Budget 2024 Highlights

Finance Minister Nirmala Sitaraman made history by presenting her seventh consecutive budget, which was also the first budget of the Modi 3.0 government. The budget set the tone for the next five years, with Viksit Bharat being the focal point, driven by the government’s unwavering focus on fiscal consolidation and capex-led growth.

However, the budget has to be analyzed in totality, with a clear understanding of what it means for all stakeholders. Viewed from this standpoint, Budget’24 turned out to be a mixed bag. While the budget ticked many boxes on macroeconomic indicators and fiscal prudence, it doled out tough love for investors and salaried employees.

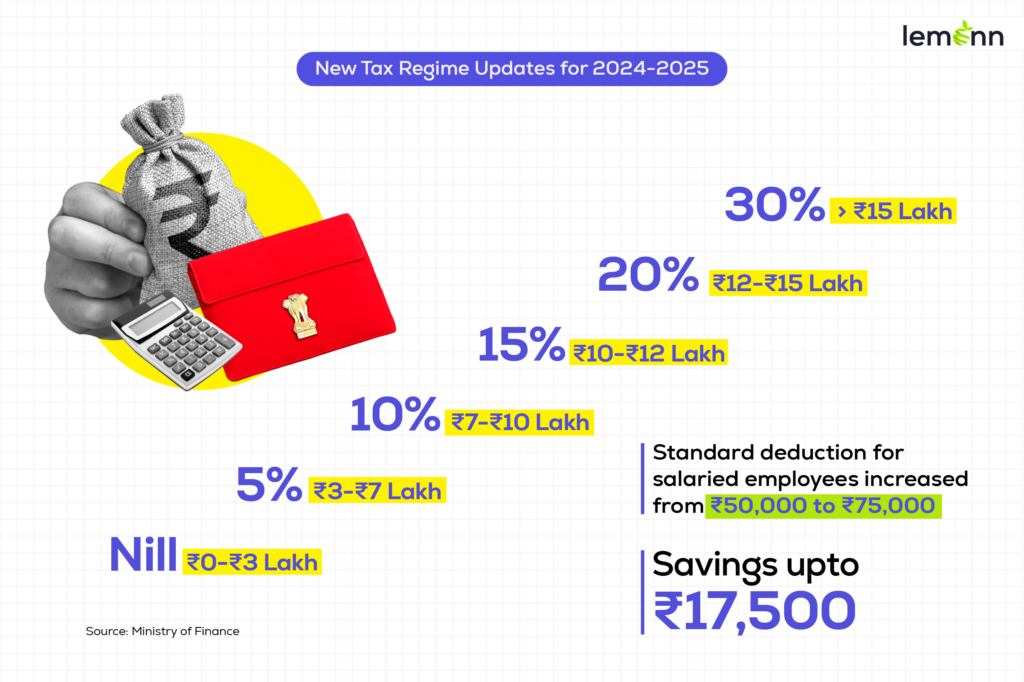

The tax rates under the new tax regime saw some tweaks which will result in taxpayers saving up to Rs. 17,500. But the long and short-term capital gains regime was revamped for all asset classes, and revised tax rates are expected to impact various asset classes differently.

Here are the budget 2024 highlights for you.

Budget Decoded

The budget speech given by the finance minister highlights the major changes and allocations made in the budget. But one needs to read the budget fine print to understand the proposed changes and in-depth implications of the changes on sectoral allocations, changes in tax and its implications on citizens and asset classes.

