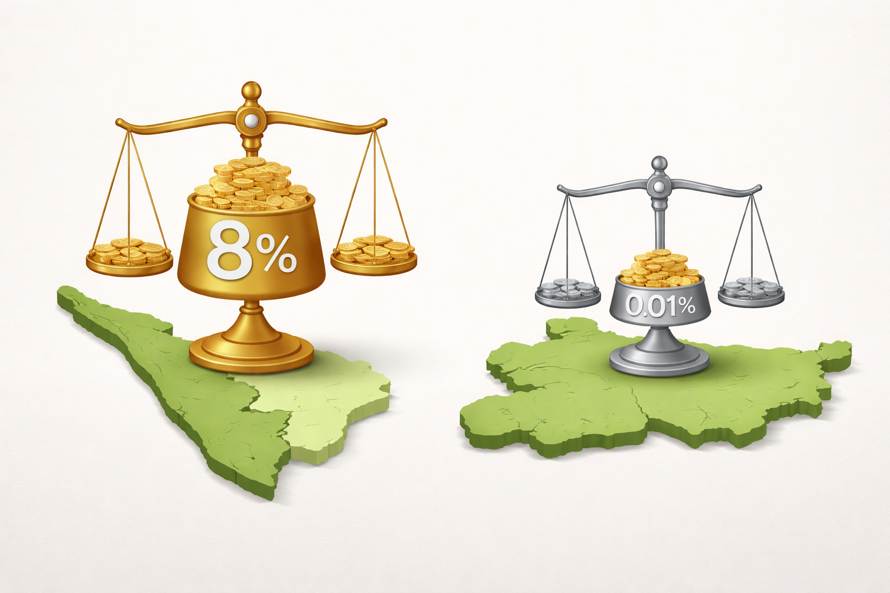

Why Is Inflation 8% in Kerala but Only 0.01% in Bihar?

If inflation is rising across India, why does Kerala report around 8% inflation while Bihar shows almost zero (0.01%)?

At first glance, it feels confusing – even unfair. But once you look at how inflation is calculated and how these two states differ economically, the gap starts to make sense.

What Inflation Really Measures (Quick Context)

Inflation does not measure how expensive a place is.

It measures how fast prices are changing compared to last year.

So:

- A rich, expensive state can show high inflation

- A poor, low-cost state can show very low inflation

Inflation is about price movement, not absolute prices.

1. Different Consumption Patterns Matter

Inflation is calculated using a Consumer Price Index (CPI) basket. Each state has a different basket based on what people actually buy.

Kerala’s consumption basket

- More spending on:

- Milk, meat, fish

- Private healthcare

- Education

- Transport and fuel

- Services

- These items saw sharp price increases recently

Bihar’s consumption basket

- Higher weight for:

- Rice, wheat, pulses

- Government-subsidized food

- Basic necessities

- Prices of these items stayed stable or fell slightly

Result: Even small price hikes in Kerala’s basket push inflation up more than in Bihar.

2. Higher Income = Higher Inflation Sensitivity

Kerala has:

- Higher per-capita income

- Strong remittance inflows

- Greater urban consumption

This leads to demand-driven inflation:

- People can afford higher prices

- Businesses pass on cost increases more easily

Bihar, on the other hand:

- Has lower purchasing power

- Faces demand constraints

- Sellers struggle to raise prices

Simply put: prices rise where people can pay.

3. Food Subsidies Keep Bihar’s Inflation Low

Bihar benefits heavily from:

- Public Distribution System (PDS)

- Free or subsidized grains

- Government welfare schemes

When food prices rise in the market:

- The CPI impact in Bihar is muted

- Households are shielded from volatility

Kerala relies more on open-market food purchases, making households more exposed to price changes.

4. Supply Chain Differences Play a Big Role

Kerala

- Imports a large share of:

- Vegetables

- Milk

- Poultry

- Higher transport and fuel costs

- Any disruption quickly raises prices

Bihar

- Largely agrarian

- Local production of staples

- Shorter supply chains

Fewer middlemen = less price pressure.

5. Services Inflation Hits Kerala Harder

Inflation today isn’t just about food.

Kerala sees higher increases in:

- Medical fees

- School and college costs

- House rents

- Personal services

Bihar’s services sector is:

- Smaller

- Less formal

- Less price-flexible

This keeps overall inflation artificially low.

Is 0.01% Inflation in Bihar “Good News”?

Not entirely.

Very low inflation can signal:

- Weak demand

- Slow income growth

- Limited pricing power for producers

In contrast, Kerala’s higher inflation reflects:

- Stronger demand

- Higher consumption

- A more service-oriented economy

Low inflation isn’t always a sign of economic health.

Key Takeaways

- Inflation measures price change, not cost of living

- Kerala’s higher inflation comes from:

- Consumption-heavy lifestyle

- Service-sector price increases

- Supply-chain dependence

- Bihar’s low inflation is due to:

- Subsidies

- Lower demand

- Stable food prices

- Neither number alone tells the full economic story

FAQs

Q. Is inflation data manipulated by states?

No. Inflation figures are calculated using national statistical methods, but state-level consumption patterns differ.

Q. Will Bihar’s inflation rise in the future?

Yes. As incomes grow and consumption increases, inflation is likely to normalize.

Q. Does high inflation mean Kerala is doing worse?

Not necessarily. It often reflects stronger demand – though it does strain household budgets.