Trade & Invest

Learn

Company

Edelweiss Asset Management Limited

Edelweiss Mutual Funds, managed by Edelweiss Asset Management Limited (EAML), is one of India's youngest and most dynamic mutual fund companies. It is a part of Edelweiss Financial Services Ltd., the parent company overseeing the entire group. Edelweiss Financial Services began its journey in 1996 and has since played a significant role in shaping the Indian financial sector. In 2008, despite the global economic downturn, the company obtained a license to operate mutual funds and launched Edelweiss Asset Management Ltd.. Against the odds, Edelweiss Mutual Funds entered a sluggish market but quickly gained momentum through its smart investment strategies and diverse fund offerings. Today, EAML manages a total of 84 funds and has Assets Under Management (AUM) of ₹1.25 lakh crores, ranking among the largest AMCs in India. With branches in 11 locations nationwide, it provides a wide array of investment options, including Equity, Debt, and Liquid funds. Edelweiss Mutual Funds stand out from traditional AMCs by embracing innovation and adopting a non-conventional investment approach. Their focus on technology and enhancing the digital experience for clients makes them one of the most tech-forward mutual fund houses in the country. Beyond mutual funds, EAML is also active in Alternative Investments, continually aiming to provide investors with an extensive range of products and customer support to maximize wealth creation.

List of Edelweiss Asset Management Limited in India

Fund Name

Edelweiss Gold and Silver ETF Fund of Fund Direct Growth

NA

123.86%

49.00%

₹3082.61 Cr

Edelweiss US Technology Equity Fund of Fund Direct Growth

NA

11.65%

30.41%

₹3683.49 Cr

Edelweiss Mid Cap Fund Direct Plan Growth Option

5

21.57%

28.08%

₹13801.71 Cr

Edelweiss Nifty Midcap150 Momentum 50 Index Fund Direct Growth

NA

15.41%

25.46%

₹1380.70 Cr

Edelweiss Europe Dynamic Equity Offshore Fund Direct Growth

NA

44.37%

23.64%

₹215.67 Cr

Edelweiss Nifty Next 50 Index Fund Direct Growth

NA

17.42%

23.45%

₹200.16 Cr

Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund Direct Growth

NA

13.64%

22.54%

₹166.85 Cr

Edelweiss Small Cap Fund Direct Growth

4

14.68%

21.76%

₹5369.04 Cr

Edelweiss Emerging Markets Opportunities Equity Offshore Direct Growth

NA

52.91%

21.70%

₹191.29 Cr

Edelweiss Flexi Cap Fund Direct Growth

4

18.29%

21.49%

₹3133.23 Cr

Edelweiss Nifty Smallcap 250 Index Fund Direct Growth

NA

10.02%

21.16%

₹184.37 Cr

Edelweiss Large & Mid Fund Direct Plan Growth Option

5

16.99%

20.89%

₹4441.85 Cr

Edelweiss Focused Fund Direct Growth

4

15.26%

20.38%

₹1038.02 Cr

Edelweiss Nifty Large Mid Cap 250 Index Fund Direct Growth

NA

16.33%

20.13%

₹319.54 Cr

Edelweiss ELSS Tax saver Direct Plan Growth Option

4

18.32%

19.37%

₹440.10 Cr

Edelweiss Aggressive Hybrid Direct Plan Growth Option

5

13.52%

18.80%

₹3453.04 Cr

Edelweiss Recently Listed IPO Fund Direct Plan Growth

NA

10.83%

18.19%

₹870.78 Cr

Edelweiss Large Cap Fund Direct Plan Growth option

5

15.88%

17.73%

₹1444.18 Cr

Edelweiss US Value Equity Offshore Fund Direct Growth

NA

16.84%

15.66%

₹202.38 Cr

Edelweiss Nifty 50 Index Fund Direct Growth

NA

13.89%

14.34%

₹247.78 Cr

Key information about edelweiss mutual funds

Mutual fund name

Edelweiss Mutual Fund

Asset Management Company Name

Edelweiss Asset Management Limited

AMC Setup Date

30 April 2008

AMC Incorporation Date

23 August 2007

Sponsor Name

Edelweiss Financial Services Limited

Trustee Organisation

Edelweiss Trusteeship Company Limited

CIO

Mr Trideep Bhattarcharya (Equity) and Mr Dhawala Dalal (Debt)

