Everything You Need to Know About Salary Slip Format

What is a Salary Slip?

Every month, after the long wait for payday, that one file lands in your inbox: the salary slip. Small document. Big story. It shows every rupee you earned, every deduction that shaped your final take-home, and every allowance that adds to your pay structure.

It’s not just a formality; it’s your mirror for the month, proof that your work, time, and energy turned into income.

A salary slip includes your name, designation, employee code, and all the math behind your earnings, basic, allowances, taxes, and deductions.

Why Salary Slip is Important for Employees

Try applying for a home loan without one, and you’ll see how powerful this small document actually is.

It tells banks how much you earn, helps HR verify your last job, and supports every major financial step you take, including applying for credit cards, tax filings, and even visa applications.

For you, it’s more than paperwork. It’s control. It shows exactly where your money goes, how much you save, how much is taxed, and how much truly belongs to you.

Each payslip becomes a snapshot of your financial growth. Month after month, it tells your story in numbers.

Legal Requirement of Issuing Salary Slips in India

Employers aren’t doing you a favor by providing salary slips; they’re fulfilling a legal duty. Under the Payment of Wages Act, 1936, and the Minimum Wages Act, 1948, every organization in India must issue salary statements to employees.

The government expects transparency; every rupee earned and deducted should be recorded.

Even small firms and startups paying their employees through bank transfers must issue slips, printed or digital. The rule is simple: if an employee gets paid, a slip must exist.

Components of a Salary Slip

Employee Information (Name, ID, Designation)

At the top, you’ll find all your professional identity markers, your name, employee code, department, and the month covered. It’s the heading of your personal financial report. This small header matters; it’s how banks, recruiters, and auditors confirm who you are and when you were paid.

Earnings Section

Basic Salary

The backbone of your paycheck.

Basic salary makes up the largest share, often 40% to 50% of total pay. Everything else, PF, HRA, bonuses, is built around this number.

It’s fully taxable, but it anchors every financial benefit you receive.

Dearness Allowance (DA)

Inflation eats into everyone’s pocket, and DA fights it back. It’s the cost-of-living adjustment, mostly for government and PSU employees, but some private companies keep it too.

DA changes periodically with inflation indexes.

House Rent Allowance (HRA)

If you rent, this part matters. HRA covers part of your rent and helps you claim tax exemptions under Section 10(13A).

The higher your city’s rent, the bigger your relief. Metro residents often see the best benefits here.

Conveyance Allowance

Your travel to work costs money; the conveyance allowance offsets that. Many firms include it as a small, steady part of the pay structure.

Special Allowance

This is the wild card. Special allowance balances your salary breakup. It could cover meals, phone bills, or be a pure incentive. It’s fully taxable but flexible; companies tweak it to make packages competitive.

Bonus/Performance Incentives

Everyone loves this line. Bonuses or incentives show recognition. It can appear monthly or yearly, tied to performance metrics or company profits.

A healthy bonus line in your slip means your work paid off, literally.

Deductions Section

Provident Fund (PF)

A piece of your salary today builds your security for tomorrow.

Both the employer and employee contribute 12% of your basic salary each month to PF. It grows with interest and ensures long-term savings for retirement.

Professional Tax

Small deduction, state-specific. Usually ₹200 or less. Collected by state governments to maintain employment records and welfare.

Income Tax (TDS)

Your employer becomes the tax collector. TDS is deducted at source based on your annual earnings and declared investments. It ensures that you’re always tax-compliant and saves you from lump-sum payments later.

Other Deductions (Loan EMI, Insurance, etc.)

This section changes from person to person. If you’ve taken a salary advance, or have enrolled in company-provided group insurance, those show up here.

Net Salary Calculation

This is where everything comes together, the real paycheck moment.

Net Salary = Gross Earnings – Total Deductions.

That’s the number you actually see credited to your bank.

For instance:

If your total earnings are ₹70,000 and deductions are ₹6,000, your take-home becomes ₹64,000.

That figure is what powers your rent, bills, and savings each month.

