How to Open a Swiss Bank Account: A Complete Guide

Individuals and companies worldwide seek Swiss bank accounts because they provide stability, privacy, and advanced financial services. Despite the numerous changes in the rules, Swiss banking remains a reliable option for those seeking safe and convenient account solutions. This article will guide you on how to open a Swiss bank account, including the required documentation, associated costs, and relevant legal considerations.

Why Open a Swiss Bank Account?

Opt for a Swiss bank account to gain exceptional financial stability, access sophisticated global services, and manage multiple currencies efficiently. It offers strong asset protection within a robust legal system and a renowned privacy framework. This solution suits those who want a secure, versatile, and discreet banking option that combines international accessibility with top-notch wealth management.

Benefits of a Swiss Bank Account

Open a Swiss bank account to deal in a wide range of currencies, ensure privacy, and achieve financial stability. Investors favor Switzerland for its low inflation and stable currency. Even with advances in transparency, robust regulations actively protect client data. Holding multiple currencies in one account reduces foreign exchange risks and makes it a strategic choice for managing international finances securely and efficiently.

Privacy and Confidentiality in Swiss Banking

Swiss banking relies on long-standing confidentiality—under Article 47 of the 1934 Banking Act, disclosing client information constitutes a criminal offence. Modern international accords mandate data exchange, yet Swiss banks protect customers’ spending and investment data from inquiries unrelated to taxes.

Swiss Banking Laws: A Brief Overview

Swiss banking law prohibits the disclosure of customer identification or financial activities under the 1934 Federal Act. Furthermore, Article 47 protects bank-client confidentiality by mandating imprisonment and penalties for infractions. Swiss privacy rules are among the strongest in the world; however, since 2017, international reporting standards such as CRS and FATCA have required data exchange.

Who Can Open a Swiss Bank Account?

Many wonder who qualifies to open a Swiss bank account when considering Swiss banking. Swiss banks welcome individuals and entities from around the world, if they meet specific compliance requirements. Understanding the eligibility criteria is the first step for both private individuals and businesses.

Eligibility Criteria for Non‑Residents

Non-residents can open Swiss bank accounts if they pass stringent identity and background checks. Applicants must also show a legal source of funds and typically meet a minimum deposit threshold. As a result, although access is available globally, not all applicants receive automatic acceptance.

Requirements for Businesses and Corporations

A business must provide verified documentation, including incorporation papers, shareholder details, and financial statements, to open a corporate account. Banks will evaluate the legitimacy of the business and its funding sources. Transparency and compliance play a crucial role in securing approval.

Swiss Bank Account Options for Individuals

The banking industry in Switzerland is expected to have a significant increase in net interest income, with estimates pointing to US$90.27 billion in 2025. So, individuals select from a range of Swiss banking solutions designed for various financial goals. This includes basic checking, savings, investment, and private banking services. Clients can easily align account types with their personal or professional needs.

Documents Required to Open a Swiss Bank Account

Keep all necessary documentation handy before you open a Swiss bank account. The procedure of applying becomes better, which helps the bank follow the requirements.

Identity Proof and Address Proof

Applicants must first provide a valid passport or national ID to prove their identity. These documents enable banks to meet KYC (Know Your Customer) obligations.

Source of Funds Declaration

Swiss banks require you to provide a clear explanation of the source of your funds. Documents proving the source of income, business income reports, or investment records are often necessary. This step ensures transparency and effectively prevents money laundering or illegal financial activities.

Additional Documents for Corporates

Corporate accounts demand extra paperwork. Companies must provide incorporation certificates, lists of shareholders, company statutes, and their most recent financial statements. Additionally, some banks may request a business plan or contracts to understand the nature of the organization better.

