Power SIP by Lemonn: A User’s Guide

Retail investors’ participation in the Indian market has been steadily increasing over the years. Most products available in the market—such as Systematic Investment Plans (SIPs) – cater to the needs of everyday investors who prefer to build their portfolio piecemeal, month by month, rupee by rupee. On its part, Lemonn is upping its game by launching Power SIP, more on that in a bit.

SIPs, which initially became popular as a way to invest in mutual funds, have evolved over the years to include direct stocks. Stock SIPs, which allow you to invest directly in stocks instead of a managed mutual fund, are all the rage among retail investors.

Now, Lemonn is taking the concept of Stock SIP up a notch and packing it with leverage to launch Power SIP. Also known as Leveraged SIP, this new tool makes investing automated, disciplined, and scalable. Put simply, Power SIP combines the discipline of SIP investing with the power of Margin Trading Facility (MTF), a unique product that allows investors to invest more money in stocks directly, without stretching their budget. This blog post will explain the product in detail, complete with a step-by-step guide for newbie investors

What is Power SIP?

To understand Power SIP better, let’s first understand Stock SIP and MTF.

A Systematic Investment Plan (SIP) is an investment plan that allows users to invest a fixed amount in a stock at regular intervals, bringing automation and discipline to equity investing. On the other hand, MTF or Margin Trading Facility lets users invest beyond their available balance by borrowing up to 80% of a stock’s value. Users only pay a small daily interest, making it a cost-efficient way to boost their investing power.

Now back to Power SIP.

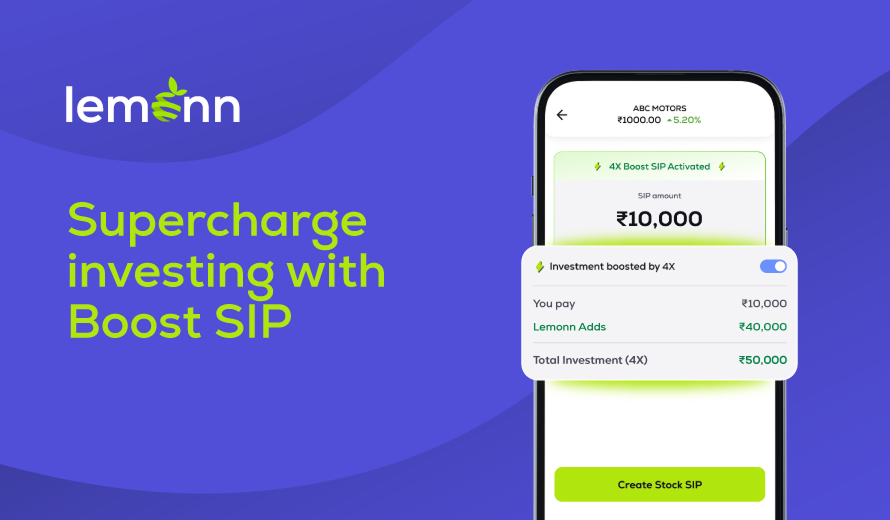

Power SIP is simply SIP, with leverage.

Power SIP on Lemonn uses the Margin Trading Facility (MTF) to let users invest in more shares every month without paying the full amount upfront.

So instead of simply getting ₹10,000 worth of stock exposure with a ₹10,000 investment, a Power SIP allows you to amplify your exposure. With a ₹10,000 monthly budget, you could gain exposure to stocks worth up to ₹50,000, thanks to the built-in leverage mechanism.

Put simply, you invest small, own more, all within a regulated, transparent framework. However, it’s important to note that Power SIP amplifies both gains and losses just like MTF.

Benefits of Power SIP on Lemonn

Power SIP is an exclusive feature available on Lemonn, designed to help users build wealth in a smart way. Wondering how it can enhance a user’s investing journey? Here are some of its key benefits.

Get more stock units:

Power SIP can help users grow their portfolio quicker by letting them invest in larger quantities without paying the full amount upfront. For example, if your SIP budget is ₹10,000, Power SIP can give you exposure to up to ₹50,000.

