4.3+ App Rating | 1.5M+ Indian Traders

+91

| Segment | % of Revenue |

|---|---|

| Oil to Chemicals | 53.12% |

| Retail | 26.68% |

| Digital Services | 11.05% |

| Others | 6.77% |

| Oil & Gas | 2.38% |

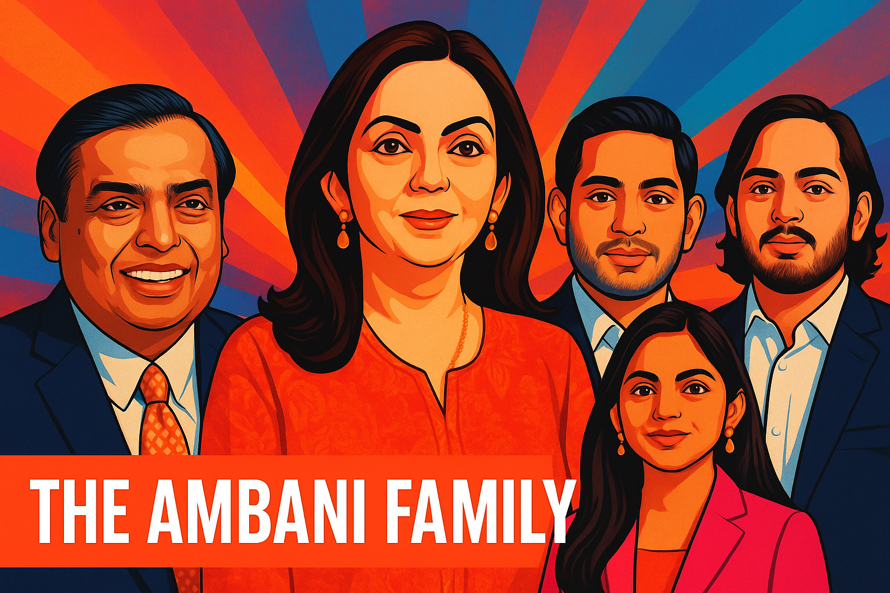

| Family Member | Role | Segment |

|---|---|---|

| Mukesh Ambani | Chairman & MD, RIL | Strategy & oversight |

| Akash Ambani | Chairman, Jio | Telecom |

| Isha Ambani | Director, Reliance Retail | Retail |

| Anant Ambani | Executive Director, RIL (2025) | Green Energy |