What Are Upper and Lower Circuits in the Stock Market?

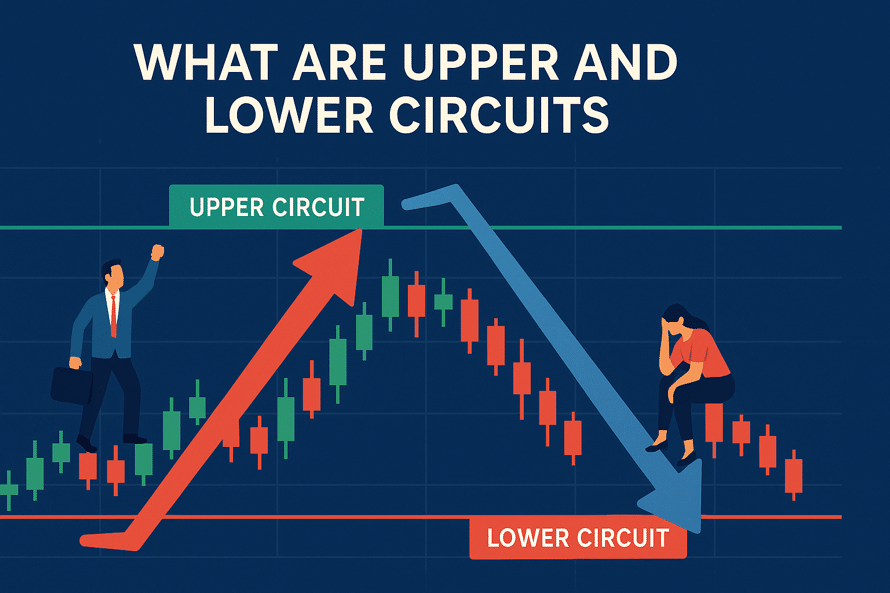

Have you ever wondered what are upper and lower circuits in the stock market? They are rules established by exchanges to avoid big swings in stock prices during a single day. If the price of a stock increases too fast, it touches the upper circuit limit. If the price drops a lot, it reaches the lower circuit. Once there is a stop, buying and selling shares of that stock becomes limited.

This helps keep the market steady for investors. All circuits are determined by comparing them to the stock’s previous closing price. Stock limits rely on the level of volatility and the amount of trading involved. Studying the difference between upper and lower circuits is important for traders and investors since this knowledge helps them make better trading decisions.

Understanding Circuit Limits in Share Trading

Circuit limits are safety measures set up by stock exchanges in trading. This prevents prices from rising or falling quickly and protects investors. But what are upper and lower circuits, and what makes them significant?

Definition of Upper Circuit

The highest price that a stock achieves in a trading session is known as its upper circuit. The stock exchange decides this limit. Whenever a stock reaches its upper circuit, trading is stopped for a while to avoid too much buying. Usually, it shows that the market expects the asset to keep going up. Knowing how the upper circuit works allows investors to make smart decisions when markets go up.

Definition of Lower Circuit

The lower circuit is the lowest selling price a stock can reach within one day. It helps prevent significant losses in the market. When the stock price reaches this limit, buying and selling are put on hold to prevent a panic. Employing this approach reduces instances of decisions made out of fear.

Purpose of Circuit Limits in Market Regulation

When price swings become too frequent, stock exchanges use circuit limits to help regulate the gyrations. Circuit limits keep trading organized and prevent manipulation. They also provide investors with time to calmly review the situation before deciding what to do.

How Are Upper and Lower Circuits Calculated?

Stock exchanges create upper and lower circuits to control sharp moves in day prices. These rules are important for maintaining the market’s stability and shielding investors from unexpected problems.

Using Percentage of Previous Day’s Closing Price

Upper and lower circuits are set using the stock’s closing price on the prior day. SEBI and stock exchanges establish circuit limits for each stock category based on factors like volatility, and these limits usually range between 5%, 10%, 15%, and 20%. In other words, they are the highest and lowest prices a stock can touch in a single trading session.

Sample Calculation with Example Values

Suppose the closing price of a particular stock was ₹200 yesterday. If the circuit limit is 10%, the highest the stock can go is ₹220, and the lowest is ₹180. As a result, the stock is allowed to trade just within the range of ₹180 to ₹220 on the following day. When these records are reached, trading stops for a time or is restricted to some degree.

Why Do Stock Exchanges Use Circuit Breakers?

When stock prices change rapidly, circuit breakers automatically cause trading to halt at the exchange. They come into effect to support a steady and equitable market for every investor.

Controlling Market Volatility

They slow down the market from reaching extreme ups or downs. If there is sudden excitement or concern, prices can fluctuate violently. By pausing trading, investors are allowed to comprehend what is happening. It allows people to make well-thought-out decisions that are not based on emotion.

Protecting Retail and Institutional Investors

Circuit breakers are helpful for all kinds of investors. When the market pauses, investors have time to review their plans. Retail investors often find it hard to get crucial details soon after an event. With circuit breakers in place, they get time to consider the situation and act accordingly.

Preventing Price Manipulation

Circuit breakers can also prevent people from taking advantage of the market. Big players in the market and rumors can sometimes influence prices. When trading is put on hold, it is hard to influence prices. This preserves the market’s integrity and boosts the confidence of those who invest. The upper and lower circuits on NSE and BSE limit the range a stock can fluctuate in a trading day, so trading stays safe and organized.

Circuit Limits: Do All Stocks Have the Same Thresholds?

Knowing the difference between upper and lower circuits can help traders make wise choices in various market situations.

