Traditionally, a bank account was where you stashed away your savings. Not any longer. Nowadays, a bank account provides a bouquet of financial services such as online banking that facilitates anywhere banking, account statements/alerts to track transactions in your account instantly, ATM card/credit card, a demat account to hold your shares and securities in electronic form, and much more. Banks also offer overdraft facilities which allow users to withdraw money over their account balance.

Practically speaking, business owners and individuals often face cash crunches due to interruptions in income inflow or a temporary increase in outflow. Worse, it would be difficult to arrange funds at short notice in such cases. An overdraft (OD) facility helps businesses and individuals meet their short-term liquidity needs.

This blog post talks about what is an overdraft facility and how it can be availed to meet your short-term liquidity requirements. Read on to learn more.

What is an overdraft facility?

The overdraft facility offered by banks and financial institutions allows you to withdraw money from your savings or current account even when the account balance is zero. In other words, it is a credit facility banks provide to individuals and businesses to meet their short-term liquidity needs.

The judicious use of overdraft facilities can help businesses effectively manage their working

capital needs by availing flexible and quick access to additional funds.

The amount of funds you can access via the overdraft facility primarily depends on your relationship with the bank. With the overdraft facility, you can withdraw money as per the authorized limit. While banks earn interest on the borrowed amount, interest rates only apply to the amount utilized from the total sanctioned limit.

How to apply for an overdraft facility

Banks offer overdraft facilities to businesses and individuals, but interested parties must apply to avail the facility. Banks and financial institutions provide the overdraft application facility both online and offline. You can visit a bank branch or apply online and submit your application with the necessary documents. The bank will review your creditworthiness and decide on your application. In case of approval, the bank will also decide on the authorized overdraft limit.

Features

Here are the key features of the overdraft facility:

- Predetermined Limit: Banks set a maximum limit when they approve an overdraft application. The limit depends on the borrower’s creditworthiness and varies for each borrower.

- Running Account: The overdraft facility is offered in an existing savings or current account. It is a running account permitting borrowers to withdraw and deposit up to the authorized limit at any time.

- Interest Charges: Interest on overdrafts is levied only on the overdrawn account at a predetermined rate, calculated daily but billed monthly.

- No Prepayment Penalties: Overdraft is a short-term loan facility. Unlike other loans, the overdraft facility does not attract a prepayment penalty for overdrawn amounts.

- Flexible Repayment: The overdraft facility does not have a repayment structure like the EMI system. The borrower can repay the overdrawn amount in varying sums depending on the availability of funds.

How does the overdraft facility work?

An overdraft (OD) facility allows the borrower to withdraw funds up to the approved limit even when the account balance is zero. When the OD facility is used, the outstanding balance increases on withdrawal, and deposits made to the account reduce the outstanding balance.

Some account holders may be pre-approved, automatically activating the OD if you overdraw. If not pre-approved, interested parties can apply through the bank, often with a quick online process or by visiting the branch.

Types of overdrafts

Banks and financial institutions offer secured and unsecured overdraft facilities. The secured overdraft facility requires collateral, while the unsecured ones do not. The collateral options are:

1. Overdraft against Property

A secured overdraft credit line is offered to businesses against residential or commercial property. Here, borrowers enjoy a high overdraft limit and low interest rate since it has a collateral asset.

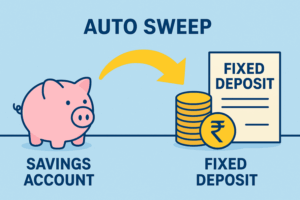

2. Overdraft against Fixed Deposits (FD)

Banks and financial institutions use your fixed deposit as collateral and extend a certain percentage of your FD as an overdraft facility. OD against an FD enjoys fast processing and minimal documentation, making it suitable for individuals seeking an overdraft facility.

3. Overdraft against Insurance Policy

Some banks extend overdraft facilities against approved insurance policies such as Unit Linked Savings Plans and Endowment Plans. Here, the insurance policy’s surrender value will be used as the collateral. Hence, a term insurance policy may not qualify as collateral for overdraft facilities.

4. Overdraft against Equity

Overdraft facilities can be availed against investments such as equity, mutual funds, and fixed-income securities. However, investments are not a favored collateral for overdraft facilities as their value depends on market movement. Therefore, an OD against such investments often has lower sanction rates.

5. Overdraft against Salary

Banks offer overdraft facilities on salary accounts. This can be one of the benefits of maintaining a salary account with a specific bank. It can also be a pre-approved OD facility that can be activated instantly on the bank’s app.

Differences between Overdraft and Term Loan

A term loan is a fixed amount of money borrowed for a set period, while an overdraft facility is a revolving temporary line of credit extended for a short period. We have listed the eight significant differences between an overdraft facility and a term loan.

| Nature | A revolving line of credit that allows withdrawals beyond the available account balance. | A fixed sum of money borrowed for a defined purpose. |

| Purpose | Best suited to meet short-term financial needs. Helps manage cashflow gaps, working capital needs, etc. | Intended for a specific purpose such as business expansion, purchase of machinery, etc. |

| Repayment | Flexible repayment. The overdraft facility can be paid off partially or fully by depositing funds into the account. | Fixed repayment schedule in the form of monthly installments (EMIs). |

| Time Horizon | Short-term, that can be as short as 1 day. | Long-term, with scheduled repayment tenures that can run into years. |

| Interest Calculation | Calculated daily on the outstanding amount. The interest will be billed monthly. | Usually calculated monthly on the entire loan amount. |

| Flexibility | Offers flexibility in terms of usage and repayment; the limit is restored once the borrowed amount is repaid. | Limited to no flexibility for withdrawing and repaying funds. |

| Collateral | May or may not require collateral depending on the amount | Depending on the type, may or may not require security or collateral. |

| Access | Immediate access to funds up to a fixed limit. | Fixed amount disbursed on milestone achievement. |

Overdraft from leading banks/NBFCs

Almost all banks and NBFCs offer overdraft facilities. You can visit the websites of leading banks or NBFCs to learn about their overdraft facilities. Different banks and NBFCs charge different rates for overdraft facilities, so it is advisable to compare the rates before availing of an overdraft facility.

FAQs

Which banks provide overdraft facilities?

All public and private sector banks provide OD facilities. However, the minimum and maximum overdraft amount, interest rate, and repayment tenure could vary depending on the applicant’s profile, creditworthiness, and repayment capacity.

Do banks provide overdraft facilities to all account holders?

Banks offer the overdraft facility to savings and current account holders.

Can I withdraw money from the overdraft facility?

Yes, an overdraft is an open credit line that allows borrowers to borrow money in portions from the total sanctioned limit.

What happens if I can’t pay my overdraft?

In a secured overdraft facility, such as an overdraft against fixed deposits or salary, the bank has the right to deduct the outstanding balance from the collateral. In an unsecured overdraft, the borrower could face hefty fines, and the credit score will be negatively impacted.

How long can a bank account be overdrawn?

The overdraft period is predetermined and will be clearly mentioned by the bank. It can depend on many factors, such as the borrower’s financial history.