Cash-flow friendly and flexible:

Power SIP lightens the monthly cash burden for investors, allowing them to stay invested even during months when funds are tight. If you are tight on budget and can only invest ₹500 per month, Power SIP can boost your exposure to up to ₹2500, multiplying your investment amount.

Automated, transparent and long-term:

Once Power SIP is set up, it runs automatically each month. All costs, interest rates, and margins are shown upfront, ensuring complete transparency. And unlike short-term leveraged trades, Power SIP builds real stock ownership, making it a smarter, long-term way to use leverage.

How to get started with Power SIP on Lemonn? A step-by-step guide

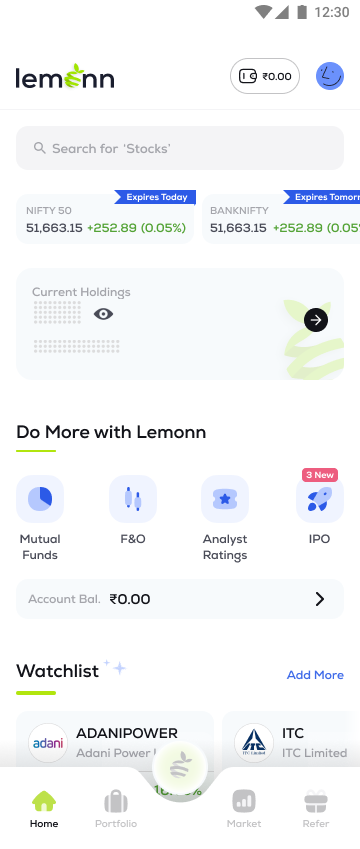

You can get started on Power SIP almost instantaneously if you have already downloaded the Lemonn app & completed your KYC on your phone.

Note: We’ve added screenshots of the Lemonn app for product understanding only.

Here’s how you can begin:

Step 1:

Open the ‘App’ and search for the company you want to invest in, and tap to open its ‘Asset Page.’

The securities are quoted as an example and not as a recommendation.

