Trade & Invest

Learn

Company

Nippon Life India Asset Management Ltd

Nippon India Mutual Fund, formerly known as Reliance Mutual Fund, is a leading asset management company in India, managing a variety of assets across mutual funds, pension funds, managed accounts, alternative investments, and offshore funds. The asset manager for Nippon India Mutual Fund (NIMF) is Nippon Life India Asset Management Limited (NAM India), with its promoters being Reliance Capital Limited and Nippon Life Insurance Company, holding 75.93% of the company's equity share capital. Reliance Capital Limited, a top RBI-registered Non-Banking Finance Company, is involved in asset management, life insurance, general insurance, stockbroking, and other financial services. Nippon India Mutual Fund was originally established as Reliance Mutual Fund in June 1995, a joint venture between India's Reliance Capital and Japan's Nippon Life Insurance. In October 2019, Nippon Life Insurance acquired Reliance's stake, leading to the fund house being renamed Nippon India Mutual Fund. Nippon India Mutual Fund manages assets worth ₹4,31,308 crores and offers a diverse range of schemes, including 52 equity funds, 266 debt funds, and 40 balanced funds. Under the leadership of CEO Sundeep Sikka, Nippon Life India Asset Management Limited provides portfolio management, mutual fund investments, financial planning, and advisory services to individuals, institutions, trusts, and private funds. Nippon Life Insurance Company (NLI), one of Japan's leading private life insurers, offers a broad array of insurance and financial products. NLI’s asset management operations in Asia are conducted through its subsidiary, Nissay Asset Management Corporation, which manages assets globally.

