4.3+ App Rating | 1.5M+ Indian Traders

+91

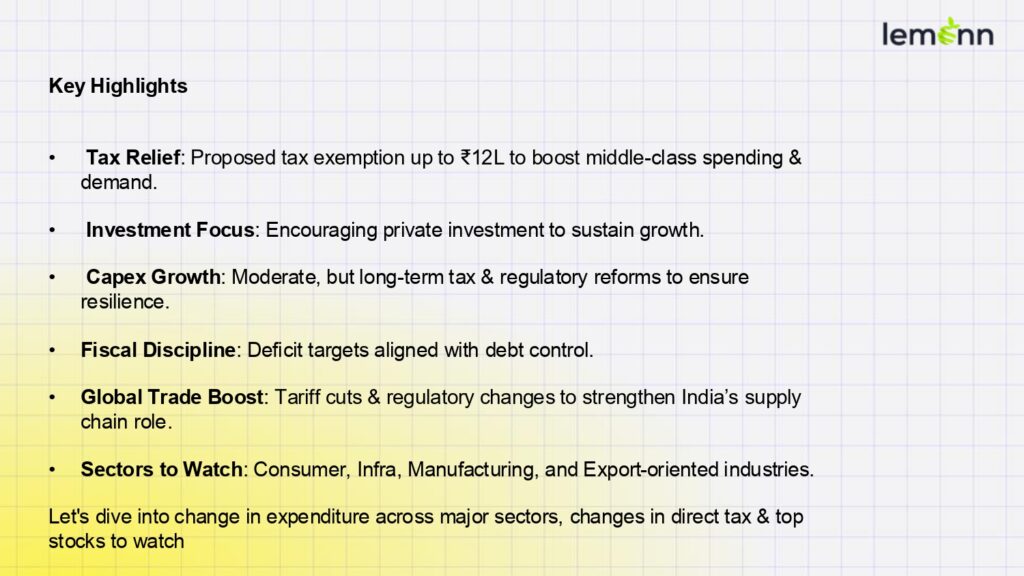

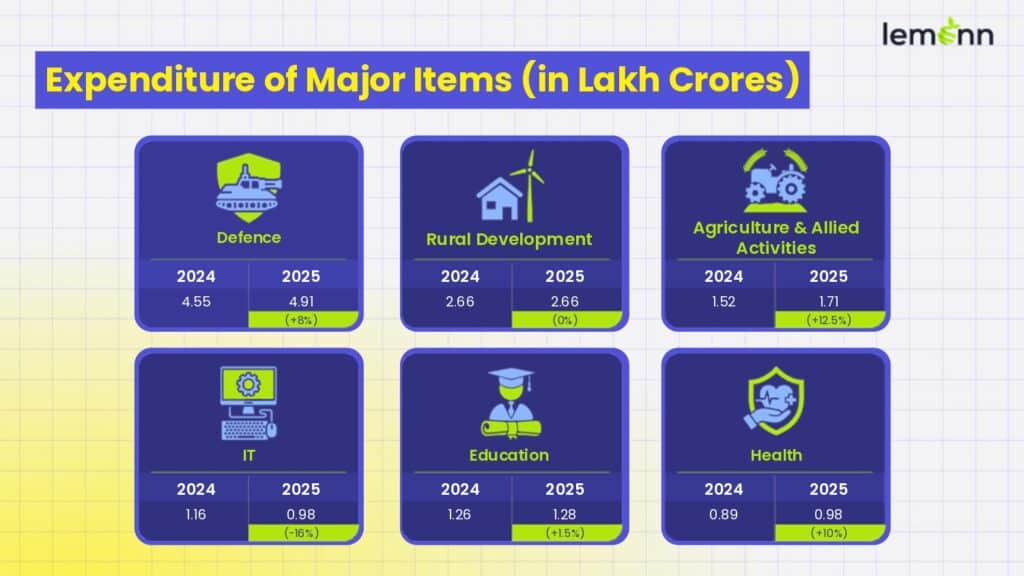

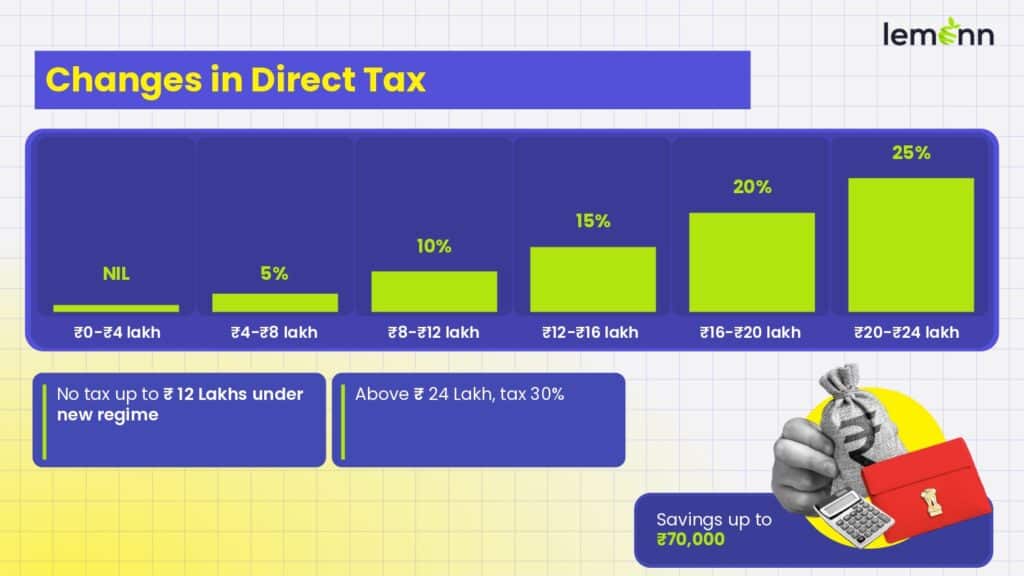

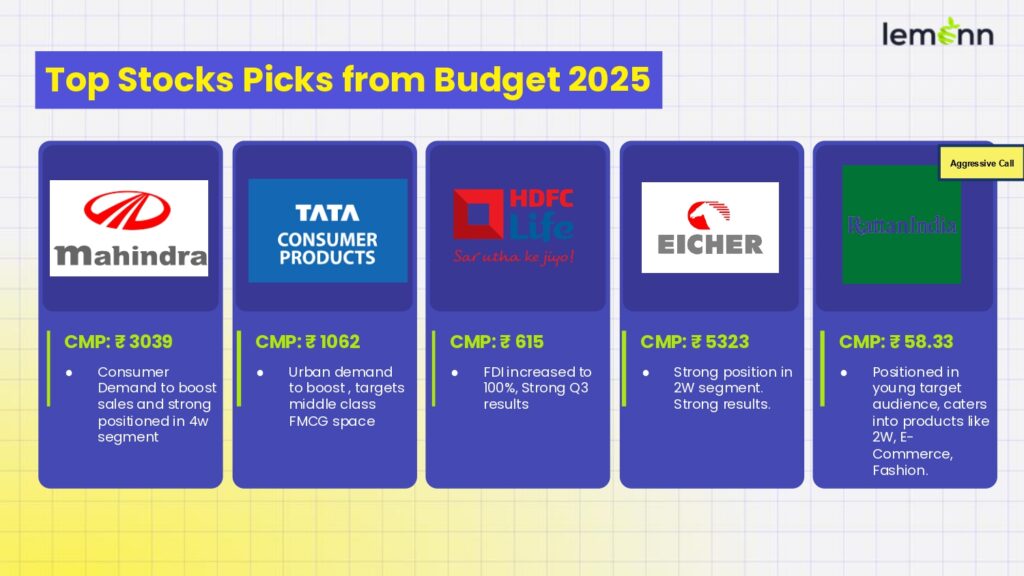

India’s 2025-26 budget focuses on boosting middle-class spending through personal income tax cuts and increasing private investment to sustain growth amid slowing economic expansion. A proposed tax exemption of up to ₹1.2 million aims to enhance disposable income and consumer demand. While capital expenditure growth remains moderate, long-term tax and regulatory reforms are expected to support economic resilience. The budget also emphasizes fiscal discipline, aligning deficit targets with debt levels, and strengthening India’s role in global supply chains through regulatory reforms and tariff rationalization to improve business competitiveness.