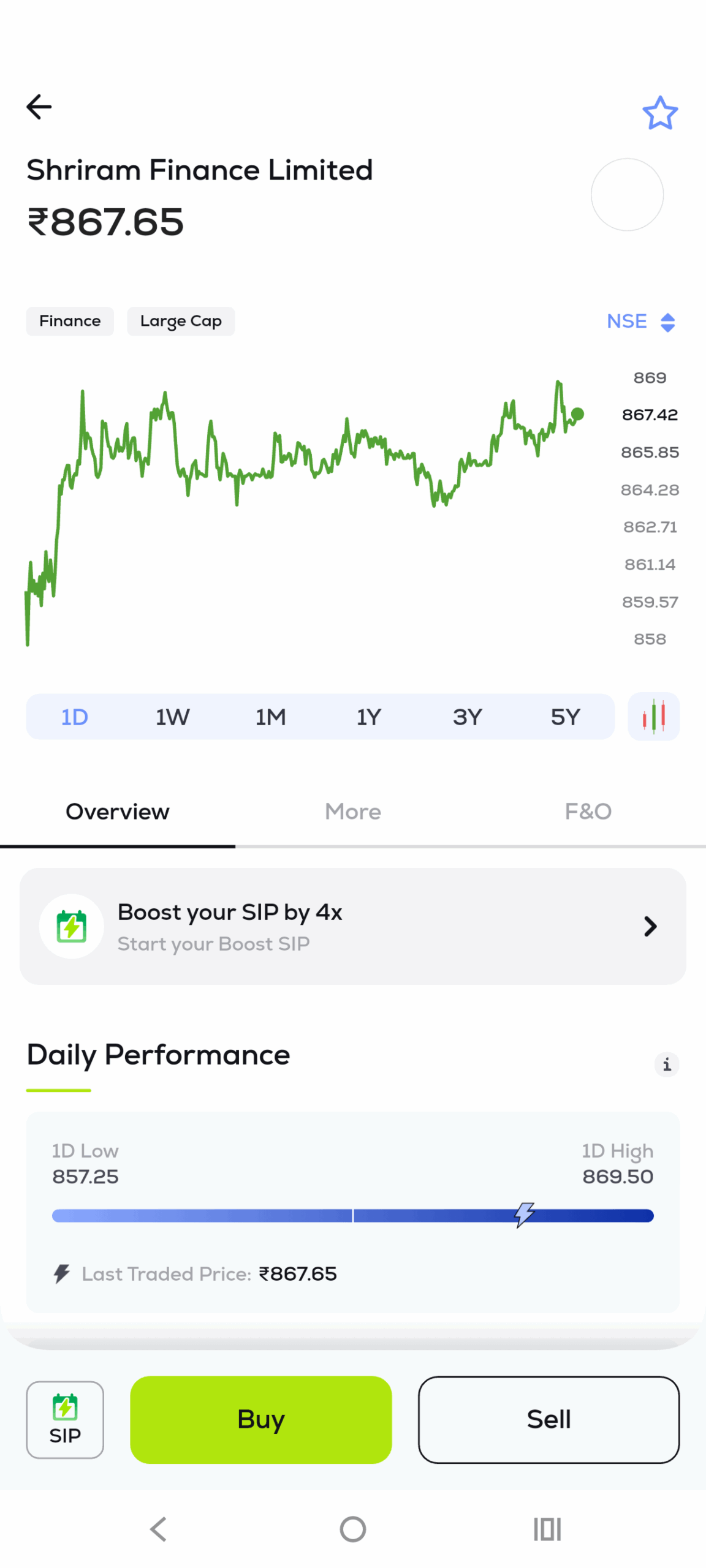

Step 2:

Tap the ‘SIP’ option located next to the ‘Buy’ button at the bottom of the screen.

The securities are quoted as an example and not as a recommendation.