List of Nippon Life India Asset Management Ltd in India

Fund Name

Nippon India Silver ETF Fund of Fund (FOF) Direct Growth

NA

166.03%

56.88%

₹6099.14 Cr

Nippon India Gold Savings Fund - Direct Plan - Growth

NA

80.42%

39.83%

₹7160.44 Cr

Nippon India Power & Infra Fund - Direct Plan - Growth

NA

20.56%

28.21%

₹6772.68 Cr

Nippon India Growth Mid Cap Fund - Direct Plan - Growth Mid Cap

5

22.74%

28.00%

₹41727.36 Cr

Nippon India Pharma Fund - Direct Plan - Growth Plan

NA

10.93%

24.65%

₹7875.40 Cr

Nippon India Nifty Midcap 150 Index Fund Direct Growth

NA

18.16%

24.36%

₹2120.59 Cr

Nippon India Value Fund - Direct Plan - Growth Option

4

14.82%

24.18%

₹8961.98 Cr

Nippon India Multi Asset Allocation Fund Direct Growth

NA

28.17%

23.84%

₹12513.31 Cr

Nippon India Nifty Next 50 Junior BeES FoF Direct Growth

4

17.10%

23.42%

₹661.07 Cr

Nippon India Multi Cap Fund - Direct Plan - Growth

4

16.94%

23.13%

₹48808.64 Cr

Nippon India Multi - Asset Omni FoF Direct Growth

NA

23.24%

23.04%

₹2136.98 Cr

Nippon India Vision Large & Mid Cap Fund - Direct Plan - Growth Plan

3

16.16%

22.44%

₹6751.46 Cr

Nippon India Small Cap Fund - Direct Plan - Growth Plan

5

12.68%

22.12%

₹65812.16 Cr

Nippon India Quant Fund - Direct Plan - Growth Plan

NA

19.72%

21.96%

₹108.85 Cr

Nippon India Banking & Financial Services Fund Direct Plan - Growth

4

24.85%

21.53%

₹7752.54 Cr

Nippon India Large Cap Fund - Direct Plan - Growth Plan

5

16.89%

20.71%

₹50106.61 Cr

Nippon India Nifty Smallcap 250 Index Fund Dir Gr

NA

9.34%

20.71%

₹2577.71 Cr

Nippon India ELSS Tax Saver Fund Direct Plan - Growth Option

3

17.36%

19.68%

₹14881.42 Cr

Nippon India Retirement Fund - Wealth Creation Scheme - Direct Growth

NA

13.82%

19.46%

₹3118.55 Cr

Nippon India Nifty Alpha Low Volatility 30 Index Fund Direct Growth

NA

12.53%

18.55%

₹1354.86 Cr

Key information about nippon india mutual funds

Mutual fund name

Nippon India Mutual Fund

Asset Management Company Name

Nippon Life India Asset Management Ltd

AMC Setup Date

30-Jun-1995

AMC Incorporation Date

24-Feb-1995

Sponsor Name

Nippon Life Insurance Company

Trustee Organisation

Nippon Life India Trustee Limited

CIO

Mr. Amit Tripathi, Mr. Sailesh Raj Bhan

MD & CEO

Mr. Sundeep Sikka

Compliance Officer

Mr. Muneesh Sud

How can you invest in nippon india mutual funds Mutual Funds

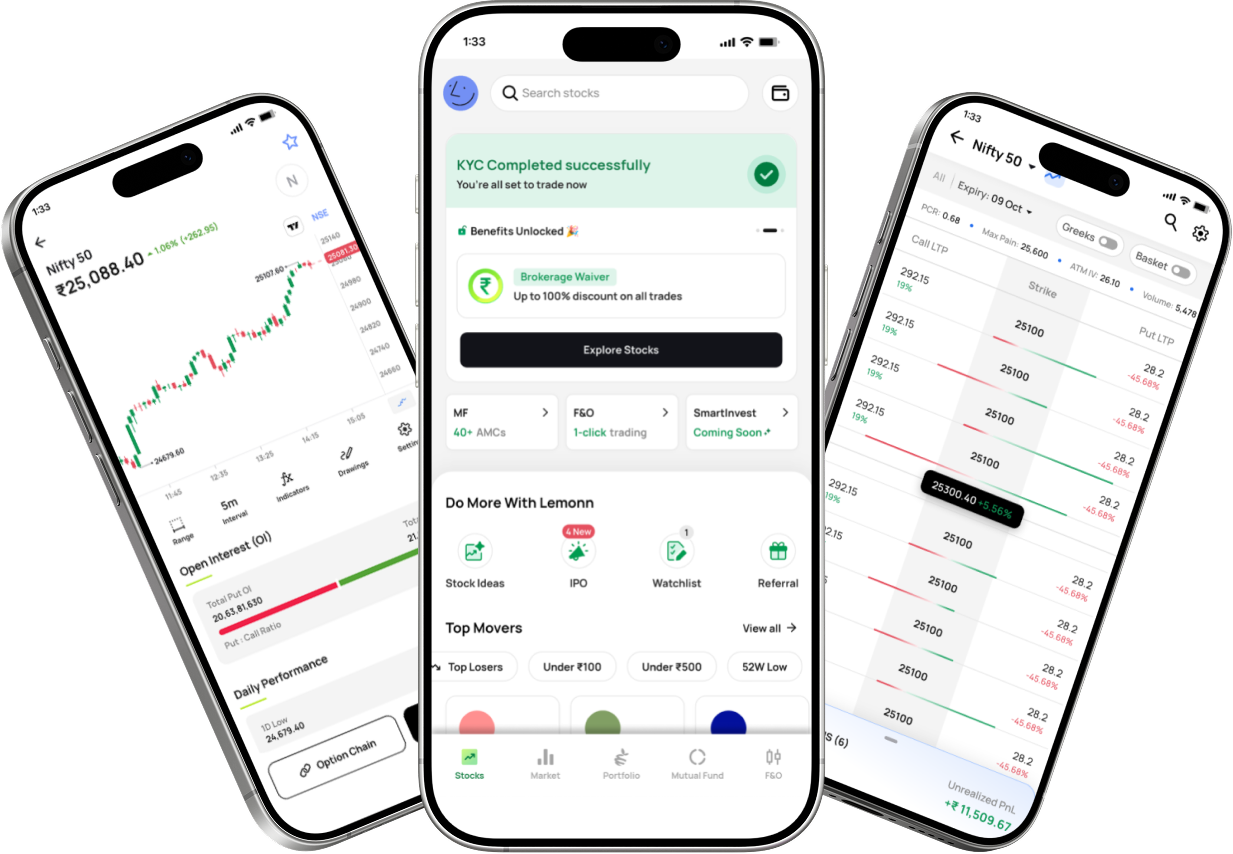

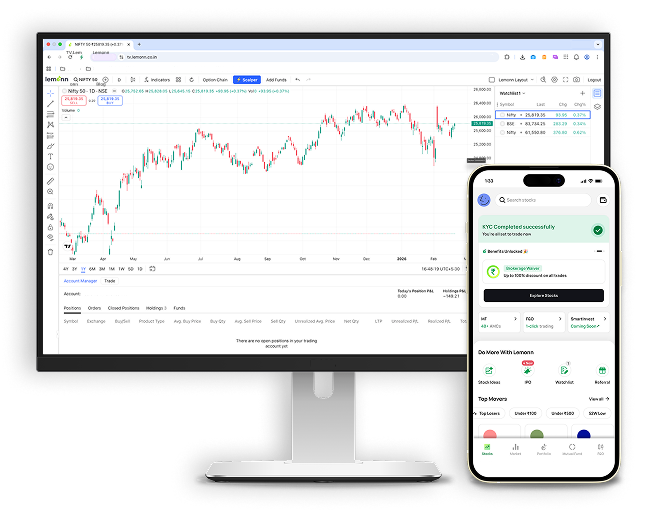

To invest in nippon india mutual funds Mutual Funds through the Lemonn App, you can follow these general steps:

Step 1 : Download the Lemonn App

If you haven't already, download the Lemonn App from the Google Play Store or Apple App Store.

