily tilted toward tech and growth stocks, which dominate the exchange.

Q: Why does the Dow only have 30 companies?

It was designed to reflect top industrial leaders. While limited in scope, the Dow has symbolic value and represents long-term stability.

Q: Can you invest in these indexes?

Yes, through index funds and ETFs like SPY (S&P 500), DIA (Dow Jones), and QQQ (NASDAQ-100).

Q: Which index performs best?

Historically, the NASDAQ often shows higher returns due to tech growth, but also higher risk. The S&P 500 offers a good balance of risk and reward.

Key Takeaways

- Dow Jones = 30 major companies, price-weighted, blue-chip focus

- S&P 500 = 500 companies, market cap-weighted, broadest U.S. snapshot

- NASDAQ = ~3,000 companies, tech-heavy, growth-oriented

Understanding these indexes helps you read the market more clearly – and invest more confidently.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.