Options are financial contracts that give traders the right, but not the obligation, to buy or sell shares at a predetermined price before a specific expiry date. Traders use them to profit from price movements or protect against losses without directly owning the underlying asset.

If you learn it, trading options is one of the best ways to build wealth over time, notwithstanding the risks. An option is a contract that lets a trader buy or sell an underlying object, like a stock or even an index, at a set price and during a specific period of time in exchange for a fee. Traders can use platforms like Lemonn to profit from price movements without actually owning the underlying securities.

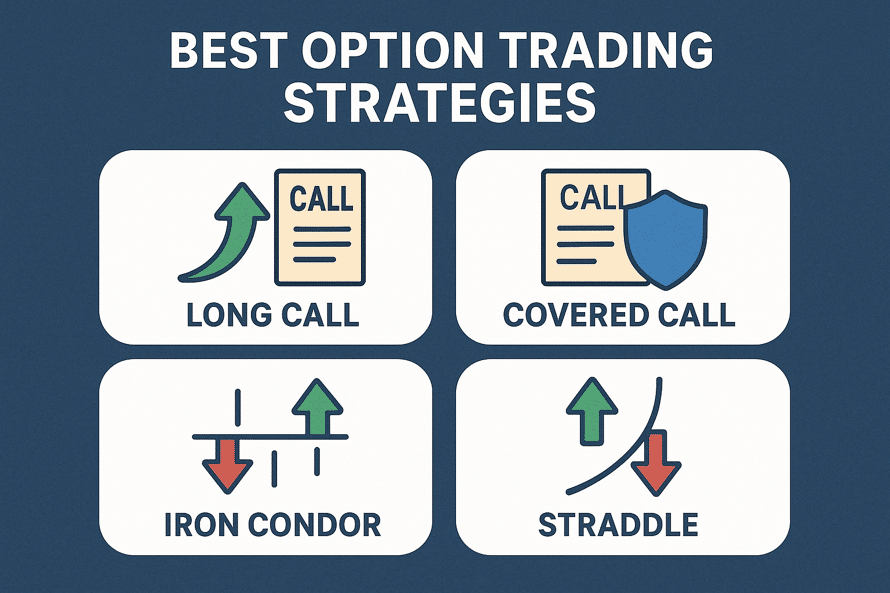

In this blog post, we’ll discuss some of the top option trading strategies. Let’s dig in.

What Are Options Trading Strategies?

Structured combinations of purchasing and/or selling call and put options on underlying assets—often stocks or crypto—are known as option trading strategies. By using the flexibility of options, these techniques aim to accomplish specific goals, such as making money, protecting against risk, or making predictions about future price changes.

Essentially, an option grants its holder the right—but not the obligation—to buy (call) or sell (put) an asset at a certain price before a given expiry date. Conversely, sellers get a premium in return for accepting the contractual responsibility.

Why Use Options Trading Strategies?

Employing option trading strategies is a convincing choice for several compelling reasons:

- Generating Revenue: By selling options (such as covered calls) and collecting premiums, traders may generate a steady income.

- Hedging: Strategies such as protective puts act as insurance, lowering losses during market downturns.

- Leverage: Options enable you to own more stock with less capital, resulting in a higher upside potential with lower risk.

- Adaptability: You may adjust your holdings according to your risk tolerance and market perspective (bearish, neutral, or bullish) using a variety of tactics, from simple to complex.

Popular Options Trading Strategies for Beginners

Simple, income-focused methods that control risk and teach the ins and outs of option trading strategies are typically beneficial to new traders.

– Covered Call

Here, an investor holds a long position in an underlying asset, like a stock, while writing (selling) call options on the same asset. Using this strategy, the trader has the opportunity to generate additional income from the premiums received by selling the call options.

– Protective Put

A protective put combines purchasing a put option by owning shares or another asset. This strategy acts as an insurance policy, protecting against losses in the event that the stock price drops. Here, an investor buys a put option for a fee, called a premium.

– Cash-Secured Put

A cash-secured put involves selling a put option while setting aside money to purchase the stock at the put option’s strike price if the option is exercised by the put buyer. In this scenario, you either keep the premium revenue you get upfront for selling the put or buy the shares at a predetermined price.

Advanced Options Trading Strategies

Advanced option trading strategies use several option legs to construct complex payout profiles for specific market perspectives and risk tolerances. These strategies benefit from predicted market situations like low volatility or significant price changes while keeping risk profiles.

Iron Condor

A bull put spread below the market and a bear call spread above it make up the iron condor, a defined-risk, neutral strategy. It, therefore, creates a net credit upon opening.

In essence, time decay and a steady implied volatility environment allow it to benefit if the underlying asset remains within a specific range until expiry. Crucially, it is a capital-efficient and structured approach for range-bound markets since both the maximum profit and loss are restricted.

Strangle and Straddle

Straddles and strangles, on the other hand, are long call-and-pull combinations that profit from significant price movements in either direction. A straddle offers the most flexibility but comes at a greater upfront cost since it utilizes the same strike price for both options.

On the other hand, a strangle lowers the premium but requires a greater move to earn a profit, as it employs alternative strikes, usually out-of-the-money. Both approaches provide potentially limitless returns and little risk (equivalent to the premium paid).

Butterfly Spread

Furthermore, butterfly spreads have four options with the same expiry that span three strikes (e.g., long one lower strike, short two middle strikes, and long one higher strike).

