Quick Summary

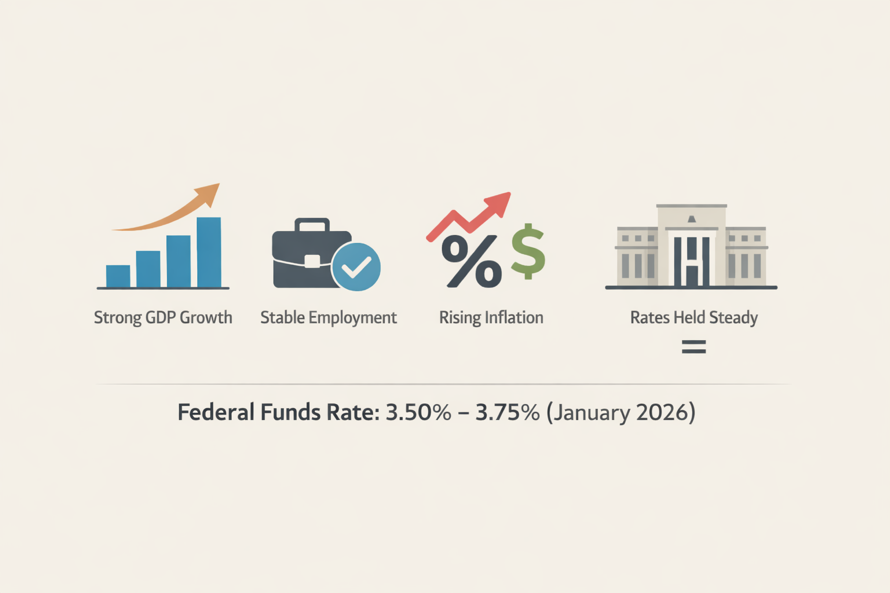

The Federal Reserve kept interest rates unchanged at its January 2026 meeting, holding the federal funds rate at 3.50% to 3.75%. Strong GDP growth, stabilizing employment, and rising tariff-driven inflation led the Fed to pause after three rate cuts in 2025. The path forward depends on how the economy reacts in the coming months.

What’s Happening with Federal Reserve Interest Rates?

On January 28, 2026, the Federal Open Market Committee (FOMC) announced that it would hold the federal funds rate steady at 3.50% to 3.75%.

This marks a shift from the second half of 2025, when the Fed made three consecutive rate cuts to stimulate the economy. Now, they’re in “pause and assess” mode, trying to understand if those cuts were enough – or too much.

Why the Fed Paused Rate Cuts in 2026

1. The Economy Is Still Strong

The U.S. economy grew by a surprising 5.4% in Q4 2025. Much of this growth came from business investment in AI infrastructure and consumer spending fueled by strong equity markets and tax refunds.

2. Jobs Are Stabilizing

- The labor market is slowing, but not collapsing.

- The unemployment rate edged down to 4.4%, and jobless claims remain low.

- The Fed sees this as a sign that the labor market is in “rough balance.”

3. Tariff-Driven Inflation Is Complicating Things

- New U.S. tariffs on European goods begin in February and could jump to 25% by June.

- This has created “tariff shadow inflation” – price increases not caused by strong demand, but by trade policy.

- These aren’t the kind of price hikes the Fed can control with rate changes.

4. Fed Independence Is Under Pressure

- Political pressure is rising, especially from President Trump, who wants much lower rates.

- The Department of Justice has opened a criminal probe into Fed Chair Jerome Powell, raising fears about the central bank’s autonomy.

Who Voted Against Holding Interest Rates?

Two dissenters on the FOMC – Stephen Miran and Christopher Waller – pushed for another rate cut. They argued that the economy still risks a slowdown and that the Fed may be holding rates too high, especially for vulnerable parts of the labor market.

What This Means for You

Mortgage and Loan Rates

- Mortgage rates held steady in January, with the 30-year average around 6.18%–6.27%.

- HELOCs are more attractive now, with rates dropping to 7.44%.

- Credit cards remain expensive, averaging 19.61% APR.

Savings Accounts

- Savers are benefiting for the first time in years.

- High-yield savings accounts still offer 3.75% to 4.20% APY, and these rates may stay elevated if the Fed remains cautious.

What’s Next for Federal Reserve Interest Rates?

The next FOMC meeting is March 17–18, 2026. Between now and then, fresh data on jobs and inflation will help shape the Fed’s next move.

What markets expect:

- A 50%+ chance of a rate cut by mid-2026

- Possibly 1–2 cuts by year-end, depending on inflation trends and political pressure

Final Thoughts: A Balancing Act

The Federal Reserve is trying to thread the needle – avoid stalling the economy while not triggering another wave of inflation. Holding interest rates steady in January shows caution and a willingness to let previous rate cuts work through the system.

Whether this pause leads to more cuts later in 2026 will depend on how the economy, labor market, and inflation respond in the months ahead.

FAQs About Federal Reserve Interest Rates

What is the current federal funds rate?

The Federal Reserve’s target range is 3.50% to 3.75% as of January 2026.

Why did the Fed stop cutting rates?

Strong GDP growth, stable unemployment, and tariff-driven inflation led the Fed to pause and wait for more data.

When will the Fed cut interest rates again?

Markets expect a possible rate cut by mid-2026, but it depends on inflation and economic conditions.

How do Federal Reserve interest rates affect me?

They influence everything from your mortgage and credit card rates to the return on your savings account. When the Fed pauses or cuts rates, borrowing can get cheaper, and saving rates may fall over time.