MD & CEO

Ms Radhika Gupta

Compliance Officer

Mr Jehzeel Master

How can you invest in edelweiss mutual funds Mutual Funds

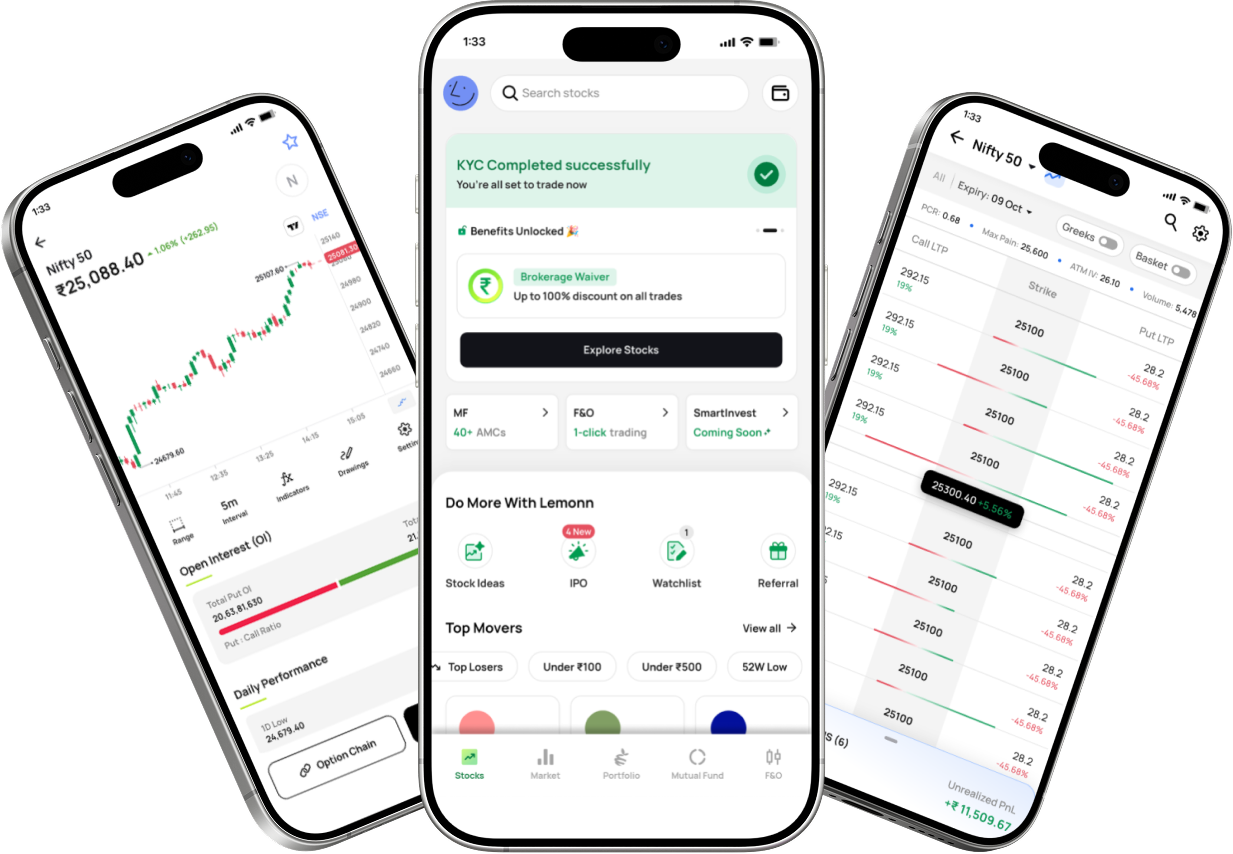

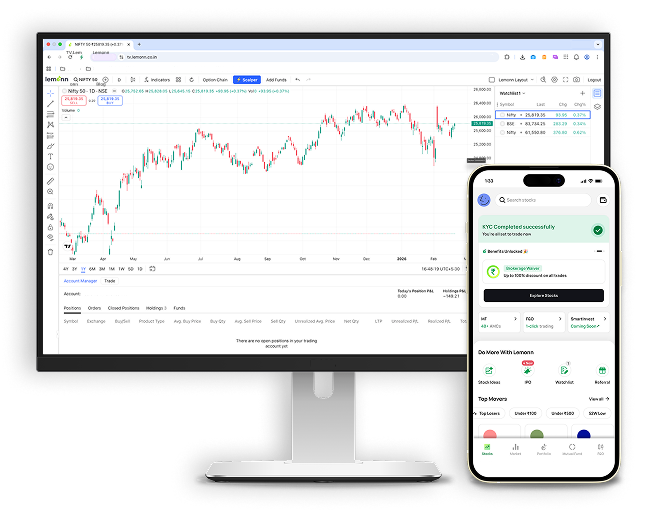

To invest in edelweiss mutual funds Mutual Funds through the Lemonn App, you can follow these general steps:

Step 1 : Download the Lemonn App

If you haven't already, download the Lemonn App from the Google Play Store or Apple App Store.