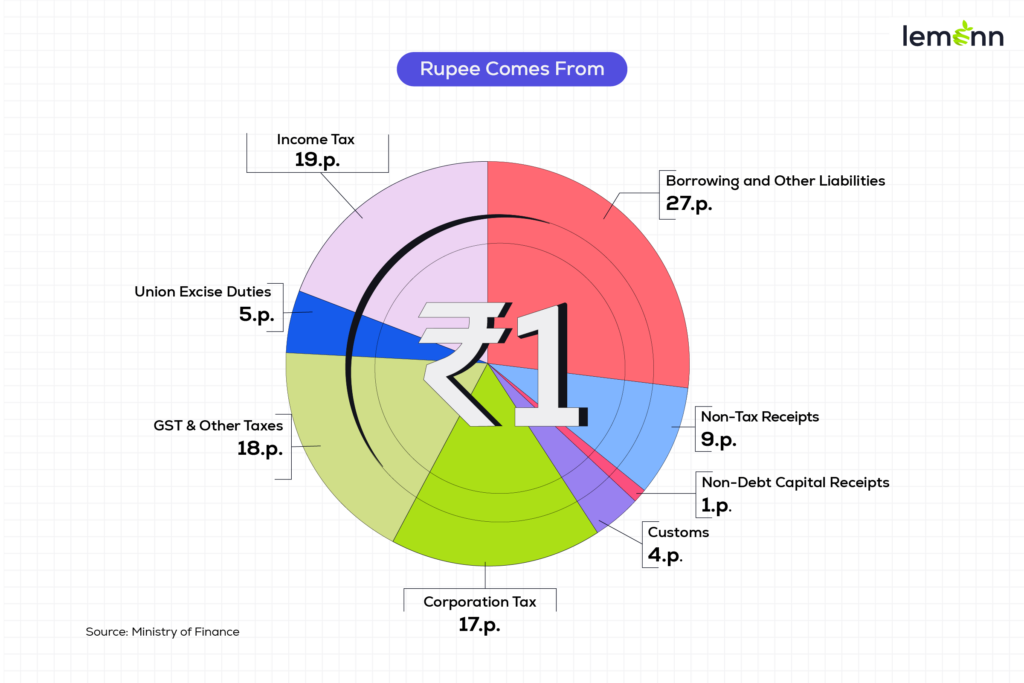

Here is what contributed to each rupee that the government earned.

Fiscal prudence and long-term development were the central themes of the budget 2024. The government has addressed the unemployment problem head on, announcing various schemes aimed at skilling the youth to make them employable. What’s more, the budget motivates the private sector to increase their employee base by reimbursing the employer EPF contribution of upto Rs. 3,000/per month/ per new hire.

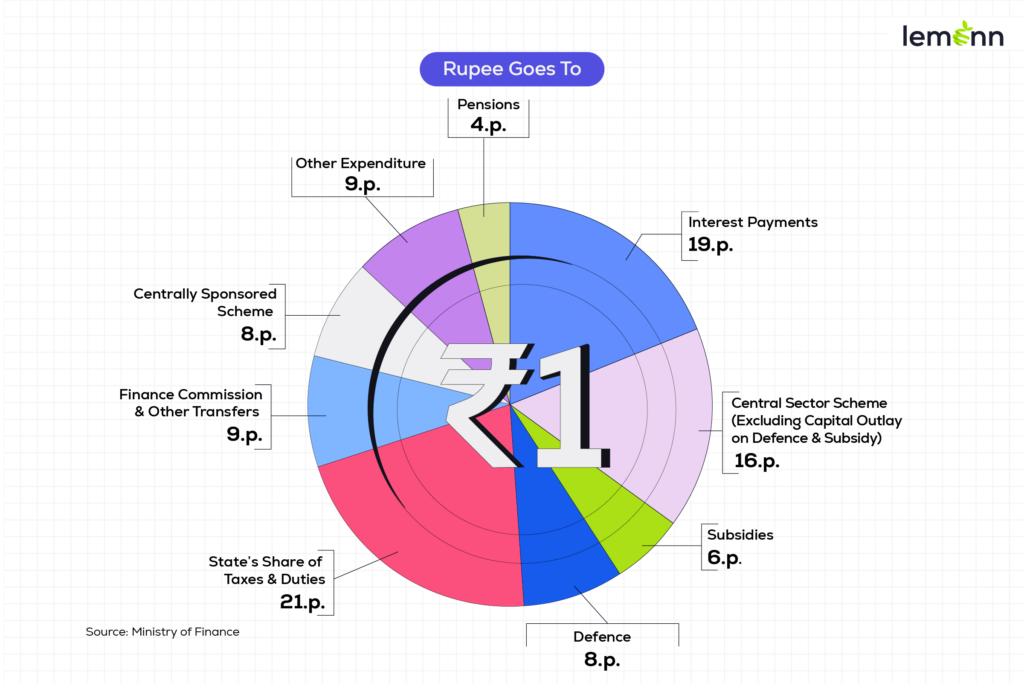

Here is how the government spent in the last financial year:

It is important to note that 19% of government spending is currently on interest repayment. This is a huge number and thus the emphasis on fiscal deficit is of utmost importance.