Step 2 : Sign up / Log in

Sign up by providing your phone number and completing the basic registration process.

If you already have an account, simply log in.

Step 3 : Complete KYC

Before investing, ensure your KYC (Know Your Customer) verification is complete. Most mutual fund apps will guide you through this. You’ll need PAN, Aadhaar, and other necessary details.

Step 4 : Search for nippon india mutual funds Mutual Funds

Once your KYC is done, search for the nippon india mutual funds Mutual Fund schemes you're interested in by using the search bar.

Step 5 : Choose a Scheme

You will see a list of various funds under nippon india mutual funds. Explore the options, check their performance, risk profile, and investment objectives.

Choose a scheme that aligns with your investment goals (e.g., equity, debt, hybrid funds).

Step 6 : Decide on the Investment Amount

You can either make a lump sum investment or set up a SIP (Systematic Investment Plan) to invest a fixed amount periodically.

Step 7 : Confirm the Investment

Enter the amount you wish to invest.

Review the details and confirm the payment method (Net Banking, UPI, etc.).

After making the payment, you will receive a confirmation of your investment.

Step 8 : Track Your Investment

You can track the performance of your nippon india mutual funds Mutual Funds on the Lemonn App dashboard. It will show NAV, returns, and other key details.

If you need any assistance, the Lemonn App usually has customer support or chat options to help. Keep an eye on expenses like entry/exit loads and expense ratios to optimize returns!

Top Fund Managers

Mr. Ashwani Kumar

Mr. Kumar has a long and distinguished career in wealth management, with experience as a fund manager since 2003. He joined Nippon India Mutual Fund (formerly known as Nippon India Mutual Funds) at a key moment in the company's growth. A graduate of the University of Pune, he also holds an MBA in Finance. Currently serving as the Senior Fund Manager for Equity Investments at Nippon India Mutual Fund, Mr. Kumar has previously worked at Zurich Asset Management Co. Ltd. His global perspective on money management has been instrumental in shaping NIMF's success, helping position the firm as one of the leaders in India's mutual fund sector.

Mr. Sailesh Raj Bhan

Mr. Bhan has an extensive career, having been with Nippon India Mutual Fund (NIMF) for over 10 years, and previously working for 15 years at Nippon India Nippon Life Asset Management Limited. He currently manages the Nippon India Multi Cap Fund, which oversees approximately $1.5 billion in assets. In addition to his role as a fund manager, Mr. Bhan serves as the Deputy Chief Investment Officer (CIO) at NIMF. A well-regarded figure in India’s wealth management sector, Mr. Bhan also manages the Nippon India Consumption Fund and provides strategic advice on international markets, making him a key player in NIMF's investment strategy.

Mr. Samir Rachh

Mr. Rachh brings 29 years of experience in asset and capital management to his role at Nippon India Mutual Fund (NIMF). An alumnus of the University of Mumbai, he began his career as the Assistant Editor of *Capital Market Magazine* before founding his own advisory and research firm, Anvicon Research. Prior to joining NIMF, he was with Hinduja Finance. Having been with NIMF for the past 12 years, Mr. Rachh is renowned for his expertise in managing Mid Cap and Small Cap stocks, areas where he is considered a specialist. His extensive background in research and analysis makes him a valuable asset to the fund management team at NIMF.

Mr. Sanjay Parekh

Mr. Parekh, with 24 years of experience in Equity Research and Fund Management, is a key figure at Nippon India Mutual Fund (NIMF). Although younger than many of his senior colleagues, he brings a wealth of expertise to the table. Prior to joining NIMF, Mr. Parekh held prominent roles, including serving as a Senior Fund Manager at ICICI Prudential Asset Management Company Ltd. and as the Head of Investment at ASK Investment Managers Ltd. from 2005 to 2008. Since joining NIMF as Senior Fund Manager in Equity Investments, he has become a highly influential figure in the business and investment circles, known for his deep market insights and strategic decision-making in equity investments.