Step 2 : Sign up / Log in

Sign up by providing your phone number and completing the basic registration process.

If you already have an account, simply log in.

Step 3 : Complete KYC

Before investing, ensure your KYC (Know Your Customer) verification is complete. Most mutual fund apps will guide you through this. You’ll need PAN, Aadhaar, and other necessary details.

Step 4 : Search for edelweiss mutual funds Mutual Funds

Once your KYC is done, search for the edelweiss mutual funds Mutual Fund schemes you're interested in by using the search bar.

Step 5 : Choose a Scheme

You will see a list of various funds under edelweiss mutual funds. Explore the options, check their performance, risk profile, and investment objectives.

Choose a scheme that aligns with your investment goals (e.g., equity, debt, hybrid funds).

Step 6 : Decide on the Investment Amount

You can either make a lump sum investment or set up a SIP (Systematic Investment Plan) to invest a fixed amount periodically.

Step 7 : Confirm the Investment

Enter the amount you wish to invest.

Review the details and confirm the payment method (Net Banking, UPI, etc.).

After making the payment, you will receive a confirmation of your investment.

Step 8 : Track Your Investment

You can track the performance of your edelweiss mutual funds Mutual Funds on the Lemonn App dashboard. It will show NAV, returns, and other key details.

If you need any assistance, the Lemonn App usually has customer support or chat options to help. Keep an eye on expenses like entry/exit loads and expense ratios to optimize returns!

Top Fund Managers

Mr. Harshad Patwardhan

Mr. Harshad Patwardhan is the Chief Investment Officer for Equities at Edelweiss Asset Management, bringing nearly 25 years of experience in the industry across various roles. Before joining Edelweiss, Mr. Patwardhan was an Executive Director and Head of Equities at JP Morgan Asset Management India. He became the CIO when Edelweiss acquired JP Morgan's schemes in 2016. Prior to his time at JP Morgan, he held senior Research Analyst positions at several multinational brokerage firms. Mr. Patwardhan holds a B.Tech degree from IIT-Bombay (1991 batch) and an MBA in Finance from IIM-Lucknow. He is also a CFA Charterholder from the CFA Institute.

Mr. Dhawal Dalal

With over 20 years of experience in the industry, Mr. Dhawal Dalal is the Chief Investment Officer for Debt at Edelweiss Asset Management. Mr. Dalal started his career in 1996 as a Research Associate at Merrill Lynch Asset Management. In 1998, he moved to DSP BlackRock Mutual Fund, where he spent 18 years and eventually became the Executive Vice President and Head of Fixed Income. During his tenure at DSP BlackRock, he managed assets worth $250 billion for clients. He left the company in 2016 to join Edelweiss. Mr. Dalal was also a member of the AMFI Val Com, where he contributed to shaping some of the most significant industry regulations.

Mr. Nalin Moniz

Mr. Nalin Moniz is the Chief Investment Officer for Alternative Equities at Edelweiss Asset Management. He graduated from the prestigious Jerome Fisher Program in Management and Technology at the University of Pennsylvania, earning joint degrees in Computer Science from the Moore School and Economics from the Wharton School. An entrepreneur at heart, Mr. Moniz began his career as a Portfolio Manager at Goldman Sachs Asset Management. After nearly four years, he left to start his own alternative asset management firm, Forefront Capital Management, in India. Despite being a start-up with minimal corporate backing, the firm performed exceptionally well, which led to its acquisition by Edelweiss in 2014. Mr. Moniz was retained as their CIO for Alternative Equities.

Mr. Pranav Parikh

Mr. Pranav Parikh is the Chief Investment Officer for Private Equity at Edelweiss Asset Management, with nearly 20 years of experience in both the Indian and American markets. He is one of the few fund managers who delivered positive returns during two of the most challenging economic cycles—the dot-com bubble burst between 1999 and 2003, and the 2008 global financial crisis. During the dot-com crash, he was a Portfolio Manager at Q Investments in Texas, and later served as the Managing Director for the Indian arm of the same company during the global financial crisis.