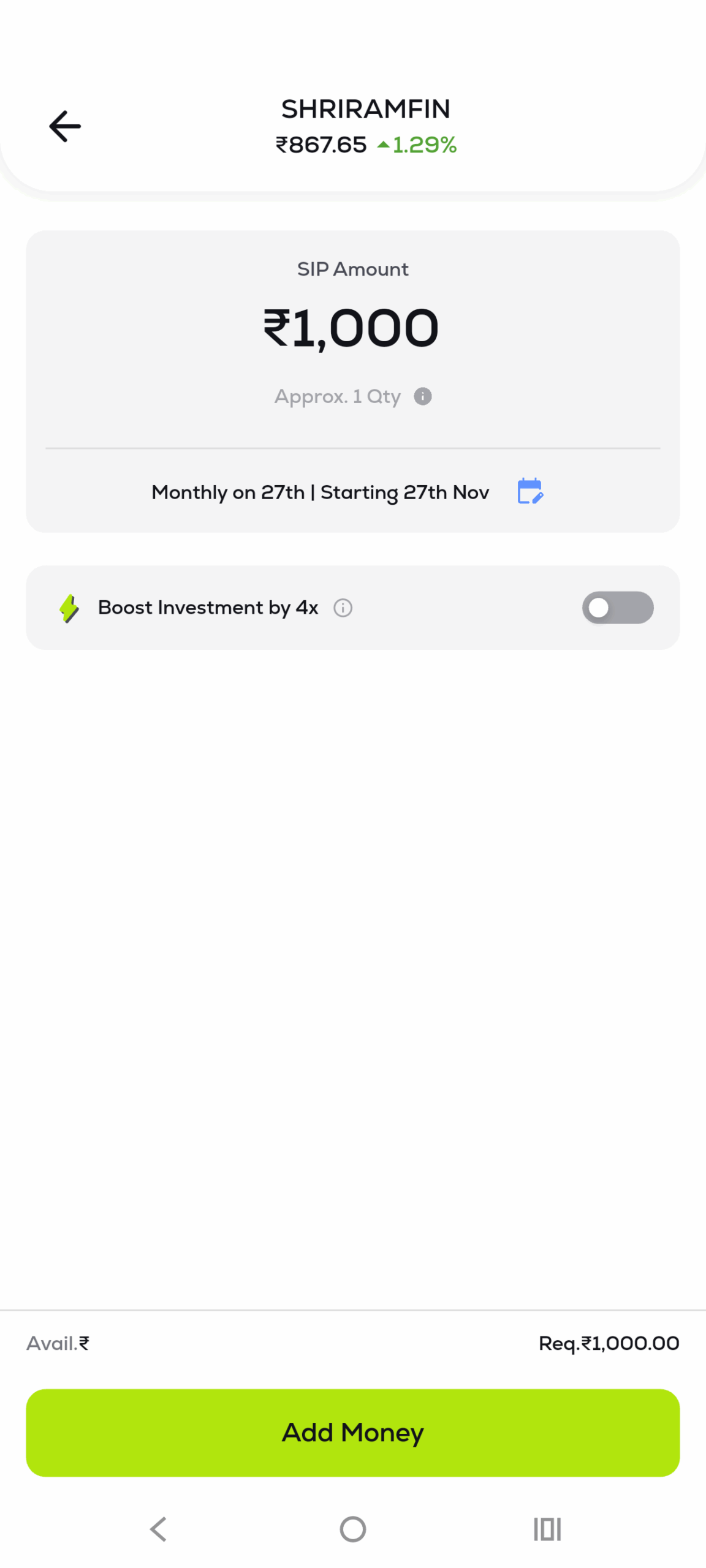

Step 3:

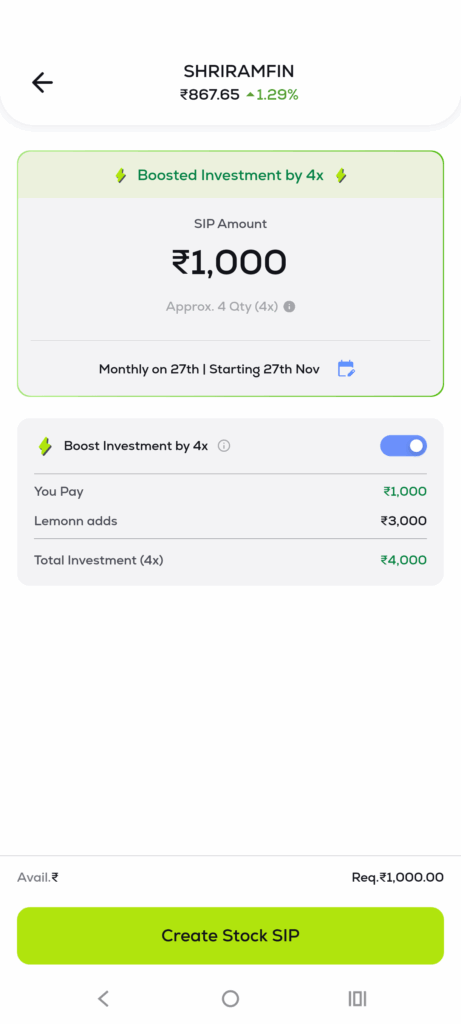

Enter SIP details, such as investment amount, start or installment date, and

Toggle ON the Boost Investment option if you want to opt for Power SIP, if it is available

Note: If the stock does not have MTF enabled, you will not see the Boost Investment toggle. However, you can proceed with normal SIP in the stock

The securities are quoted as an example and not as a recommendation.

Step 4:

If Boost is ON, Lemonn will show the leverage multiplier, your monthly debit amount, and the additional amount Lemonn will invest each month. Review these details before proceeding.

The securities are quoted as an example and not as a recommendation.