On the fiscal front, the budget talked about boosting growth while also reducing the fiscal deficit target by 0.2% to 4.9% for FY 2024-25. However, the capital gains tax revamp left investors fuming, which we will discuss in a bit.

Budget and Economy

The capex outlay for the year 2024-25 was left unchanged from what was proposed in the interim budget. This was in line with the market expectations as the next budget will be presented in February 2025, which is just six months from now.

The government has got a grip on the fiscal prudence front and the record RBI dividend seems to have been put to good use to bring the fiscal deficit target down to 4.9% of the GDP from the proposed 5.2% in the interim budget. Additionally, the fiscal deficit target for the year 2025-26 was set at 4.5%. This speaks for the government’s focus on reducing debt. The reducing fiscal deficit over time will strengthen the country’s economic position.

This budget also set the focus on development for the next five years while also signaling a policy continuation and business-as-usual approach despite being a coalition government.

On the economic front, the Indian macro indicators look strong, with inflation under control and healthy tax collection expectations.

Long story short, the budget hit all the right notches on the macroeconomic front. The budget 2024 highlights would be incomplete without an update on tax slab changes and the mega overhaul of the capital gains tax on various asset. This how the tax changes will impact you.

The Budget 2024 and You

Overall, the budget got the macroeconomics right. As an Indian or someone working in India, you would benefit from a stable, growing economy in the long run. Now, let’s get to what has changed on the taxation front.

Tax slabs 2024: What changed in the budget?

The budget speech talked about a review of the Income Tax Act 1969 with a focus on simplifying the existing tax regime. Additionally, the focus of the current government will be on widening the tax base while reducing litigation and appeals around income tax compliance among individual taxpayers.

Changes to the New Tax Regime and its impact on your salary

Changes were made to tax slabs under the New Tax Regime. A taxpayer under the new regime is likely to save up to Rs. 17,500. Here is an infographic of the applicable tax slabs for the financial year 2024-25.

On personal income tax front, the standard deduction under the new tax regime was increased to Rs. 75,000 from Rs. 50,000.

As a salaried employee, if you opt for the new tax regime, you will enjoy tax-free income of up to Rs. 7.75 lakh.

This move will likely increase your disposable income.

Changes to Short- and Long-Term Capital Gains Tax

The finance minister proposed to overhaul the short- and long-term capital gains structure to simplify the calculation and compliance for the investor without impacting the government coffers. However, the tax overhaul left a sour taste as investors are likely to pay more tax now than in the year before.