Variation by Stock Type and Volatility

Stocks are grouped into categories, and each has its own circuit limit setup. The degree of these limits depends on the type of stock and how its prices fluctuate. Because highly volatile stocks swing rapidly, they are given larger circuit limits to let prices change more. In some cases, tight rules are placed on stocks that could be sensitive to changes so that investors are not exposed to sudden losses.

Impact of Liquidity and Market Capitalization

How well the stock market moves and its overall value play a role in setting circuit thresholds. Generally, large-cap stocks with better liquidity are set to have tighter circuit limits. This happens because the prices of these goods are unlikely to change significantly. Due to the less frequent trading of small-cap or less liquid stocks, the price limits are often wider to handle bigger fluctuations. This helps make trading stable and ensures fairness in establishing market prices.

What Happens When a Stock Hits Its Circuit Limit?

Stock market circuits act as limits set by exchanges to prevent sudden price changes. We need to understand what happens when a stock reaches its highest or lowest limit.

Market Behavior at the Upper Circuit

A stock hits its upper circuit when it reaches the highest possible price rise allowed on that day. No trades take place above this price level. Due to this, some sellers might hesitate to sell, and buyers will often wait in line for the stock. As a result, the stock could remain limited to the highest price range for the rest of the day. This is a necessary consideration when understanding what are upper and lower circuits.

Market Behavior at the Lower Circuit

A fall on the lower circuit indicates that the price of the stock has reached its lowest permitted level. Investors cannot place sell orders that go under this limit. Issues with demand, such as a lack of buyers, might appear. It often means there is no positive outlook for the company in the market.

Possible Trading Halts or Freeze Conditions

If there is frequent odd activity or circuit breakers in a stock price, trading in that stock might stop. It allows investors to think things over. During unpredictable situations, market limits may sometimes be revised or lifted for a short time.

Real-World Example of Circuit Application

Sharp price movements in stock markets are controlled with circuit limits. Such limitations help keep everything stable and secure investors’ investments. You can understand what are upper and lower circuits by looking at a straightforward example.

10% Circuit Calculation for a $50 Stock

If a stock has a 10% circuit limit and is trading at $50, then:

$50 + 10% = $55 is the upper circuit.

Lower Circuit = $50 minus 10% = $45

This implies that during a single trading session, the stock cannot move above $55 or below $45 in value. The stock exchange determines this range.

Price Behavior within the Set Range

In case of high demand, the value of the stock might climb to $55 and be capped from further rising. Also, if panic selling takes hold, shares might fall to the lower $45 limit. When a circuit breaker activates, it might stop trading temporarily or authorize trading but with set limits. As a result, the price shifts are better managed, leading to less market fluctuation.

Special Cases: Market-Wide Circuit Breakers

Stock markets have always been popular places for investing and creating wealth. On the downside, investing in stocks can be risky since prices in the market can change rapidly. As a result, the chances of large gains or losses in stock markets are very high. Because of this, market-wide circuit breakers are put in place to prevent traders from acting recklessly or making impulse purchases.

Index-Level Circuits for Sensex and Nifty

If the SENSEX or Nifty changes by more than a certain amount within one day, market circuit breakers are put in place. These are determined using movement thresholds of 10%, 15%, and 20%.

Market Halts Triggered by Index Movements

A stop here causes trading to stop for a period, which varies depending on the level breached and the time it happened. These allow investors to consider the state of things. They enable employees to make wiser and more reasonable decisions. It differs from stock-specific circuits. In this case, it is crucial to comprehend what are upper and lower circuits.

Conclusion

Understanding upper and lower circuits is crucial to navigating the stock market. These circuits are put in place to prevent excessive volatility, preserve investors’ interests, and maintain the market’s integrity. By understanding how these limits behave, investors can better react to market action with more awareness, discipline, and confidence.

FAQs

1. What is the difference between the upper and lower circuits in stocks?

The upper circuit sets the maximum price that a stock can achieve in a day. Lower circuit refers to the lowest trade price that is acceptable for the security.

2. Can you buy or sell shares after a stock hits its upper or lower circuit?

You cannot purchase shares once the stock has reached its upper circuit. If the stock reaches the lower circuit, there are no opportunities for selling. The expected trades are stopped momentarily.

3. What triggers an upper or lower circuit?

If the price for a stock goes above or below certain levels set by the exchange, it causes the stock to move from one circuit to another, preventing excessive swings in prices.

4. Are circuit limits the same for all stocks?

No, the amount you can trade on a circuit is determined by the stock. Typically, they are either 2%, 5%, 10%, or 20%, determined by how volatile a stock is and how much it is traded.

5. What does it mean if a stock frequently hits its circuit limit?

It reflects that the price is very volatile and speculation is high. People are flocking to either purchase or sell. These types of stocks are riskier and should be studied carefully before investing.

6. Can circuit limits change overnight?

Stock exchanges can update their circuit rules when the market is highly volatile or something significant occurs. The updates are communicated and set in place by the close of the most recent trading day.

7. What happens if an entire index hits a circuit breaker?

Trading temporarily stops when the index sees a sharp shift in either direction. This action soothes the market and allows investors to make calm decisions.

8. How should investors react to circuit limit events?

Try to keep a cool head and do not panic. Review financial news and changes in the marketplace. Make sure to study the market well before selling or buying during these events. You need to be patient.

Disclaimer

The stocks mentioned in this article are not recommendations. Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved. Lemonn do not guarantee any assured returns on any investments. Past performance of securities/instruments is not indicative of their future performance.

To read the RA disclaimer

Research Analyst - Gaurav Garg