Bearer Cheque: Meaning, Features, and Examples

Introduction to Bearer Cheques

A bearer cheque feels like a leftover from an older banking era, yet it still plays a role in day-to-day transactions across India. It carries a unique simplicity: whoever physically holds the cheque receives the money. No questions.

The concept did not disappear. Even in 2026, businesses, traders, and individuals occasionally use bearer cheques for instant cash withdrawals and quick settlements, although the world now leans heavily toward UPI and digital payments.

What Is a Bearer Cheque?

A bearer cheque is a cheque payable to whoever presents it at the bank counter. The word “Bearer” printed or written on the cheque gives the bank authority to release cash immediately to the person presenting it.

Origin and Purpose of Bearer Cheques in Banking

Bearer cheques emerged from traditional cheque-based banking, built for fast, hassle-free cash transfers. Before digital payments became popular, individuals could send someone to a bank to receive cash without formal authorization.

Why Bearer Cheques Are Commonly Used

They remain common for:

- Quick withdrawals without the account holder visiting the bank

- Small business settlements

- Immediate cash payments without time-consuming verification

Bearer cheques offer convenience where speed matters more than documentation.

Features of a Bearer Cheque

Bearer cheques come with features that define how banks process them. Each feature shapes the experience of using this instrument.

Payable to the Bearer of the Instrument

The most important feature: payment goes to whoever brings the cheque physically to the bank. Even if a name appears on it, the word “Bearer” overrides the name in terms of encashment.

No Endorsement Required

Unlike order cheques, an endorsement or signature on the back is unnecessary. The cheque itself authorizes the bank to give cash directly.

Instant Payment Across Bank Branches

Most bank branches clear bearer cheques instantly at the counter, subject to verification. This makes bearer cheques one of the speediest traditional transaction methods.

Risk of Misuse if Lost or Stolen

Since anyone holding the cheque receives payment, misplaced cheques can result in unwanted encashment. Once paid, tracing the payee becomes nearly impossible.

Format and Example of a Bearer Cheque

Understanding the layout helps users identify a bearer cheque immediately.

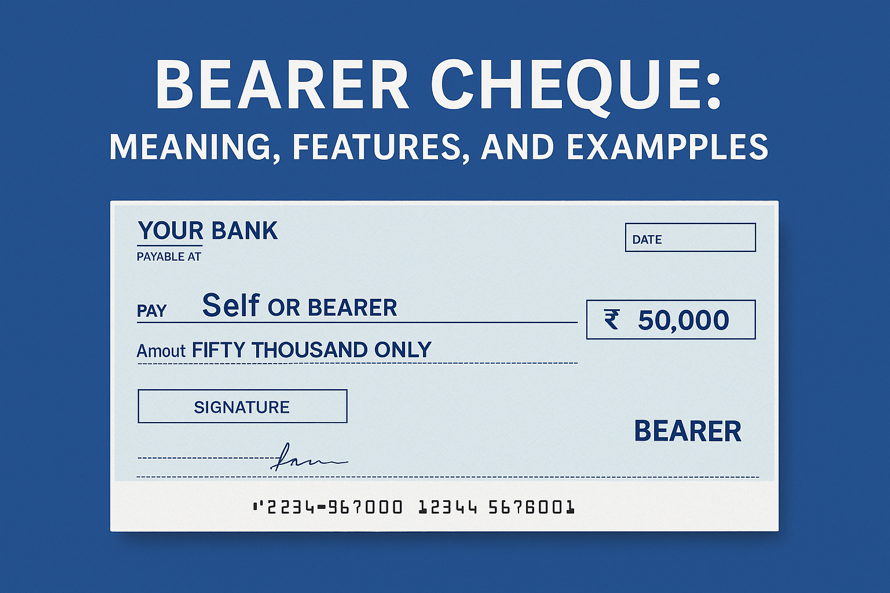

Sample Layout of a Bearer Cheque

A typical bearer cheque includes:

- Date

- Payee name or “Self”

- Amount in words and numbers

- Signature of account holder

- The word “Bearer” printed on the cheque leaf

Banks print “Bearer” by default unless crossed out manually.

How to Identify a Bearer Cheque

Look for:

- The printed word “Bearer” on the right side of the cheque

- No cutting or marking that changes “Bearer” to “Order”

- No crossing (//) indicating Account Payee

If “Bearer” stays intact, the cheque acts as a bearer instrument.

Difference Between “Bearer” and “Order” on a Cheque Leaf

- Bearer Cheque: Pays whoever presents it

- Order Cheque: Pays only the person named on it, after verification

How a Bearer Cheque Works

Understanding its functioning helps users avoid confusion at the bank.

Step-by-Step Process of Cashing a Bearer Cheque

- Holder presents a cheque at the issuing bank branch

- Bank verifies account balance

- Teller compares the drawer’s signature with the specimen records

- Cash is released instantly

Role of Bank Verification and Signature Matching

The only mandatory verification is the account holder’s signature. Banks protect account holders by strictly comparing signatures before releasing cash.

Limits on Bearer Cheque Withdrawals

RBI allows bearer cheques but encourages banks to monitor large withdrawals. Many branches limit instant cash payouts above certain thresholds for security and AML compliance.

Difference Between Bearer Cheque and Other Cheque Types

Cheque types vary in purpose, risk, and documentation.