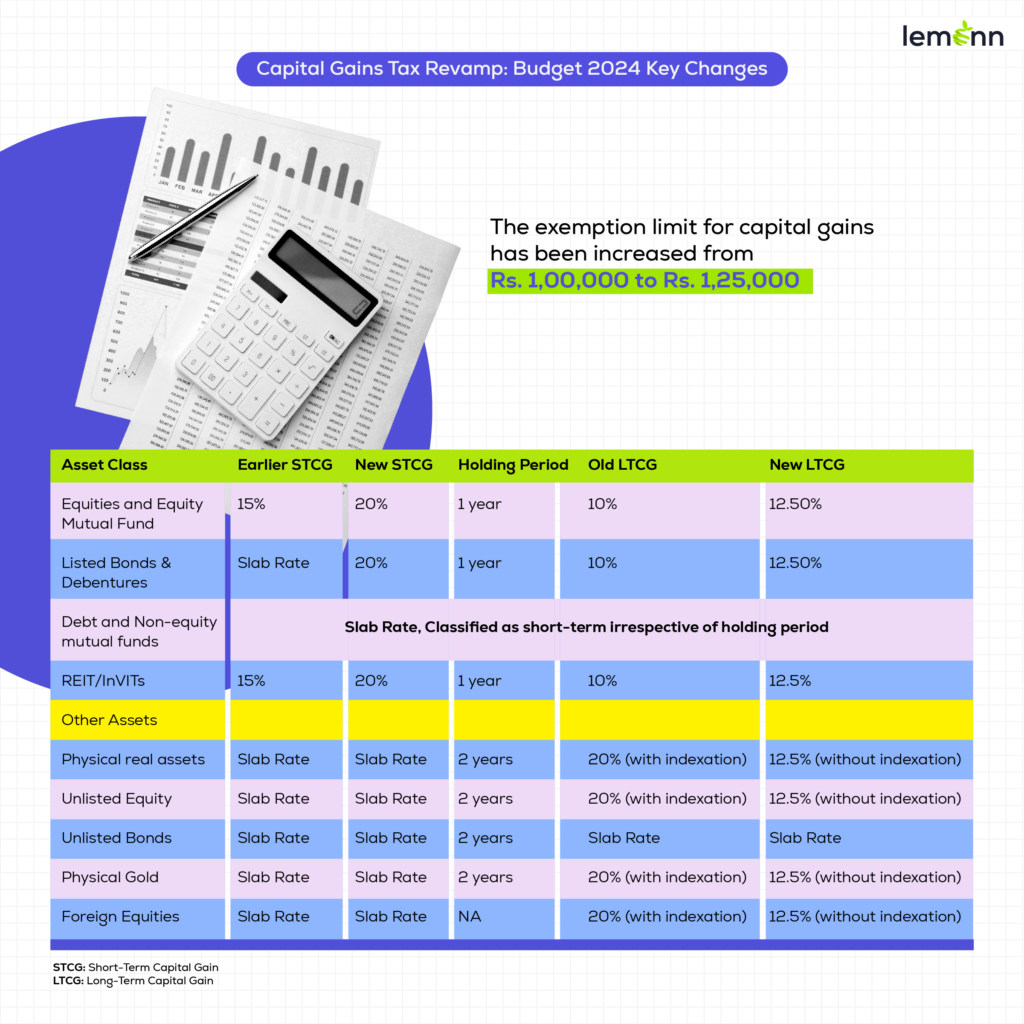

Another major change that spooked investors was the removal of indexation benefits for physical real estate, physical gold, unlisted equity, and foreign debt/equity. While the long-term capital gains tax levied on these assets saw a significant decrease from 20% to 12.5%, investors holding any of the above-mentioned assets for a very long time are likely to pay more taxes as indexation benefits are not applicable.

Equity investors were in for a shock as both the short- and long-term capital gains tax on listed equities were increased. The STCG was increased by 5% to 20% and the LTCG was hiked by 2.5% to 12.5%. The only silver lining in the cloud was the increase in the exemption limit from Rs 1,00,000 to Rs 1,25,000.

Here is an infographic highlighting tax changes for all asset classes:

The chart above highlights the pre and post-budget change rate and how these changes can impact your investment income. The increased exemption can lower your tax liability compared to a year prior even with the increased tax rate. Here is how it will work.

Currently, the LTCG is charged at 10% and has an exemption limit of Rs. 1,00,000. The tax amount on an income of Rs. 2,00,000 will amount to Rs. 10,400 (including a 4% cess, but excluding surcharge).

With the new amendment, the exemption limit has been hiked to Rs. 1,25,000. Consequently, the tax on the gains of Rs. 2,00,000 will come to Rs. 9,375, including a 4% cess, but excluding surcharge). The new tax rate will result in savings of Rs. 650 for taxpayers.

Small investors will benefit from these changes to an extent. However, the impact of the taxation changes will depend on the amount of gains.

Changes in Securities Transaction Tax (STT)

The STT charged on Futures and Options transactions saw a significant hike. The retail participation in the F&O market is growing at a scorching pace, prompting the market regulator to raise concerns. STT was increased to curb increasing retail participation. Here are the revised STT rates:

- Futures up from 0.0125% to 0.02%

- Options up from 0.0625% to 0.1%

The change might look insignificant in isolation, but it has the potential to add up with multiple transactions.

Conclusion

Taxes are the only constant in life and this budget proved yet again that taxes are something that cannot be glossed over. While the change in tax slabs and the increase in exemption amount cheered the salaried individuals, the revamp in capital gains tax left them disappointed.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.