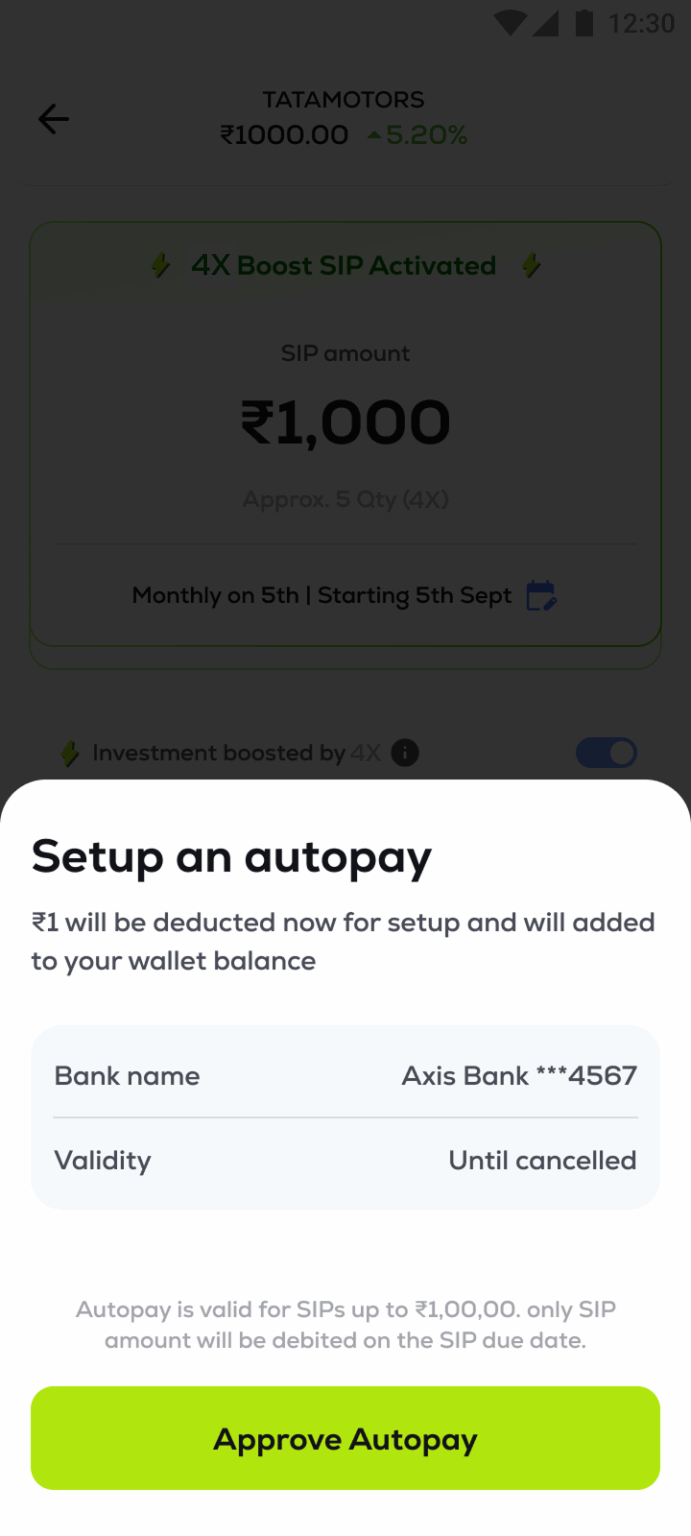

Step 5:

Complete mandate. You will be prompted to create a UPI autopay mandate. This is required for SIP creation and future installments. The app will redirect you to your UPI app to approve the mandate.

Note: Once the mandate is active, it’s valid for all future SIPs (until canceled). Additionally, the total mandate limit is ₹1 lakh across all SIPs, with each stock SIP capped at ₹15,000 of your own funds. Lemonn then adds leverage on top, boosting your total investment exposure beyond your contribution. These steps apply to users setting up Power SIP for the first time. Mandate creation is required only during the first SIP setup. From the second SIP onwards, no new mandate will be created, and investments will continue automatically as scheduled.

The securities are quoted as an example and not as a recommendation.