Bearer Cheque vs Order Cheque

- Bearer cheque needs no identification.

- Order cheque requires identity verification and endorsement.

Bearer Cheque vs. Crossed Cheque

- A crossed cheque must be deposited in a bank account.

- A bearer cheque provides cash immediately at the counter.

Bearer Cheque vs. Account Payee Cheque

Account Payee cheques are safest, locking funds to a specific account number. Bearer cheques rely entirely on physical possession.

Advantages of Bearer Cheques

Bearer cheques provide speed and flexibility.

Quick and Convenient Transactions

No ID. No formalities. Immediate encashment.

No Need for Payee Details

This simplifies payments when the payee’s banking details are unavailable or unnecessary.

Ideal for Small Cash Payments

Perfect for:

- Daily wage payments

- Vendor settlements

- Urgent cash requirements

Disadvantages and Risks

Bearer cheques create layers of caution because the instrument relies entirely on physical possession. Once the cheque leaves the drawer’s hands, the entire control shifts to whoever holds it.

High Risk of Fraud and Theft

A bearer cheque behaves almost like cash. Whoever carries it becomes the payee at the counter. This creates a situation where a simple loss on a busy street, a misplaced wallet, or a forgotten envelope turns into an instant risk. A bearer cheque does not ask questions at the time of encashment. The bank checks the drawer’s signature, confirms the account balance, and releases money directly to the presenter.

No Record of Payee in Bank System

Another challenge sits quietly in the background. When a bearer cheque moves through the banking system, the only traceable party is the drawer. The bank’s system records that the drawer issued a cheque, that funds were withdrawn on a certain date, and that a teller released cash. Yet the identity of the person receiving the cash stays outside the trail.

Limited Use in Business Transactions

Large companies have strict audit cycles. Every payment must align with proof, invoices, and ledger entries. Bearer cheques do not provide that clarity. Since anyone can receive payment, the financial trail becomes thin and sometimes unsuitable for structured accounting.

RBI Guidelines and Legal Aspects

The Reserve Bank of India monitors bearer cheques closely because large cash transactions influence compliance, safety, and transparency.

RBI Restrictions on Large Bearer Cheque Payments

RBI allows bearer cheques without hesitation for everyday cash withdrawals. However, for large-value withdrawals, banks follow prudential caution. RBI encourages branches to guide customers toward safer alternatives for high amounts, such as crossed cheques, account payee cheques, or digital transfers.

Reporting and KYC Requirements

When withdrawals exceed certain thresholds, banks activate additional verification layers. These checks support AML, KYC, and due diligence standards. Tellers may request basic identification from the presenter, confirm signatures with deeper scrutiny, and review account behaviour before releasing cash.

Rules for Banks Handling Bearer Cheques

Banks follow three primary obligations:

- Signature verification: Teller compares the drawer’s signature with bank records.

- Account balance validation: Bank confirms funds before processing.

- Monitoring for suspicious withdrawals: Any unusual activity triggers internal alerts for safety.

Practical Uses of Bearer Cheques Today

Bearer cheques do not dominate daily payments anymore, but they still survive in specific pockets of Indian financial culture.

Common Scenarios Where Bearer Cheques Are Still Used

Their relevance remains strong in situations where someone needs cash but cannot visit the bank personally. Examples include:

- Urgent withdrawal handled by a trusted person

- Small vendor or contractor payments

- Local business settlements where cash flow moves quickly

Decline of Bearer Cheques in the Digital Era

Digital tools reshaped India’s payment landscape. UPI offers lightning-fast transfers, IMPS operates around the clock, NEFT handles structured settlements, and online banking links everything together.

Alternatives Like UPI and Online Transfers

Today’s digital ecosystem offers effortless choices:

- UPI for instant payments

- IMPS for urgent bank-to-bank transfers

- NEFT/RTGS for structured settlements

- Mobile wallets for quick digital cash flow

Conclusion – Should You Use a Bearer Cheque in 2026?

Bearer cheques still serve a purpose, especially for quick cash transactions. Yet the safety trade-off remains considerable. For simplicity, they work wonderfully, but for accountability and security, digital payments easily outperform them.

FAQs

What is a bearer cheque with an example?

A bearer cheque pays whoever holds it. Example: A cheque written as “Pay Bearer ₹5000” can be encashed by anyone carrying it.

How is a bearer cheque different from an order cheque?

Bearer cheques pay the holder; order cheques pay a specific named person after verification.

Can anyone encash a bearer cheque?

Yes, any individual presenting the cheque receives payment after the bank verifies the drawer’s signature.

Is a bearer cheque safe to use?

It offers convenience but carries risk because possession equals payment.

Can bearer cheques be deposited in a bank account?

Yes, although most people encash them directly, banks allow deposits if the customer prefers.

What happens if a bearer cheque is lost?

Whoever finds it can encash it. Account holders must issue a stop-payment request urgently to prevent misuse.

Are there any RBI limits on bearer cheque amounts?

RBI allows them but urges banks to monitor large-value withdrawals and follow AML reporting norms.

What are the advantages and disadvantages of bearer cheques?

Advantages include convenience and speed; disadvantages include a high chance of misuse and limited traceability.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn (Formerly known as NU Investors Technologies Pvt. Ltd) do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.