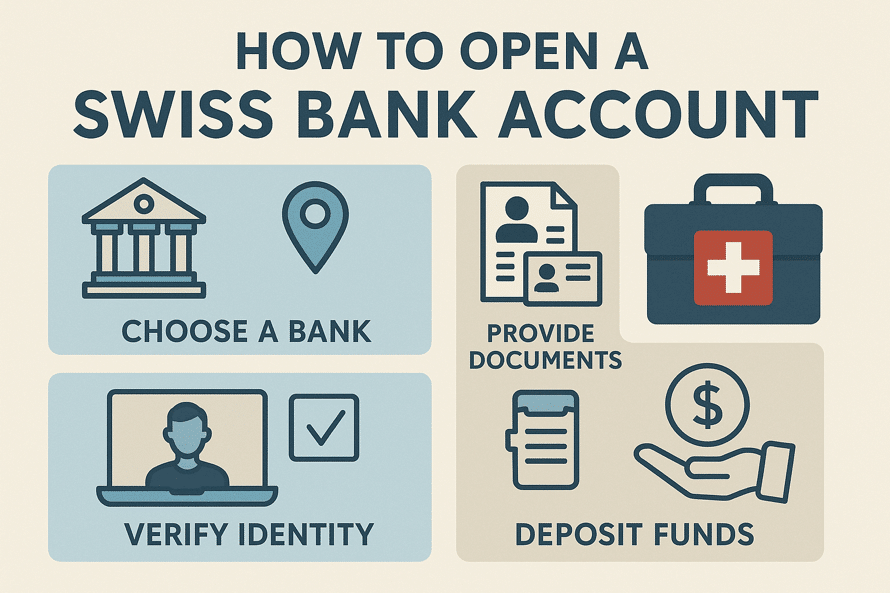

Step-by-Step Process to Open a Swiss Bank Account

To open a Swiss bank account, you must follow a specific process that ensures compliance with the law and transparency of your funds. At first, the levels seem complicated, but if you take them one at a time, they can be dealt with easily. Individuals and businesses can efficiently and securely open accounts by following this process diligently.

Choosing the Right Swiss Bank

Selecting the right Swiss bank is a crucial step. Besides, various banks provide different services, fees, and account types based on your personal or business needs. Therefore, compare options and evaluate the bank’s expertise with foreign or non-resident customers.

Submitting an Application: Online vs In-Person

Next, decide whether to apply online or in person. Many banks support online applications, but some still require a physical visit for identity verification. However, the choice ultimately relies on the bank’s policies, your location, and your preferences.

Verification and Compliance Checks

The bank will conduct thorough compliance checks after submission. Identity verification, financial background review, and source of funds evaluation are included. This step ensures adherence to anti-money laundering (AML) and Know Your Customer (KYC) regulations.

Minimum Deposit Requirements

Most Swiss banks require you to make a minimum deposit to activate your account. Non-resident accounts typically require higher minimum amounts, though the amount varies between institutions and account types. Besides, it’s crucial to confirm deposit thresholds beforehand to prevent delays or rejections.

Types of Swiss Bank Accounts

Swiss banks offer various types of accounts to meet different financial goals. Choosing to open a Swiss bank account guarantees access to customized financial solutions, whether for personal or professional use.

Personal Bank Account

Individuals seeking secure and flexible financial services find a personal Swiss bank account ideal. This account covers firm income and expenditures and records all transactions in its statement, like a current account.

Corporate Bank Account

Corporate accounts serve as a specific type of checking account that enables company owners to manage their personal and business funds separately. This account covers firm income and expenditures and records all transactions in its statement, like a current account.

Numbered Accounts

Numbered accounts provide added confidentiality by using a number instead of the holder’s name, unlike standard accounts. These accounts no longer provide full anonymity due to regulations, but they still facilitate internal discretion. Therefore, they attract clients who prioritize extra layers of privacy.

Investment Accounts

Clients interested in growing their wealth benefit from Swiss investment accounts that offer professional portfolio management. They also provide access to a variety of assets, including stocks, bonds, and funds. These accounts suit individuals who prioritize long-term financial planning and returns.