Ms. Meenakshi Dawar

Ms. Dawar has over 10 years of experience in the mutual fund industry and is currently with Nippon India Mutual Fund, where she manages the Nippon India Value Fund and Nippon India Vision Fund. She holds a B.Tech degree from IGIT-Delhi and a PG in Management from the Indian Institute of Management (IIM), Ahmedabad. Her background in research and fund management, particularly in equity, has earned her a strong reputation in the industry. Before her current role, Ms. Dawar had a successful tenure at IDFC, where she played a key role in multiple product launches. She also gained experience as an Equity Research Analyst at ICICI Securities, further honing her expertise in equity markets. Her diverse career and pioneering efforts in the industry have made her a respected professional in the fund management space.

AMC/Fund Houses

ITI Asset Management Limited

IDBI Asset Management Limited

IDFC Asset Management Company Limited

NJ Asset Management Private Limited

Bandhan Asset Management Company Limited

Groww Asset Management Ltd.

Kotak Mahindra Asset Management Co Ltd

HSBC Asset Management(India)Private Ltd

Mahindra Manulife Investment Management Pvt. Ltd.

Zerodha Asset Management Private Limited

Helios Capital Asset Management (India) Private Limited

Sundaram Asset Management Company Ltd

Aditya Birla Sun Life AMC Ltd

Shriram Asset Management Co Ltd

360 ONE Asset Management Limited

Invesco Asset Management (India) Private Ltd

Samco Asset Management Pvt Ltd

Union Asset Management Co. Pvt. Ltd.

Franklin Templeton Asst Mgmt(IND)Pvt Ltd

Tata Asset Management Limited

Bajaj Finserv Asset Management Limited

Baroda BNP Paribas Asset Management India Pvt. Ltd.

Motilal Oswal Asset Management Co. Ltd

Quantum Asset Management Co Pvt. Ltd.

PGIM India Asset Management Private Limited

DSP Investment Managers Private Limited

Canara Robeco Asset Management Co. Ltd.

Taurus Asset Management Company Limited

Quant Money Managers Limited

Navi AMC Limited

PPFAS Asset Management Pvt. Ltd

Indiabulls Asset Management Company Ltd.

Mirae Asset Investment Managers (India) Private Limited

HDFC Asset Management Company Limited

IIFL Asset Management Limited

ICICI Prudential Asset Management Company Limited

Old Bridge Asset Management Private Limited

Trust Asset Management Private Limited

Bank of India Investment Managers Private Limited

JM Financial Asset Management Limited

Edelweiss Asset Management Limited

Axis Asset Management Company Limited

UTI Asset Management Co Ltd

WhiteOak Capital Asset Management Limited

LIC Mutual Fund Asset Management Limited

SBI Funds Management Ltd

AMC/Fund Houses

ITI Asset Management Limited

IDBI Asset Management Limited

IDFC Asset Management Company Limited

NJ Asset Management Private Limited

Bandhan Asset Management Company Limited

Groww Asset Management Ltd.

Kotak Mahindra Asset Management Co Ltd

HSBC Asset Management(India)Private Ltd

Mahindra Manulife Investment Management Pvt. Ltd.

Zerodha Asset Management Private Limited

Helios Capital Asset Management (India) Private Limited

Sundaram Asset Management Company Ltd

Aditya Birla Sun Life AMC Ltd

Shriram Asset Management Co Ltd

360 ONE Asset Management Limited

Invesco Asset Management (India) Private Ltd

Samco Asset Management Pvt Ltd

Union Asset Management Co. Pvt. Ltd.

Franklin Templeton Asst Mgmt(IND)Pvt Ltd

Tata Asset Management Limited

Bajaj Finserv Asset Management Limited

Baroda BNP Paribas Asset Management India Pvt. Ltd.

Motilal Oswal Asset Management Co. Ltd

Quantum Asset Management Co Pvt. Ltd.

PGIM India Asset Management Private Limited

DSP Investment Managers Private Limited

Canara Robeco Asset Management Co. Ltd.

Taurus Asset Management Company Limited

Quant Money Managers Limited

Navi AMC Limited

PPFAS Asset Management Pvt. Ltd

Indiabulls Asset Management Company Ltd.

Mirae Asset Investment Managers (India) Private Limited

HDFC Asset Management Company Limited

IIFL Asset Management Limited

ICICI Prudential Asset Management Company Limited

Old Bridge Asset Management Private Limited

Trust Asset Management Private Limited

Bank of India Investment Managers Private Limited

JM Financial Asset Management Limited

Edelweiss Asset Management Limited

Axis Asset Management Company Limited

UTI Asset Management Co Ltd

WhiteOak Capital Asset Management Limited

LIC Mutual Fund Asset Management Limited

SBI Funds Management Ltd

FAQs

Loved by 1.5M+ users with a 4.3+ ⭐ app rating - Join now!