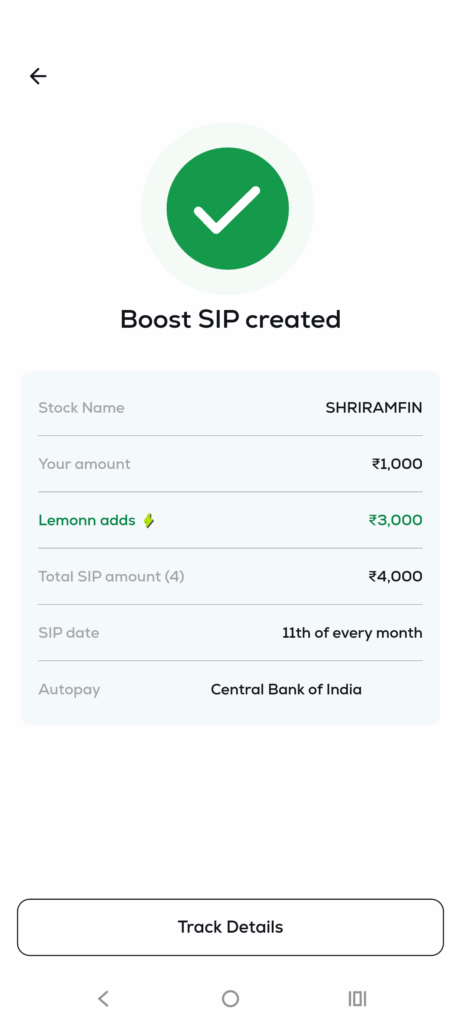

Step 6:

After completing the mandate, your order will be placed on the market (T or T+1). If you selected a different start date, it will be placed on your SIP installment date.

The securities are quoted as an example and not as a recommendation.

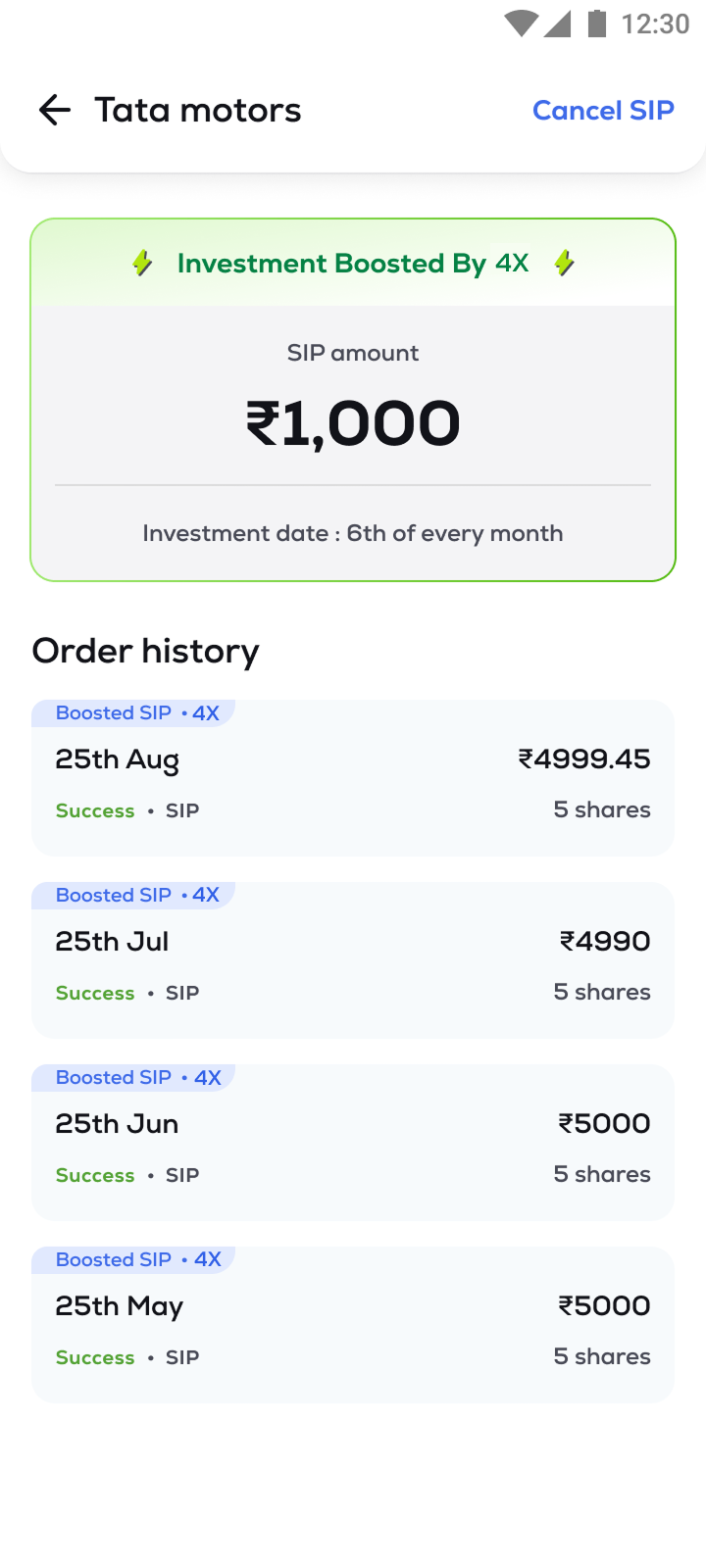

Step 7:

On the confirmation screen, you will see a Track Details button. Tap it to view your SIP transaction list, where you can monitor all your SIPs.