Costs and Fees of Swiss Bank Accounts

Swiss bank accounts offer superior services, but they come with related charges. Understanding these costs ahead of time is essential for effective financial planning and account management, particularly when you open a Swiss bank account.

Account Maintenance Fees

Swiss banks commonly impose maintenance fees for account management and administrative services. Fees vary according to the account type and degree of service. As a result, private or investment accounts often have higher fees than regular personal accounts.

Transaction Charges

Swiss banks charge fees for local and foreign transactions. Payments within a country often cost less than payments across borders. Traveling abroad frequently significantly increases the overall fees on your account.

Currency Conversion Fees

When changing currencies, Swiss bank imposes exchange rate margins as well as extra service costs. Market rates and account circumstances determine these fees. Account holders with multiple currencies must monitor conversion costs to optimize their international financial transactions.

Legal Considerations and Compliance for International Clients

It’s crucial to understand global regulations and local laws to ensure complete transparency and avoid penalties when planning to open a Swiss bank account.

FATCA and CRS Compliance

Swiss banks must comply with Foreign Account Tax Compliance Act (FATCA) for US citizens and Common Reporting Standard (CRS) for other jurisdictions under global tax laws. Thus, relevant tax authorities automatically receive account information. Clients must disclose their tax residency and adhere to local reporting obligations.

Swiss Banking Secrecy Act: Myths and Realities

Swiss Banking Secrecy Act protects customers’ confidentiality, although its scope has been reduced. Secrecy cannot trump international tax accords. While privacy remains strong, the myth of total anonymity no longer reflects the current regulatory environment.

Reporting Requirements for Foreign Account Holders

Foreign account holders must legally notify their Swiss accounts to their home country’s tax authorities. Banks communicate account information via international standards such as CRS. Inaccurate disclosure can lead to financial penalties or legal action.

Alternatives to Swiss Banking: Exploring Other Offshore Options

Switzerland captures attention, while Singapore, Luxembourg, and the Channel Islands offer modern banking, strict regulations, and low costs. These alternatives suit those who seek robust privacy, sophisticated offerings, and global connectivity without Swiss-specific constraints or costs.

Conclusion

Swiss bank accounts offer stability, a range of currency services, and customized financial solutions to high-net-worth individuals, expatriates, and businesses. Recent transparency measures have transformed it into a well-regulated conduit for secure, global financial management, reducing the anonymity aspect. Applicants must understand their eligibility, complete the paperwork, choose the right bank, and follow legal and tax restrictions to open a Swiss bank account.

FAQs

1. Can foreigners open a Swiss bank account?

Yes. Swiss banks welcome foreign clients over 18, if they clear compliance checks and meet deposit and documentation requirements.

2. Is there a minimum balance required for a Swiss bank account?

Yes. Non-resident and corporate accounts typically require initial deposits that start in the high five-figure or low six-figure Swiss franc range, though amounts can vary.

3. Are Swiss bank accounts still secret?

Local clients and confidential practices remain shielded by secrecy, while foreign-held and numbered accounts are subject to automatic reporting regimes. Absolute confidentiality no longer exists.

4. What are the tax implications of having a Swiss bank account?

Foreign holders must report their offshore balances and income in accordance with rules such as the Report of Foreign Bank and Financial Accounts (FBAR), FATCA, and CRS. Swiss banks report account data to Swiss tax authorities, which then share it with international authorities.

5. How long does it take to open a Swiss bank account?

The bank processes your request in a few weeks to a couple of months, depending on their procedures and how quickly you provide the necessary documents to open a Swiss bank account.

6. Can I open a Swiss bank account online?

Yes, but not in every location. Some banks enable residents to open accounts remotely through video verification. In-person visits remain necessary for non-residents.

7. Do Swiss banks offer accounts in multiple currencies?

Yes. Swiss banks offer multi-currency accounts that enable clients to hold funds in Swiss francs, euros, US dollars, and other major currencies.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.