Mutual Fund NAV Explained: How It’s Calculated, Regulated, and Why It Matters

What Is NAV in Mutual Funds?

NAV, or Net Asset Value, is the per-unit price of a mutual fund. It tells you how much one unit of the fund is worth, based on the market value of all the assets the fund holds, minus its liabilities.

If you’re investing in mutual funds, NAV is the number you’ll see daily — the price at which you buy or sell fund units.

But NAV is more than just a price. It’s the result of a complex, daily accounting process that reflects the real-time value of your investment.

How NAV Is Calculated (With a Real Example)

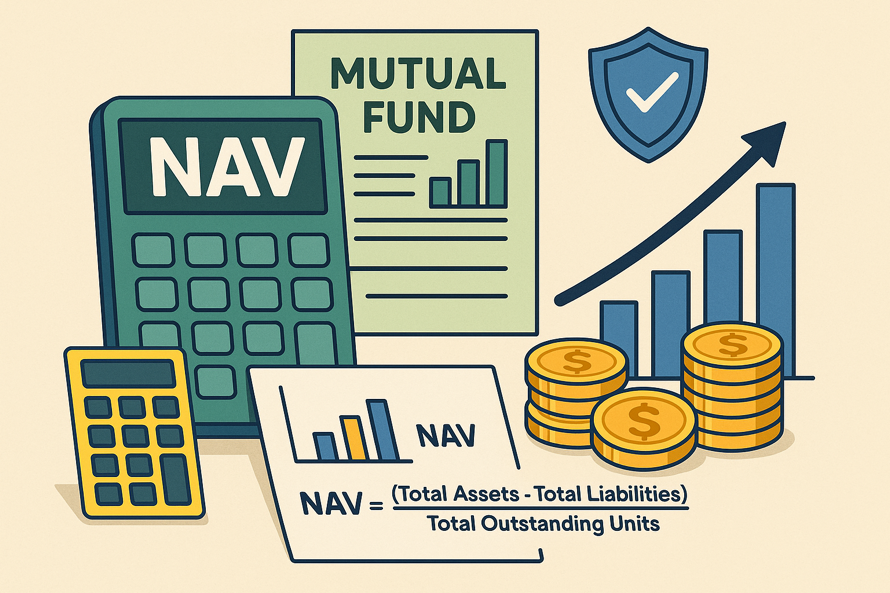

NAV is calculated using this formula:

NAV = (Total Assets – Total Liabilities) / Total Outstanding Units

Let’s break that down:

- Assets include the market value of stocks, bonds, cash, interest earned, and receivables.

- Liabilities include management fees, operational expenses, and pending payments.

- Outstanding units are the total fund units held by investors.

Real-Life Example:

If a fund has:

- Total assets = ₹111.07 crore

- Total liabilities = ₹15.01 crore

- Outstanding units = 50 lakh

Then:

NAV = (₹111.07 crore – ₹15.01 crore) / 50 lakh = ₹19.21 per unit

NAV is calculated at the end of every trading day, using the day’s closing prices. So, if markets rise or fall, your fund’s NAV reflects that by the next evening.

NAV Varies by Fund Type

Not all funds treat NAV the same way:

- Open-End Funds: You buy/sell units directly from the fund house at the day’s NAV.

- Closed-End Funds: These trade on stock exchanges. Their market price can differ from NAV.

- ETFs: Like closed-end funds, but with mechanisms to keep the market price close to NAV.

- Private Equity Funds: NAV here is more of an estimate, updated quarterly or semi-annually.

How SEBI Regulates NAV Calculations in India

SEBI, India’s capital market regulator, has strict rules to ensure that NAV reflects the true value of a fund.

Key Highlights:

- Fair Valuation Rule: Fund houses must value assets fairly — not inflate or manipulate figures.

- Three-Tier Oversight: Fund managers, trustees, and auditors all oversee the valuation process.

- Waterfall Method for Debt Funds: A step-by-step system that prioritizes actual trade prices over estimates, reducing subjectivity in bond valuations.

- NAV Cut-Off Timings: Since 2021, the NAV you get depends on when your funds actually reach the AMC’s account — not when you place the order.

Why NAV Alone Doesn’t Show Fund Performance

Here’s a common mistake: thinking a fund with a ₹1,000 NAV is “better” than one with a ₹10 NAV. That’s like saying a pizza that costs ₹500 tastes better than one that costs ₹100 — without knowing the size, ingredients, or taste.

NAV is just a number. What matters is how much it grows over time.

To judge performance, look at:

- Alpha: How much the fund beats its benchmark

- Beta: How volatile the fund is compared to the market

- Sharpe Ratio: How much return it gives per unit of risk

What’s Eating Into Your NAV? Fees.

Every mutual fund charges a Total Expense Ratio (TER) — the annual cost of managing the fund.

It’s automatically deducted from the NAV each day. Higher fees mean slower NAV growth.

SEBI caps the TER based on the fund’s size. Bigger funds can charge lower fees, passing savings to investors.

| AUM (₹ Crore) | Max TER (Equity Funds) |

|---|---|

| 0 – 500 | 2.25% |

| 500 – 2,000 | 2.00% – 1.75% |

| 10,000+ | 1.05% |

Key Takeaways

- NAV = Price per Unit, not a performance score.

- It’s recalculated daily, based on closing asset prices minus liabilities.

- SEBI enforces strong valuation and disclosure rules to protect investors.

- To evaluate a mutual fund, look beyond NAV: check performance metrics and fees.

- Timing matters: your transaction’s NAV depends on when the money is received, not just when you click “Invest.”

FAQs: Mutual Fund NAV, Simplified

Q1: Is a higher NAV bad?

No. NAV reflects how long the fund has been growing, not how expensive it is.

Q2: Can NAV go down?

Yes, if the market value of the fund’s assets falls, NAV drops.

Q3: When is NAV calculated?

At the end of each trading day — typically after 3:30 PM (India) or 4:00 PM (US).

Q4: What if I invest after the cut-off time?

You’ll get the next day’s NAV if the fund doesn’t receive your money on time.

Q5: Does a low TER guarantee better returns?

Not always, but it reduces cost drag, which helps performance over the long term.