The securities are quoted as an example and not as a recommendation.

Step 8:

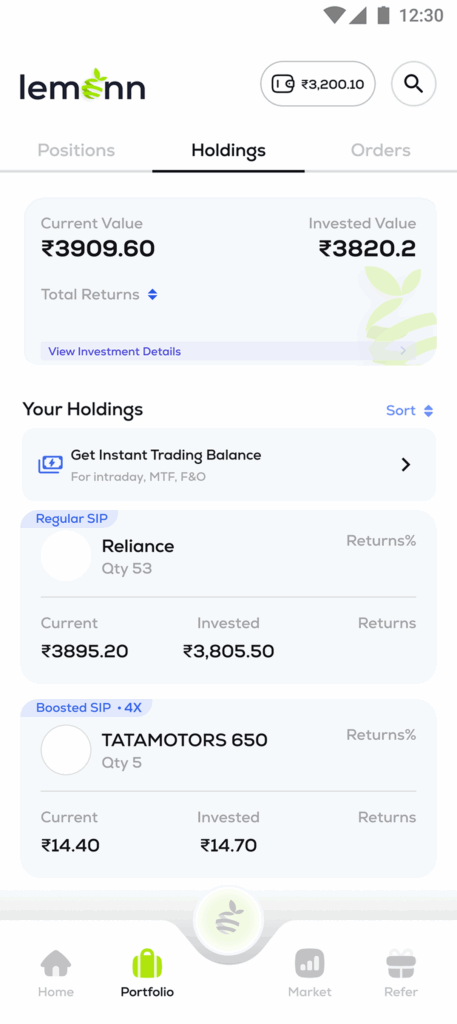

The placed order will appear in your Portfolio. (Once executed, the SIP order appears in Open Orders and then moves to Closed Orders when filled).

Holdings update automatically: Power SIP (MTF) positions appear under the MTF Card; regular SIPs appear under Normal Holdings.

The securities are quoted as an example and not as a recommendation.

Why Power SIP matters

In markets that move quickly and unexpectedly, consistency becomes the key. Power SIP ensures that even when prices stagnate, your exposure keeps working harder, setting you up for the next rally.

So whether you are investing in blue-chip stocks or your favorite long-term bets, Lemonn’s Power SIP helps you stay disciplined and efficient. However, it’s important to note that Power SIP amplifies both gains and losses. Meaning, if stock prices fall, your losses will also be multiplied by the leverage just like profits, and you will still need to pay interest on the Lemonn funded amount. So, it is crucial to stay aware of the market volatility and invest responsibly.

Disclaimer: For Margin Trading Funding (MTF) the provisions of SEBI Circular no. CIR/MRD/DP/54/2017 dated June 13, 2017, shall be complied with. Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation. Such representations are not indicative of future results. Brokerage will not exceed the SEBI prescribed limit. NU Investors Technologies Private Limited | Registered Address: Galaxy, Unit No. 603, A Wing, Everest Grand, Mahakali Caves Road, Opp. Ahura Centre, Andheri East, Chakala Midc, Mumbai, Maharashtra - 400093 | CIN: U67200MH2021PTC364704 | SEBI Registration no.: INZ000304837 / Validity of Registration: Stock broking – March 21, 2024 – Perpetual | Depository Participant – May 30, 2024 – Perpetual | NSE Member Code: 90251 | NSE Clearing Member code: M70302 | BSE Member Code: 6813 | CDSL Member Code: 96400 | SEBI DP no. IN-DP-712-2022 | SEBI Research Analyst Registration No. - INH000016764, Jun 24, 2024 - Perpetual