Mr. Gautam Kaul

Mr. Gautam Kaul is the designated Fund Manager for Fixed Income at Edelweiss Asset Management, bringing nearly two decades of experience in fund management with leading AMCs. An MBA in Finance from Savitribai Phule Pune University, Mr. Kaul started his career in 2001 at Mata Securities. He then moved to Sahara India Mutual Fund, where he worked for a year before joining Lotus India Asset Management Company. After two years, he continued his career at Religare Asset Management Company and later at IDBI Asset Management Ltd., where he served as a Fund Manager for nearly seven years.

AMC/Fund Houses

ITI Asset Management Limited

IDBI Asset Management Limited

IDFC Asset Management Company Limited

NJ Asset Management Private Limited

Bandhan Asset Management Company Limited

Groww Asset Management Ltd.

Kotak Mahindra Asset Management Co Ltd

HSBC Asset Management(India)Private Ltd

Mahindra Manulife Investment Management Pvt. Ltd.

Zerodha Asset Management Private Limited

Helios Capital Asset Management (India) Private Limited

Sundaram Asset Management Company Ltd

Aditya Birla Sun Life AMC Ltd

Shriram Asset Management Co Ltd

360 ONE Asset Management Limited

Invesco Asset Management (India) Private Ltd

Samco Asset Management Pvt Ltd

Union Asset Management Co. Pvt. Ltd.

Franklin Templeton Asst Mgmt(IND)Pvt Ltd

Tata Asset Management Limited

Bajaj Finserv Asset Management Limited

Baroda BNP Paribas Asset Management India Pvt. Ltd.

Motilal Oswal Asset Management Co. Ltd

Quantum Asset Management Co Pvt. Ltd.

PGIM India Asset Management Private Limited

DSP Investment Managers Private Limited

Canara Robeco Asset Management Co. Ltd.

Taurus Asset Management Company Limited

Nippon Life India Asset Management Ltd

Quant Money Managers Limited

Navi AMC Limited

PPFAS Asset Management Pvt. Ltd

Indiabulls Asset Management Company Ltd.

Mirae Asset Investment Managers (India) Private Limited

HDFC Asset Management Company Limited

IIFL Asset Management Limited

ICICI Prudential Asset Management Company Limited

Old Bridge Asset Management Private Limited

Trust Asset Management Private Limited

Bank of India Investment Managers Private Limited

JM Financial Asset Management Limited

Axis Asset Management Company Limited

UTI Asset Management Co Ltd

WhiteOak Capital Asset Management Limited

LIC Mutual Fund Asset Management Limited

SBI Funds Management Ltd

AMC/Fund Houses

ITI Asset Management Limited

IDBI Asset Management Limited

IDFC Asset Management Company Limited

NJ Asset Management Private Limited

Bandhan Asset Management Company Limited

Groww Asset Management Ltd.

Kotak Mahindra Asset Management Co Ltd

HSBC Asset Management(India)Private Ltd

Mahindra Manulife Investment Management Pvt. Ltd.

Zerodha Asset Management Private Limited

Helios Capital Asset Management (India) Private Limited

Sundaram Asset Management Company Ltd

Aditya Birla Sun Life AMC Ltd

Shriram Asset Management Co Ltd

360 ONE Asset Management Limited

Invesco Asset Management (India) Private Ltd

Samco Asset Management Pvt Ltd

Union Asset Management Co. Pvt. Ltd.

Franklin Templeton Asst Mgmt(IND)Pvt Ltd

Tata Asset Management Limited

Bajaj Finserv Asset Management Limited

Baroda BNP Paribas Asset Management India Pvt. Ltd.

Motilal Oswal Asset Management Co. Ltd

Quantum Asset Management Co Pvt. Ltd.

PGIM India Asset Management Private Limited

DSP Investment Managers Private Limited

Canara Robeco Asset Management Co. Ltd.

Taurus Asset Management Company Limited

Nippon Life India Asset Management Ltd

Quant Money Managers Limited

Navi AMC Limited

PPFAS Asset Management Pvt. Ltd

Indiabulls Asset Management Company Ltd.

Mirae Asset Investment Managers (India) Private Limited

HDFC Asset Management Company Limited

IIFL Asset Management Limited

ICICI Prudential Asset Management Company Limited

Old Bridge Asset Management Private Limited

Trust Asset Management Private Limited

Bank of India Investment Managers Private Limited

JM Financial Asset Management Limited

Axis Asset Management Company Limited

UTI Asset Management Co Ltd

WhiteOak Capital Asset Management Limited

LIC Mutual Fund Asset Management Limited

SBI Funds Management Ltd

FAQs

Loved by 1.5M+ users with a 4.3+ ⭐ app rating - Join now!