Salary Slip Formats

Standard Salary Slip Format

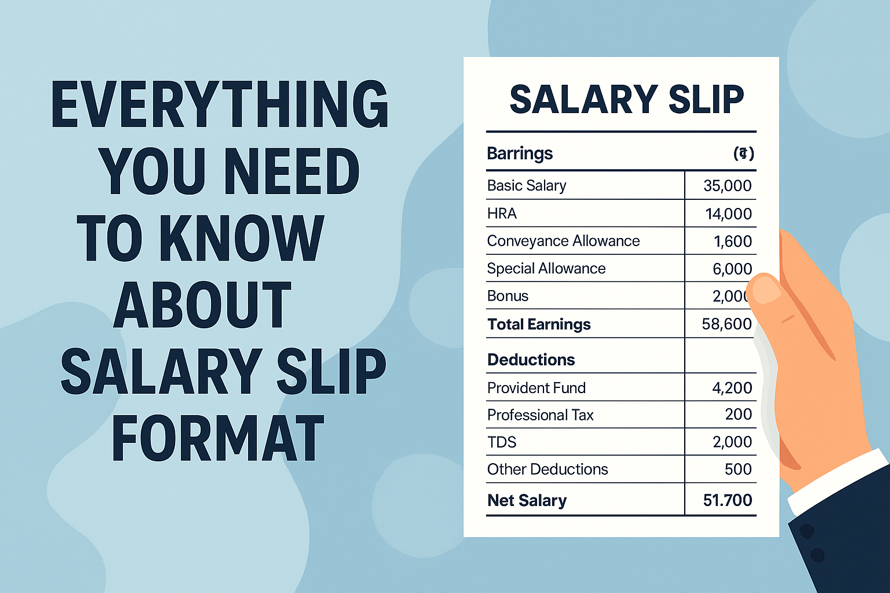

Here’s how a standard Salary Slip Format looks when laid out neatly:

| Particulars | Amount (₹) |

|---|---|

| Earnings | |

| Basic Salary | 35,000 |

| HRA | 14,000 |

| Conveyance Allowance | 1,600 |

| Special Allowance | 6,000 |

| Bonus | 2,000 |

| Total Earnings | 58,600 |

| Deductions | |

| Provident Fund | 4,200 |

| Professional Tax | 200 |

| TDS | 2,000 |

| Other Deductions | 500 |

| Total Deductions | 6,900 |

| Net Salary | 51,700 |

Clean, clear, and compliant. That’s the blueprint every HR team follows.

Salary Slip Format in Excel

Excel gives flexibility. You can build dynamic formulas, link sheets, and generate payslips in seconds. It’s ideal for startups or consultants who need professional records without expensive payroll tools.

One change in the basic column, and every figure auto-updates.

Salary Slip Format in Word

Word salary slips are polished and printable. Great for formal presentation or government submissions. They carry branding, letterheads, and signatures.

PDF Salary Slip Format

This is the corporate favorite. PDF salary slips are secure, locked, and easy to email. Modern HR systems attach digital signatures and QR codes for verification, making them tamper-proof and universally accepted.

Importance of Salary Slip

Proof of Employment and Income

Need to prove your employment? This is your evidence. Salary slips are accepted by recruiters, embassies, and government agencies as official employment proof.

Three recent slips are often all it takes to confirm your current pay and role.

Loan and Credit Card Applications

Banks check your payslip before lending money. It shows your repayment capacity and income stability. Regular salary credits build credibility faster than any credit score ever could.

Income Tax Filing and Returns

When tax season hits, your payslip becomes your best ally. It summarizes taxable income, deductions, and contributions for easy reconciliation with Form 16.

Common Mistakes in Salary Slips

Errors in Earnings Section

Sometimes a bonus disappears or HRA is mistyped. Even minor mistakes affect tax calculations. Reviewing every payslip ensures your PF, DA, and gross match the company’s records.

Incorrect Deductions

TDS miscalculations or wrong PF entries can reduce your take-home unfairly. Always verify deduction percentages against your declared investments.

Miscalculation of Net Salary

One wrong formula can change everything. Cross-check your net salary with bank credits to catch any mismatch early.

How to Create a Salary Slip

Using Excel Templates

Creating salary slips in Excel is quick. Columns for employee details, earnings, deductions, and totals make it manageable. Use formulas to automate net pay and tax.

It’s the go-to choice for small businesses and freelancers managing payouts independently.

Using HR and Payroll Software

Large organizations rely on automation. Tools like GreytHR, Zoho People, RazorpayX Payroll, and Keka generate compliant salary slips instantly.

They calculate PF, TDS, and PT automatically, sync with accounting systems, and store digital copies for every employee.

Manual Preparation vs. Automated Generation

Manual creation offers control but risks human error. Automation brings precision, consistency, and legal compliance.

Conclusion – Salary Slip as a Vital Financial Document

At first glance, it’s just another HR form. But the salary slip holds serious power. It represents your income, your taxes, and your professional credibility.

Whether you’re planning a loan, proving employment, or tracking expenses, this single sheet supports it all.

Digitization has made salary slips faster, safer, and easier to verify. No waiting for printouts, no paper trails. Just log in, download, and store securely.

For employees, it’s financial awareness. For employers, it’s compliance. For both, it’s trust.

FAQs

Q1: What are the mandatory components of a salary slip in India?

Basic pay, allowances (HRA, DA, etc.), deductions (PF, PT, TDS), and the final net salary must be included.

Q2: Can I request a salary slip from my employer if it is not provided?

Yes. Every employee has the right to receive a monthly salary slip in print or digital format.

Q3: Is a digital salary slip valid for official purposes?

Absolutely. Digitally signed or system-generated salary slips are fully valid for loans, tax filings, and visa processing.

Q4: How do banks verify salary slips during loan applications?

They check employer authenticity, salary credits in your account, and PAN or UAN details for consistency.

Q5: Can salary slips be used as income proof for visa applications?

Yes, embassies accept the last three months’ salary slips as financial evidence for visa and immigration cases.