They provide a low-cost, low-risk, and low-reward arrangement that works best when you anticipate little volatility. Losses are kept within predetermined bounds, and the maximum gain is realized if the underlying closes in on the middle strike at expiry.

How to Choose the Right Options Strategy for You

If you want to learn how to choose the appropriate option trading strategies for your trades in the F&O market, the following steps can assist you. Here are some helpful pointers to consider.

Select Market Segment

Choose a market sector to trade initially. The underlying asset for your trade options contracts will depend on this. It might be stocks, commodities, or currencies. If you want to trade equities, you must decide which company’s shares to trade before choosing stock options trading strategies.

Assess Your Market View

After choosing a market category and asset, evaluate its market prognosis. Do you believe the asset’s price will rise or fall? Do you expect considerable asset price volatility before the option expires? Do you anticipate an asset price graph with less volatility? Next, answer these questions to identify bullish, bearish, or neutral options trading strategies.

Consider Trading Timeframe

You should also consider your trading timing. Your market perspective may occur within this period. This parameter is crucial because you must choose choices with expiry dates that match the timetable. If your options expire early, the market action you expect may not have happened. The market forecast may have already transpired by the time you conclude your transaction if the options expire too late.

Determine Trading Objectives

Next, determine your trading goals. Option trading strategies may maximize earnings, minimize losses, hedge a position in a separate market, or speculate on price changes. Multi-legged options trading methods can help you achieve multiple goals. Once you are clear about your trading goals, you may choose an options strategy.

Choose an Options Strategy

After determining your market sector, asset, market outlook, trading goals, and timescales, you may select a strategy. Options trading strategies serve distinct purposes and market perspectives. Some are good for bullish markets, others for bearish ones. Neutral options trading methods abound.

Examine its Risk-Reward Proposition

After selecting an options trading strategy, you must concentrate on its internals. This requires assessing the strategy’s risk-reward proposition and profit and loss probabilities. To determine whether a plan meets your risk-reward choices, evaluate the maximum gain or loss in various market conditions.

Backtest and Simulate Before Execution

You may backtest and replicate a strategy to confirm its efficacy in actual market circumstances. Use past price data to backtest an options trading strategy and evaluate its results. It doesn’t guarantee future market changes will provide the same outcomes, but it helps you visualize the method.

Risks to Consider in Options Trading

Option trading strategies require risk management to minimize losses and maximize gains. This section discusses four methods for managing options trading risk.

- Implied Volatility (IV): The market’s anticipation of future price volatility is reflected in implied volatility.

- Size of Position: Protecting traders from overcommitting to one deal is key to options risk management. The quantity of contracts you trade depends on your risk tolerance and capital, and it helps balance a portfolio.

- Stop Loss: With stop-loss orders, you may reduce your possible losses. This risk management tool allows traders to set a maximum loss on a transaction, which closes the deal if it is reached.

- Adjustments: As the market shifts, you should be ready to modify your holdings. The volatility of the option or the underlying asset may serve as the basis for adjustments.

Tips for Successful Options Trading

Establishing precise rules and astute routines may significantly improve results for steady performance in option trading strategies.

- Develop a Sound Trading Plan: To maintain discipline even amid market fluctuations, start with well-defined goals that are in line with your risk tolerance and market perspective.

- Facilitate Risk Management: Always calculate possible losses, use stop-loss techniques, and refrain from using excessive leverage, particularly when working with directional positions.

- Select Liquid Contracts and Execute Wisely: Limit orders and an emphasis on high-liquidity options help to reduce slippage and guarantee cleaner trade entry.

- Constantly Evaluate and Adjust: Keeping a trade log, thinking about your wins and failures, and following what’s happening in the market will help you improve your strategy.

- Understand Greeks and Volatility: Understanding delta, theta, and vega allows you to anticipate the effects of time decay and volatility changes on your investments. Additionally, monitoring implied volatility cycles can provide further insights.

Conclusion

Option trading strategies can generate revenue, manage portfolio risk, or profit from market fluctuations. Begin with cautious methods like covered calls, defensive puts, and cash-secured puts to gain confidence.

Iron condors, straddles, strangles, and butterfly spreads are sophisticated multi-leg tactics you can learn. Market forecast, risk tolerance, finances, and comfort with complexity should guide your plan. Effective risk management and learning can make options great trading tools.

FAQs

Q. What is the easiest options trading strategy?

The covered call strategy, which involves selling call options on equities you already own, is the simplest. It’s easy, generates income, and reduces risk when you own the stock.

Q. How do option trading strategies make money?

Premium collection, directional price movements, time decay (theta), and volatility fluctuations are the ways that option trading strategies generate profits. Before the plan expires, profits are generated when it is in line with market behavior.

Q. Which options strategy has the least risk?

The least risky option is the defensive put. It is a popular option for conservative investors seeking protection, as it functions akin to insurance, limiting downside losses while allowing for upside gains.

Q. Can beginners make money with options?

Yes, beginners may profit from options by using low-risk trading techniques like cash-secured puts and covered calls. Education, self-control, and beginning small with defined-risk transactions are all necessary for success.

Q. What is the best strategy for income-using options?

For income, the covered call strategy is the best option. When keeping high-quality, stable equities over the long term, it is simple to manage, consistently generates premium profits, and performs well in sideways markets.